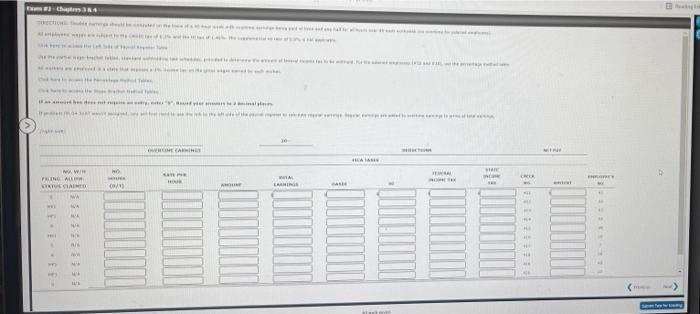

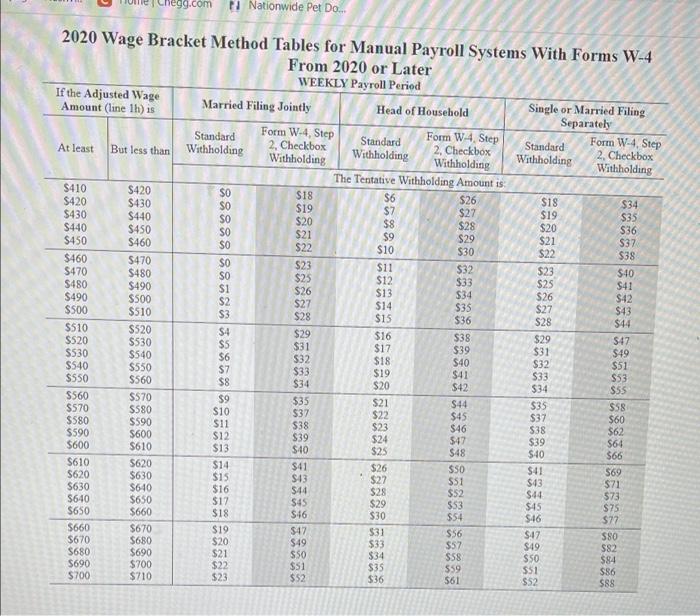

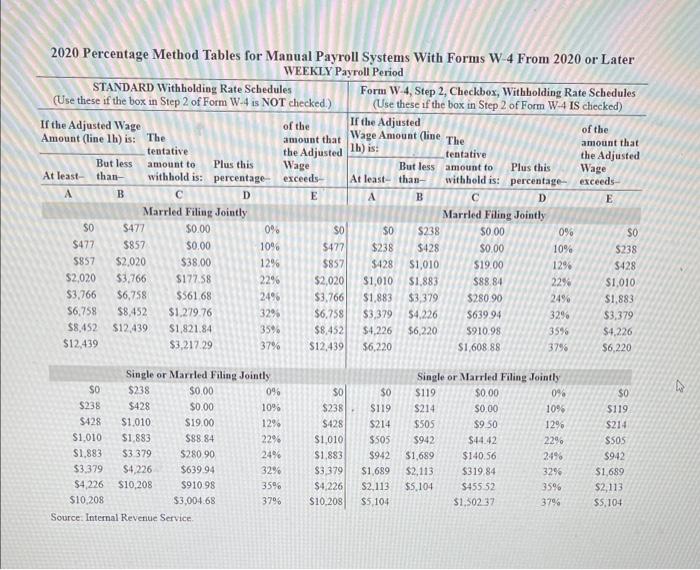

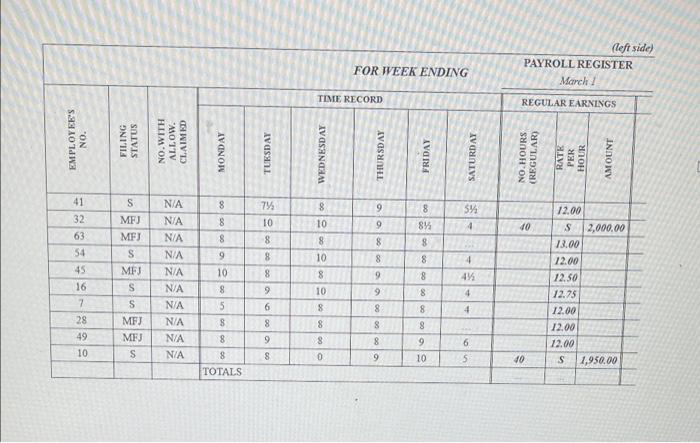

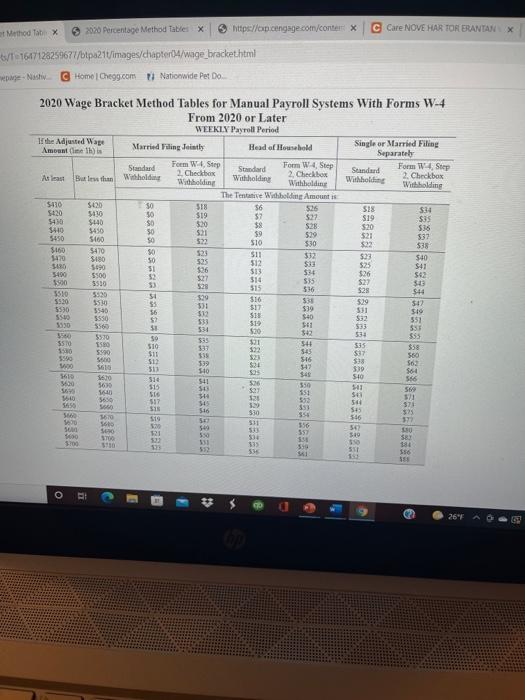

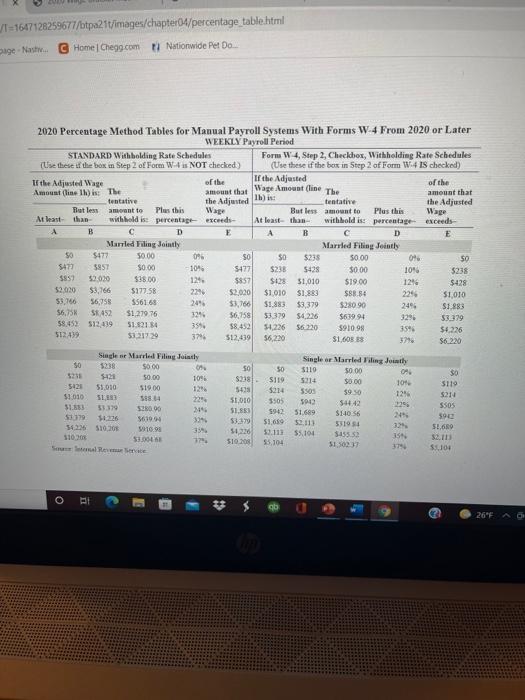

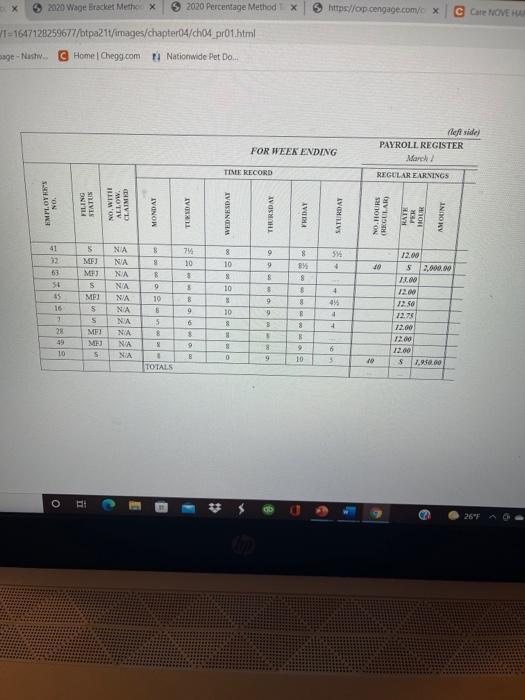

sha SER WH POL USTAN W TRINE PIETER Chegg.com Nationwide Pet Do... 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Head of Household Single or Married Filing Standard Separately Form W-4, Step Standard Form W 4. Step At least But less than 2. Checkbox Withholding Form W-4, Step Standard 2. Checkbox Withholding Withholding Withholding Withholding 2. Checkbox Withholding The Tentative Withholding Amount is $410 S420 SO $18 $420 $6 $430 SO $26 $18 $19 $34 $430 $7 $440 SO $27 $19 $20 $35 $8 $440 $450 SO $28 $20 $36 $21 $9 $450 $460 $29 SO $21 $37 $22 $10 $30 $22 $460 $38 $470 SO S23 $470 $11 $480 $32 SO $23 $25 $40 $480 $12 $490 S1 $33 $25 $26 541 $490 $13 S500 S2 $34 $26 $42 $27 $500 $14 $35 $510 $3 $27 $28 $43 $15 $36 $28 $44 $510 $520 $4 $29 $16 S520 $38 $530 S5 $29 S47 $31 $17 $530 $39 $540 $6 $31 $49 S32 $18 $40 $540 S550 $7 $32 $33 $51 $19 $S50 $560 $41 S33 $8 $34 $53 $20 S42 $34 $55 S560 SS70 $9 $35 $21 $44 $570 SS80 $35 SS8 $10 $37 $22 $580 $45 $590 $37 $11 $38 $60 $23 $590 $46 5600 $38 $62 $12 $39 524 $600 547 $39 $610 $64 $13 $40 $25 $40 $66 $610 5620 $14 $41 $26 $50 $41 $620 $630 569 $15 $43 $27 $51 $43 $630 S640 $71 $16 $44 $28 $52 S640 $44 $650 $17 $45 $29 $53 $45 $650 $660 $18 $75 $46 $30 $54 $46 $77 5660 $670 $19 $47 $31 S56 $47 $670 580 $680 $20 $49 $33 $57 $49 5680 $690 $21 SSO 582 $34 SS8 $50 $690 $700 $22 $S1 $35 559 $51 $86 $700 $710 $23 $52 $36 561 $52 $88 $48 573 $84 the Adjusted 1b) is: 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked.) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted of the Amount (line 1h) is: The amount that Wage Amount (line The amount that tentative tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least than- withhold is: percentage exceeds At least than withhold is: percentage-exceeds B D E A B D E Married Filing Jointly Married Filing Jointly SO $477 $0.00 0% $0 $238 $0.00 0% SO $477 $857 $0.00 10 $477 $238 $428 $0.00 10% $238 $857 $2,020 $38.00 12% $857 $428 $1,010 $19.00 129 5428 $2,020 $3,766 $127.58 22% $2,020 $1,010 $1,883 $88.84 22% $1.010 $3.766 $6,758 $561 68 2496 $3,766 $1,883 $3,379 3280 90 2496 $1.883 $6,758 $8.452 $1,279.76 32 $6,758 $3,379 $4,226 $639 94 3296 $3,379 $8,452 S12.439 $1,821.84 35% $8.452 $4,226 $6,220 5910.98 3595 $4.226 $12,439 $3.217.29 37% $12,439 56.220 $1,608 88 3796 $6,220 30 SO Single or Married Filing Jointly SO $238 $0.00 096 $238 $428 $0.00 10% $428 $1.010 $19.00 12% $1,010 $1,883 $88.84 22% $1.883 $3 379 $280 90 2496 $3379 $4,226 $639.94 32% $4,226 $10.208 $910.98 35% $10.208 $3,004,68 3796 Source: Internal Revenue Service SO $238 $428 $1010 $1.883 $3,379 $4,226 $10.208 $119 $214 $505 $942 $1,689 S2.113 $5,104 Single or Married Filing Jointly $119 $0.00 0% S214 $0.00 10% $505 $9.50 12% $942 $44.42 22% $1,689 $140.56 24% $2,113 $319.84 329 $5,104 S455 52 3596 $1,30237 37% $0 $119 $214 SSOS $942 $1,689 $2,113 $5,104 (left side) PAYROLL REGISTER March FOR WEEK ENDING TIME RECORD REGULAR EARNINGS NA 8 9 79 10 8 5% 4 MFJ MFJ 9 10 S 8 8% 8 8 8 8 9 8 10 8 10 8 8 8 41 32 63 54 45 16 7 28 49 10 8 smsmss E 10 9 NA N/A NA N/A NA N/A N/A N/A 8 9 4 4% 4 8 9 12.00 S 2,000.00 13.00 12.00 12.50 12.75 12.00 12.00 12.00 S 1,950.00 8 8 8 8 10 8 8 6 8 5 8 8 4 8 MFJ MFU S 8 9 8 8 ola 6 5 8 8 0 9 10 J0 TOTALS ORX * 2020 GOTOWA ..mag.com/inde MONGO.com Em2 Chapter 34 TORRES OVERSEAS HRACTOR REPAY FICA LAS NO TRES tom FATEH HO FEDERAL I TAX STATE INCH TAX TOTAI TARRINGS CON A OANDI SINONEN FO 11 ANONE 42 1 41 Te AL A Towe 20% OG 6481 WOX WWW COLOR GOD - Oplers 34 VEHIC DEDUCTIONS METTY HA TALS ww/ STARE SATE PEH MATH PENA TAX ONE NO SEATUS BLAIMED 1972 HOLA ANG Ar VI TAK AR 40 CE NA w YA SP ME > ( IR Det TO + DX te 34 ORTA F MIC w w STATE HIVYO HI TAX AM LU 1 De NA M Method Tax 3 2020 Percentage Method Tablet X https://op.cengage.com/conter X Care NOVE HAR TOR ERANTAN X 5/1647128259677/bipa21t/images/chapter14/wage_brackethtml - Nasty C Homo Chegg.com Nationwide Pet Do 536 5450 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period the Adjusted Wape Amount th) Married Wiling Jointly Head of Blousehold Single or Married Filing Separately Standard Form W.Step Standard Form W 4 Step