Answered step by step

Verified Expert Solution

Question

1 Approved Answer

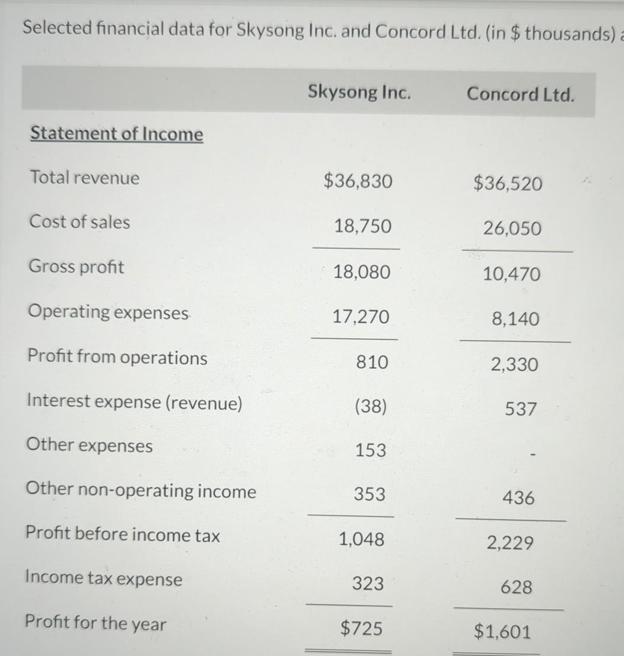

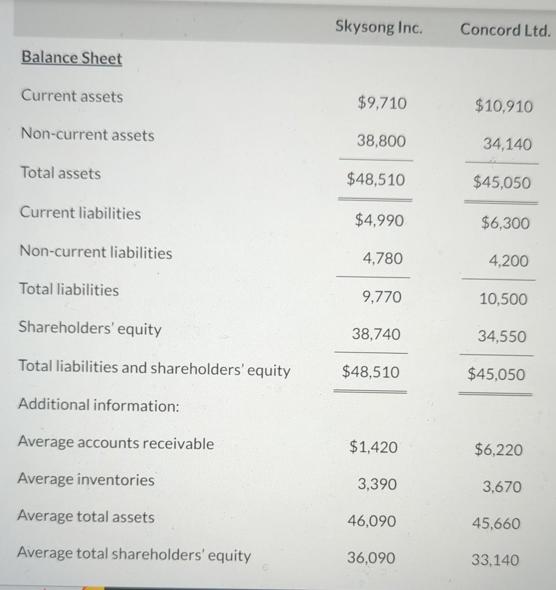

Selected financial data for Skysong Inc. and Concord Ltd. (in $ thousands) a Statement of Income Total revenue Cost of sales Gross profit Operating

