Answered step by step

Verified Expert Solution

Question

1 Approved Answer

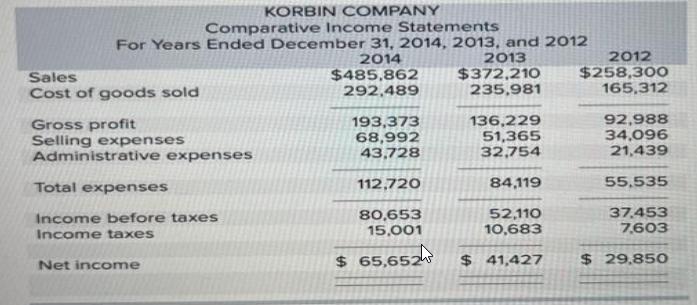

Selected comparative financial statements of Korbin Company follow: KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2014, 2013, and 2012 2013 2014 $485,862

Selected comparative financial statements of Korbin Company follow:

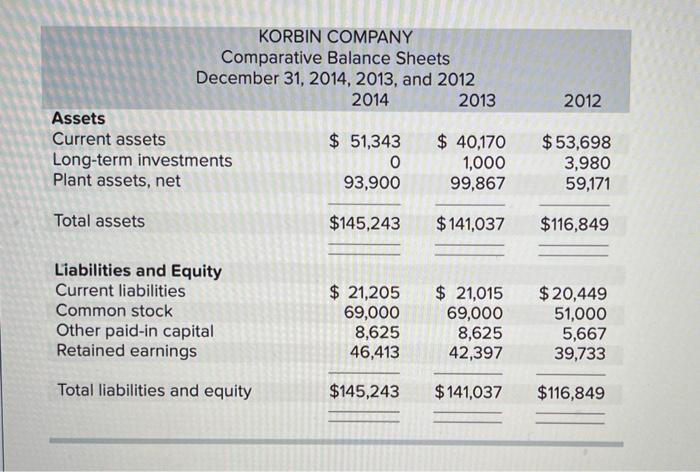

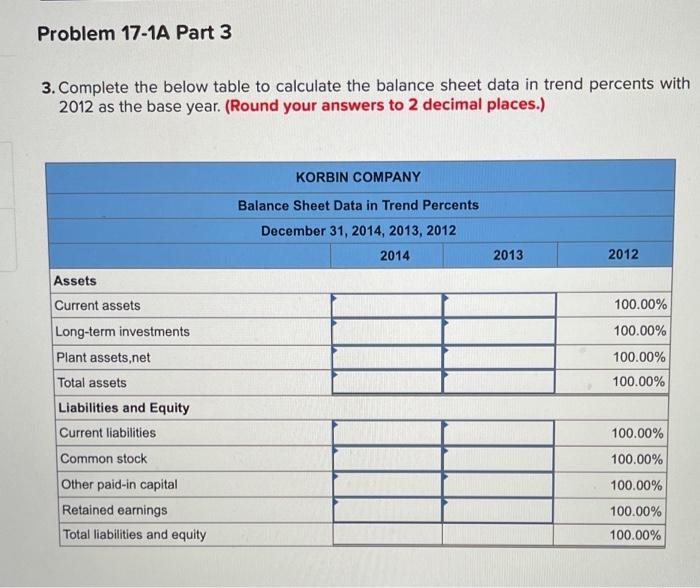

KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2014, 2013, and 2012 2013 2014 $485,862 $372,210 292,489 235,981 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income 193,373 68,992 43,728 112,720 80,653 15,001 $ 65,652 136,229 51,365 32,754 84,119 52,110 10,683 $41,427 2012 $258,300 165,312 92,988 34,096 21,439 55,535 37,453 7,603 $ 29,850 KORBIN COMPANY Comparative Balance Sheets December 31, 2014, 2013, and 2012 2014 2013 Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 51,343 0 93,900 $145,243 $ 21,205 69,000 8,625 46,413 $145,243 $ 40,170 1,000 99,867 $141,037 $ 21,015 69,000 8,625 42,397 $141,037 2012 $53,698 3,980 59,171 $116,849 $20,449 51,000 5,667 39,733 $116,849 Problem 17-1A Part 3 3. Complete the below table to calculate the balance sheet data in trend percents with 2012 as the base year. (Round your answers to 2 decimal places.) Assets Current assets Long-term investments Plant assets,net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2014, 2013, 2012 2014 2013 2012 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The formula for getting the percentage should be Percentage Current year Base year R21 fr A B C D G ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started