Question

Shadow Peaches runs a fruit-packing business in southern Florida. The firm buys peaches by the truckload in season. The fruit is then separated into

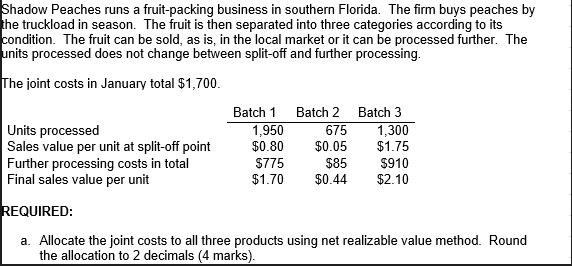

Shadow Peaches runs a fruit-packing business in southern Florida. The firm buys peaches by the truckload in season. The fruit is then separated into three categories according to its condition. The fruit can be sold, as is, in the local market or it can be processed further. The units processed does not change between split-off and further processing. The joint costs in January total $1,700. Units processed Sales value per unit at split-off point Further processing costs in total Final sales value per unit Batch 1 1,950 $0.80 $775 $1.70 Batch 2 675 $0.05 $85 $0.44 Batch 3 1,300 $1.75 $910 $2.10 REQUIRED: a. Allocate the joint costs to all three products using net realizable value method. Round the allocation to 2 decimals (4 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App