Standard 2. Checkbox Form W4, Step Aslas Butless than Withholding Withholding 2. Checkbox Wholding 2. Checkbox Withholdin Withholding Withholding The Tentative Withbold Amounts $110 SD 30 518 $6 5420 $25 528 $34 5430 VO $19 $7 527 5430 S35 $140 SO 519 520 $8 $410 528 $450 $20 30 521 $9 529 5160 $21 537 50 522 510 $30 $38 $160 $470 SO 523 $11 1470 $180 332 $23 50 $40 525 50 5590 512 $33 31 $25 $26 S41 5400 $500 $13 $34 52 $26 $42 900 $27 $530 $14 $35 53 528 $27 56 515 536 5510 $28 $44 5529 $99 5530 $530 $16 55 $30 529 351 $12 5590 5540 $17 56 $39 531 $12 $19 5550 $13 52 $40 533 S32 5330 $ 551 $ 50 533 534 520 535 $42 3560 $930 $34 59 555 5570 150 $35 $21 510 547 $33 $35 522 $58 5990 $11 543 319 $17 SO 500 512 S16 $38 w $39 31 $1 563 347 $19 510 564 615 1670 345 510 Sie 5600 541 566 5690 526 515 SU 350 HI 569 14.00 56 SLS 151 544 15:40 $4 5650 51 517 120 313 53 5450 54 $ 371 516 35 330 $ 160 32 $50 519 5 546 17 560 331 500 356 SO 549 562 53 552 0 50 560 STO 314 519 3700 33 53 123 333 540 5345 SST 361 156 SES 521 O . - 267 T=1647128259677/btpa21t/images/chapter0/percentage_table.html page - Nastre Home | Chegg.com I Nationwide Pet Do the Adjusted Wage 5472 2020 Percentage Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later WEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules Use these the box in Step 2 of Form W-4 s NOT checked.) (Use these of the box in Step 2 of Form W.4 IS checked) of the If the Adjusted Wage If the Adjusted of the Amount (line 1h) in The amount that Wage Amount (line The amount that tentative tentative the Adjusted Rat les amount to Plus this Wape But less amount to Plus this At least than withheld ist percentage exceeds At least than withbold is percentage exceeds B C D E B C D Married Filing Jointly Married Filing Joints 50 5477 50.00 096 SO SO $238 50.00 0% 50 5857 $0.00 104 5477 $238 5428 30.00 10% 5238 3852 $9.030 $38.00 124 5857 S428 51,010 $19.00 121 $428 $2.020 $3,166 5177.58 2294 $2.020 $1.010 $1.883 $88.34 2256 $1,010 55.166 56,758 $56168 2496 $3,766 $1.883 $3,379 $280 90 249 $1.883 56,758 56452 $1.219.76 56,758 $3379 $4226 $639 94 3296 53.379 58.452 512 419 51.12184 394 58,452 54,226 5620 $910 98 3596 $4.226 512 49 33.21729 3798 $12,439 56,220 $1,605 88 52% $6.220 Single or Married Filing Jointly Single or Married Filing Jostly SO 5238 0% 50 50 $119 5000 09. 