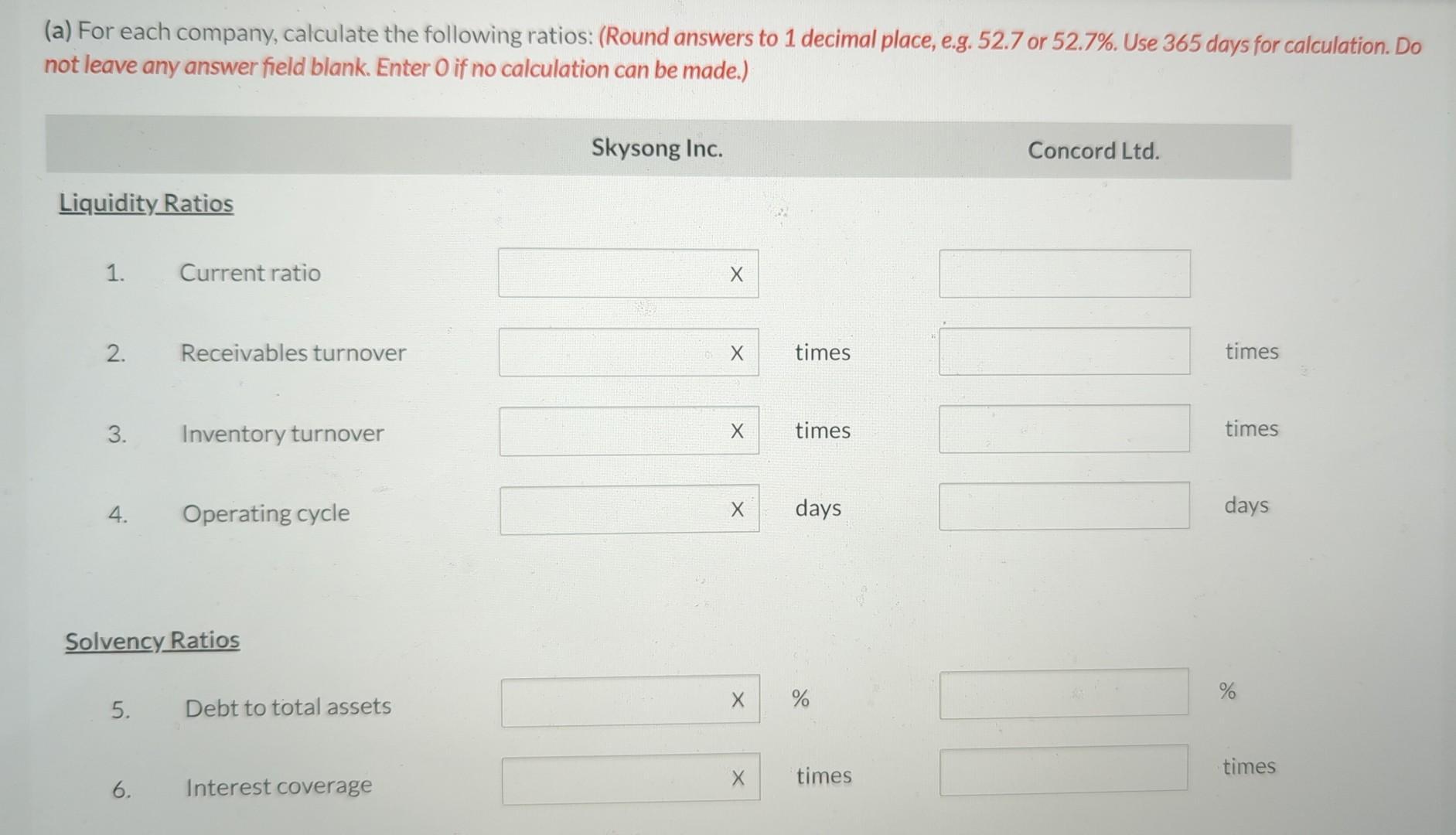

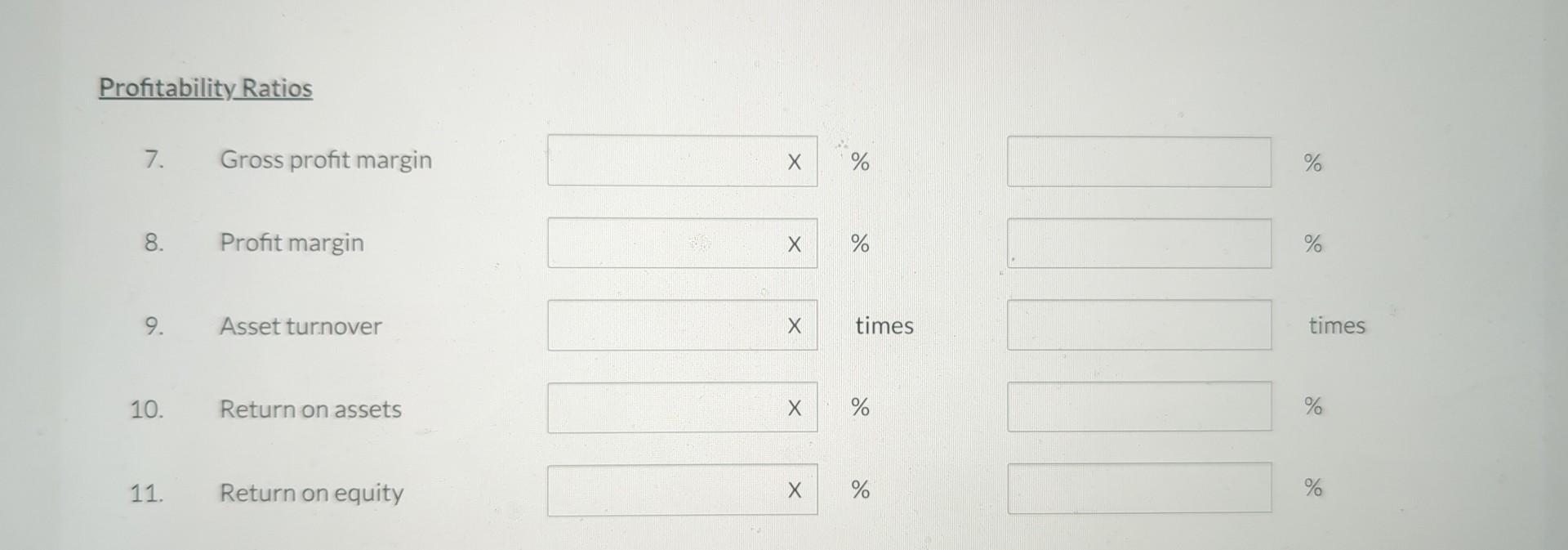

Selected financial data for Skysong Inc. and Concord Ltd. (in $ thousands) a Statement of Income Total revenue Cost of sales Gross profit Operating expenses. Profit from operations Interest expense (revenue) Other expenses Other non-operating income Profit before income tax Income tax expense Profit for the year Skysong Inc. $36,830 18,750 18,080 17,270 810 (38) 153 353 1,048 323 $725 Concord Ltd. $36,520 26,050 10,470 8,140 2,330 537 436 2,229 628 $1,601 Balance Sheet Current assets Non-current assets Total assets Current liabilities Non-current liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity Additional information: Average accounts receivable Average inventories Average total assets Average total shareholders' equity Skysong Inc. $9,710 38,800 $48,510 $4,990 4,780 9,770 38,740 $48,510 $1,420 3,390 46,090 36,090 Concord Ltd. $10,910 34,140 $45,050 $6,300 4,200 10,500 34,550 $45,050 $6,220 3,670 45,660 33,140 (a) For each company, calculate the following ratios: (Round answers to 1 decimal place, e.g. 52.7 or 52.7%. Use 365 days for calculation. Do not leave any answer field blank. Enter O if no calculation can be made.) Liquidity Ratios 1. 2. 3. 4. 5. Current ratio 6. Receivables turnover Inventory turnover Solvency Ratios Operating cycle Debt to total assets Interest coverage Skysong Inc. X X X X X times times days % times Concord Ltd. times times days % times Profitability Ratios 7. 8. 9. 10. 11. Gross profit margin Profit margin Asset turnover Return on assets Return on equity X X X X X % do % times % % % % times % %

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started