Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Several investors are in the process of organizing a new company. The investors feel that $500,000 would be adequate to finance the new company's

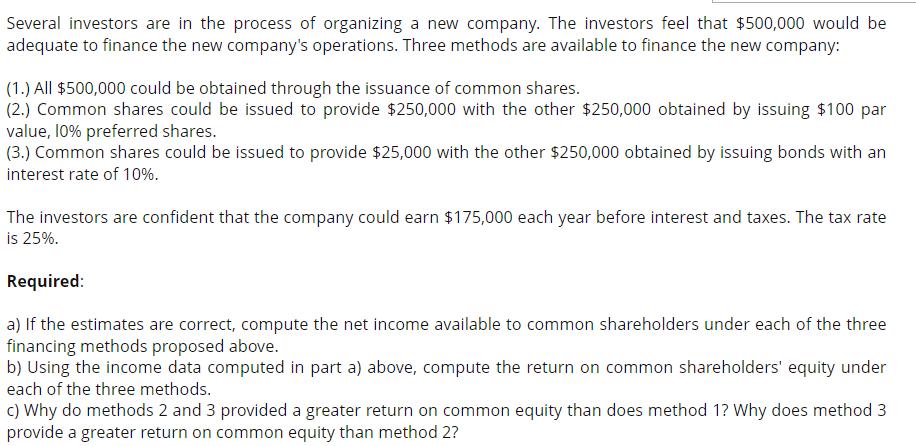

Several investors are in the process of organizing a new company. The investors feel that $500,000 would be adequate to finance the new company's operations. Three methods are available to finance the new company: (1.) All $500,000 could be obtained through the issuance of common shares. (2.) Common shares could be issued to provide $250,000 with the other $250,000 obtained by issuing $100 par value, 10% preferred shares. (3.) Common shares could be issued to provide $25,000 with the other $250,000 obtained by issuing bonds with an interest rate of 10%. The investors are confident that the company could earn $175,000 each year before interest and taxes. The tax rate is 25%. Required: a) If the estimates are correct, compute the net income available to common shareholders under each of the three financing methods proposed above. b) Using the income data computed in part a) above, compute the return on common shareholders' equity under each of the three methods. c) Why do methods 2 and 3 provided a greater return on common equity than does method 1? Why does method 3 provide a greater return on common equity than method 2?

Step by Step Solution

★★★★★

3.62 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a 1 Net income available to common shareholders 175000 0 175000 2 Net income available to common sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started