12 50.00 30 10% $238 S119 5214 $0.00 5421 $119 51,010 $19.00 12 5435 $214 5503 $9 30 $1.010 12% SL, 5884 22 5214 51,010 $505 5042 $4442 31.333 53.379 22 528090 SSOS 51.888 5942 51,689 $1179 $140256 1226 245 5694 3346 590 55 659 54236 510208 $2,113 5519 54 32 WM10.98 359 5.69 S1236 53.112 $5.104 51020 34555 53.504 32 IS S. 55.104 Screen 5130237 3794 104 50.00 104 510201 O pi # 2 26F 2020 Wage Bracket Methox 2020 Percentage Method X https://op cengage.com/ Care NOVE HU T=1647128259677/tp321/images/chapter04/ch04_pro.html age-Nash. Home | Chegg.com Nationwide Pet Do... FOR WEEK ENDING (left side) PAYROLL REGISTER March REGULAR EARNINGS TIME RECORD LROUN NO ONLILA STATUS NO, WITH ALLOW. CLAIMED MONDAY TUENDAT WEDNESDAY THURSDAY PRIMAT SATURDAY NOHOURS (REGULARO HATE DOR AMOUNT 8 9 8 594 41 12 63 E- 74 10 3 MFJ ME 10 9 - 10 8 8 9 8 00 99 el 10 3% 8 $ 8 $ ssss NA NA NA NA NA NA NA NA NA 15 16 MP3 12.000 5 2,000.00 13.00 12.00 12.50 22.75 12.00 10 8 9 4 9 10 8 --- 9 8 5 8 2 3 28 49 10 .6 $ 9 ME ME s 1200 NA 8 9 1 6 5 0 10 12.00 S 2.950.00 10 TOTALS o O . E 25F sha SER WH POL USTAN W TRINE PIETER Chegg.com Nationwide Pet Do... 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Head of Household Single or Married Filing Standard Separately Form W-4, Step Standard Form W 4. Step At least But less than 2. Checkbox Withholding Form W-4, Step Standard 2. Checkbox Withholding Withholding Withholding Withholding 2. Checkbox Withholding The Tentative Withholding Amount is $410 S420 SO $18 $420 $6 $430 SO $26 $18 $19 $34 $430 $7 $440 SO $27 $19 $20 $35 $8 $440 $450 SO $28 $20 $36 $21 $9 $450 $460 $29 SO $21 $37 $22 $10 $30 $22 $460 $38 $470 SO S23 $470 $11 $480 $32 SO $23 $25 $40 $480 $12 $490 S1 $33 $25 $26 541 $490 $13 S500 S2 $34 $26 $42 $27 $500 $14 $35 $510 $3 $27 $28 $43 $15 $36 $28 $44 $510 $520 $4 $29 $16 S520 $38 $530 S5 $29 S47 $31 $17 $530 $39 $540 $6 $31 $49 S32 $18 $40 $540 S550 $7 $32 $33 $51 $19 $S50 $560 $41 S33 $8 $34 $53 $20 S42 $34 $55 S560 SS70 $9 $35 $21 $44 $570 SS80 $35 SS8 $10 $37 $22 $580 $45 $590 $37 $11 $38 $60 $23 $590 $46 5600 $38 $62 $12 $39 524 $600 