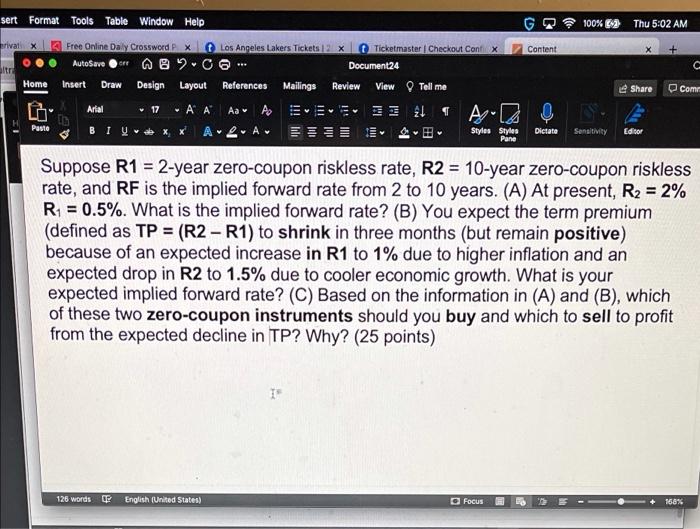

sert Format Tools Table Window Help 100% Thu 5:02 AM erivat X Los Angeles Lakers Tickets Content X oltre Free Online Daily Crossword PX AutoSave ore 2.0 Insert Draw Design Layout Ticketmaster Checkout Conx Document24 Review View Tell me C Home References Mailings Share Com to Arial 17 AA Aa EEE 13 4 Pasto BI XXA Styles Styles Pane Dictate Sensitivity Editor Suppose R1 = 2-year zero-coupon riskless rate, R2 = 10-year zero-coupon riskless rate, and RF is the implied forward rate from 2 to 10 years. (A) At present, R2 = 2% R = 0.5%. What is the implied forward rate? (B) You expect the term premium (defined as TP = (R2 - R1) to shrink in three months (but remain positive) because of an expected increase in R1 to 1% due to higher inflation and an expected drop in R2 to 1.5% due to cooler economic growth. What is your expected implied forward rate? (C) Based on the information in (A) and (B), which of these two zero-coupon instruments should you buy and which to sell to profit from the expected decline in TP? Why? (25 points) 126 words English (United States) O Focus 158% sert Format Tools Table Window Help 100% Thu 5:02 AM erivat X Los Angeles Lakers Tickets Content X oltre Free Online Daily Crossword PX AutoSave ore 2.0 Insert Draw Design Layout Ticketmaster Checkout Conx Document24 Review View Tell me C Home References Mailings Share Com to Arial 17 AA Aa EEE 13 4 Pasto BI XXA Styles Styles Pane Dictate Sensitivity Editor Suppose R1 = 2-year zero-coupon riskless rate, R2 = 10-year zero-coupon riskless rate, and RF is the implied forward rate from 2 to 10 years. (A) At present, R2 = 2% R = 0.5%. What is the implied forward rate? (B) You expect the term premium (defined as TP = (R2 - R1) to shrink in three months (but remain positive) because of an expected increase in R1 to 1% due to higher inflation and an expected drop in R2 to 1.5% due to cooler economic growth. What is your expected implied forward rate? (C) Based on the information in (A) and (B), which of these two zero-coupon instruments should you buy and which to sell to profit from the expected decline in TP? Why? (25 points) 126 words English (United States) O Focus 158%