Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sharma Industries wishes to select the best of two possible investment projects - Gulf Oil and Esso. The firm observes that the risk-free rate

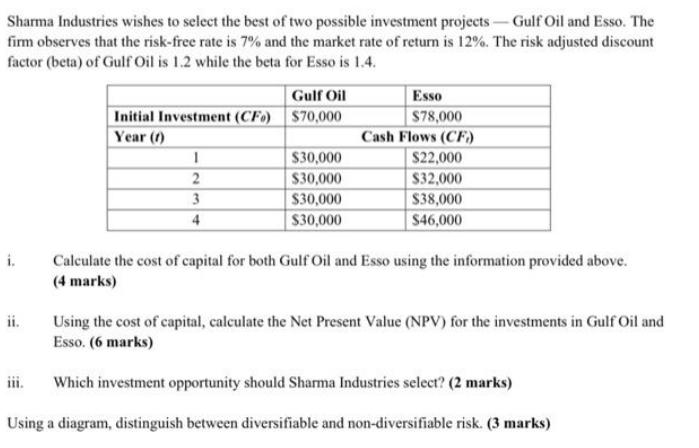

Sharma Industries wishes to select the best of two possible investment projects - Gulf Oil and Esso. The firm observes that the risk-free rate is 7% and the market rate of return is 12%. The risk adjusted discount factor (beta) of Gulf Oil is 1.2 while the beta for Esso is 1.4. i. Gulf Oil Initial Investment (CF) $70,000 Year (1) ii. 1 2 3 4 $30,000 $30,000 $30,000 $30,000 Esso $78,000 Cash Flows (CF) $22,000 $32,000 $38,000 $46,000 Calculate the cost of capital for both Gulf Oil and Esso using the information provided above. (4 marks) Using the cost of capital, calculate the Net Present Value (NPV) for the investments in Gulf Oil and Esso. (6 marks) Which investment opportunity should Sharma Industries select? (2 marks) Using a diagram, distinguish between diversifiable and non-diversifiable risk. (3 marks)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer i ii iii Now that we have calculated the NPVs for both Gulf Oil and Esso we can compare them ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started