547 $39 $610 $64 $13 $40 $25 $40 $66 $610 5620 $14 $41 $26 $50 $41 $620 $630 569 $15 $43 $27 $51 $43 $630 S640 $71 $16 $44 $28 $52 S640 $44 $650 $17 $45 $29 $53 $45 $650 $660 $18 $75 $46 $30 $54 $46 $77 5660 $670 $19 $47 $31 S56 $47 $670 580 $680 $20 $49 $33 $57 $49 5680 $690 $21 SSO 582 $34 SS8 $50 $690 $700 $22 $S1 $35 559 $51 $86 $700 $710 $23 $52 $36 561 $52 $88 $48 573 $84 the Adjusted 1b) is: 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked.) (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage of the If the Adjusted of the Amount (line 1h) is: The amount that Wage Amount (line The amount that tentative tentative the Adjusted But less amount to Plus this Wage But less amount to Plus this Wage At least than- withhold is: percentage exceeds At least than withhold is: percentage-exceeds B D E A B D E Married Filing Jointly Married Filing Jointly SO $477 $0.00 0% $0 $238 $0.00 0% SO $477 $857 $0.00 10 $477 $238 $428 $0.00 10% $238 $857 $2,020 $38.00 12% $857 $428 $1,010 $19.00 129 5428 $2,020 $3,766 $127.58 22% $2,020 $1,010 $1,883 $88.84 22% $1.010 $3.766 $6,758 $561 68 2496 $3,766 $1,883 $3,379 3280 90 2496 $1.883 $6,758 $8.452 $1,279.76 32 $6,758 $3,379 $4,226 $639 94 3296 $3,379 $8,452 S12.439 $1,821.84 35% $8.452 $4,226 $6,220 5910.98 3595 $4.226 $12,439 $3.217.29 37% $12,439 56.220 $1,608 88 3796 $6,220 30 SO Single or Married Filing Jointly SO $238 $0.00 096 $238 $428 $0.00 10% $428 $1.010 $19.00 12% $1,010 $1,883 $88.84 22% $1.883 $3 379 $280 90 2496 $3379 $4,226 $639.94 32% $4,226 $10.208 $910.98 35% $10.208 $3,004,68 3796 Source: Internal Revenue Service SO $238 $428 $1010 $1.883 $3,379 $4,226 $10.208 $119 $214 $505 $942 $1,689 S2.113 $5,104 Single or Married Filing Jointly $119 $0.00 0% S214 $0.00 10% $505 $9.50 12% $942 $44.42 22% $1,689 $140.56 24% $2,113 $319.84 329 $5,104 S455 52 3596 $1,30237 37% $0 $119 $214 SSOS $942 $1,689 $2,113 $5,104 (left side) PAYROLL REGISTER March FOR WEEK ENDING TIME RECORD REGULAR EARNINGS NA 8 9 79 10 8 5% 4 MFJ MFJ 9 10 S 8 8% 8 8 8 8 9 8 10 8 10 8 8 8 41 32 63 54 45 16 7 28 49 10 8 smsmss E 10 9 NA N/A NA N/A NA N/A N/A N/A 8 9 4 4% 4 8 9 12.00 S 2,000.00 13.00 12.00 12.50 12.75 12.00 12.00 12.00 S 1,950.00 8 8 8 8 