Answered step by step

Verified Expert Solution

Question

1 Approved Answer

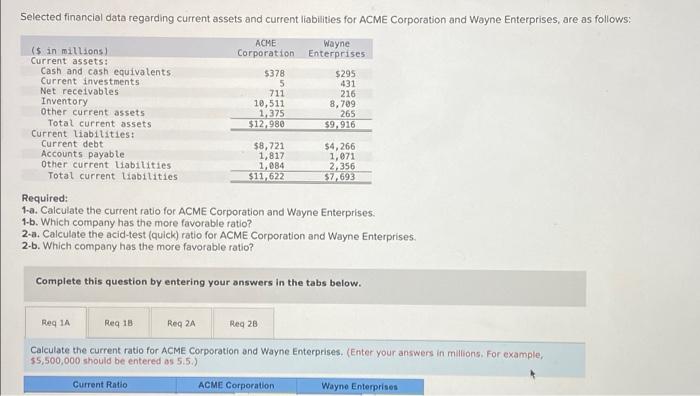

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation Wayne Enterprises ($ in millions)

Selected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation Wayne Enterprises ($ in millions) Current assets: Cash and cash equivalents Current investments Net receivables Inventory Other current assets Total current assets Current liabilities: Current debt Accounts payable Other current liabilities Total current liabilities Req 1A Req 1B $378 5 711 10,511 1,375 $12,980 Req 2A Current Ratio $8,721 1,817 1,084 $11,622 Required: 1-a. Calculate the current ratio for ACME Corporation and Wayne Enterprises. 1-b. Which company has the more favorable ratio? 2-a. Calculate the acid-test (quick) ratio for ACME Corporation and Wayne Enterprises. 2-b. Which company has the more favorable ratio? Complete this question by entering your answers in the tabs below. Req 2B $295 431 216 8,709 265 $9,916 $4,266 1,071 2,356 $7,693 ACME Corporation Calculate the current ratio for ACME Corporation and Wayne Enterprises. (Enter your answers in millions. For example, $5,500,000 should be entered as 5.5.) Wayne Enterprises

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started