10 8 8 6 8 5 8 8 4 8 MFJ MFU S 8 9 8 8 ola 6 5 8 8 0 9 10 J0 TOTALS ORX * 2020 GOTOWA ..mag.com/inde MONGO.com Em2 Chapter 34 TORRES OVERSEAS HRACTOR REPAY FICA LAS NO TRES tom FATEH HO FEDERAL I TAX STATE INCH TAX TOTAI TARRINGS CON A OANDI SINONEN FO 11 ANONE 42 1 41 Te AL A Towe 20% OG 6481 WOX WWW COLOR GOD - Oplers 34 VEHIC DEDUCTIONS METTY HA TALS ww/ STARE SATE PEH MATH PENA TAX ONE NO SEATUS BLAIMED 1972 HOLA ANG Ar VI TAK AR 40 CE NA w YA SP ME > ( IR Det TO + DX te 34 ORTA F MIC w w STATE HIVYO HI TAX AM LU 1 De NA M Method Tax 3 2020 Percentage Method Tablet X https://op.cengage.com/conter X Care NOVE HAR TOR ERANTAN X 5/1647128259677/bipa21t/images/chapter14/wage_brackethtml - Nasty C Homo Chegg.com Nationwide Pet Do 536 5450 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period the Adjusted Wape Amount th) Married Wiling Jointly Head of Blousehold Single or Married Filing Separately Standard Form W.Step Standard Form W 4 Step Standard 2. Checkbox Form W4, Step Aslas Butless than Withholding Withholding 2. Checkbox Wholding 2. Checkbox Withholdin Withholding Withholding The Tentative Withbold Amounts $110 SD 30 518 $6 5420 $25 528 $34 5430 VO $19 $7 527 5430 S35 $140 SO 519 520 $8 $410 528 $450 $20 30 521 $9 529 5160 $21 537 50 522 510 $30 $38 $160 $470 SO 523 $11 1470 $180 332 $23 50 $40 525 50 5590 512 $33 31 $25 $26 S41 5400 $500 $13 $34 52 $26 $42 900 $27 $530 $14 $35 53 528 $27 56 515 536 5510 $28 $44 5529 $99 5530 $530 $16 55 $30 529 351 $12 5590 5540 $17 56 $39 531 $12 $19 5550 $13 52 $40 533 S32 5330 $ 551 $ 50 533 534 520 535 $42 3560 $930 $34 59 555 5570 150 $35 $21 510 547 $33 $35 522 $58 5990 $11 543 319 $17 SO 500 512 S16 $38 w $39 31 $1 563 347 $19 510 564 615 1670 345 510 Sie 5600 541 566 5690 526 515 SU 350 HI 569 14.00 56 SLS 151 544 15:40 $4 5650 51 517 120 313 53 5450 54 $ 371 516 35 330 $ 160 32 $50 519 5 546 17 560 331 500 356 SO 549 562 53 552 0 50 560 STO 314 519 3700 33 53 123 333 540 5345 SST 361 156 SES 521 O . - 267 T=1647128259677/btpa21t/images/chapter0/percentage_table.html page - Nastre Home | Chegg.com I Nationwide Pet Do the Adjusted Wage 5472 2020 Percentage Method Tables for Manual Payroll Systems With Forms W 4 From 2020 or Later WEEKLY Payroll Period STANDARD Withholding Rate Schedules Form W-4, Step 2, Checkbox, Withholding Rate Schedules Use these the box in Step 2 of Form W-4 s NOT checked.) (Use these of the box in Step 2 of Form W.4 IS checked) of the If the Adjusted Wage If the Adjusted of the Amount (line 1h) in The amount that Wage Amount (line The amount that tentative tentative the Adjusted Rat les amount to Plus this Wape But less amount to Plus this At least than withheld ist percentage exceeds At least than withbold is percentage exceeds B C D E B C D Married Filing Jointly Married Filing Joints 50 5477 50.00 096 SO SO $238 50.00 0% 50 5857 $0.00 104 5477 $238 5428 30.00 10% 5238 3852 $9.030 $38.00 124 5857 S428 51,010 $19.00 121 $428 $2.020 $3,166 5177.58 2294 $2.020 $1.010 $1.883 $88.34 2256 $1,010 55.166 56,758 $56168 2496 $3,766 $1.883 $3,379 $280 90 249 $1.883 56,758 56452 $1.219.76 56,758 $3379 $4226 $639 94 3296 53.379 58.452 512 419 51.12184 394 58,452 54,226 5620 $910 98 3596 $4.226 512 49 33.21729 3798 $12,439 56,220 $1,605 88 52% $6.220 Single or Married Filing Jointly Single or Married Filing Jostly SO 5238 0% 50 50 $119 5000 09. 12 50.00 30 10% $238 S119 5214 $0.00 5421 $119 51,010 $19.00 12 5435 $214 5503 $9 30 $1.010 12% SL, 5884 22 5214 51,010 $505 5042 $4442 31.333 53.379 22 528090 SSOS 51.888 5942 51,689 $1179 $140256 1226 245 5694 3346 590 55 659 54236 510208 $2,113 5519 54 32 WM10.98 359 5.69 S1236 53.112 $5.104 51020 34555 53.504 32 IS S. 55.104 Screen 5130237 3794 104 50.00 104 510201 O pi # 2 26F 2020 Wage Bracket Methox 2020 Percentage Method X https://op cengage.com/ Care NOVE HU T=1647128259677/tp321/images/chapter04/ch04_pro.html age-Nash. Home | Chegg.com Nationwide Pet Do... FOR WEEK ENDING (left side) PAYROLL REGISTER March REGULAR EARNINGS TIME RECORD LROUN NO ONLILA STATUS NO, WITH ALLOW. CLAIMED MONDAY TUENDAT WEDNESDAY THURSDAY PRIMAT SATURDAY NOHOURS (REGULARO HATE DOR AMOUNT 8 9 8 594 41 12 63 E- 74 10 3 MFJ ME 10 9 - 10 8 8 9 8 00 99 el 10 3% 8 $ 8 $ ssss NA NA NA NA NA NA NA NA NA 15 16 MP3 12.000 5 2,000.00 13.00 12.00 12.50 22.75 12.00 10 8 9 4 9 10 8 --- 9 8 5 8 2 3 28 49 10 .6 $ 9 ME ME s 1200 NA 8 9 1 6 5 0 10 12.00 S 2.950.00 10 TOTALS o O . E 25F