Answered step by step

Verified Expert Solution

Question

1 Approved Answer

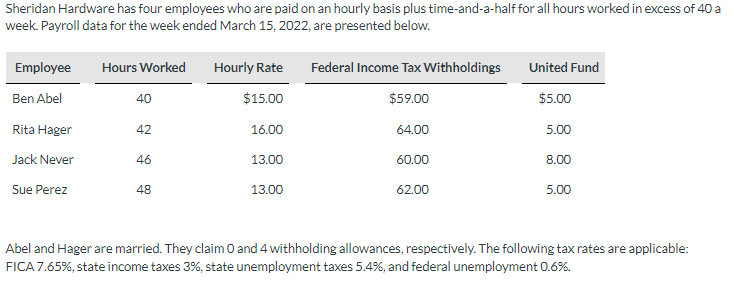

Sheridan Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll

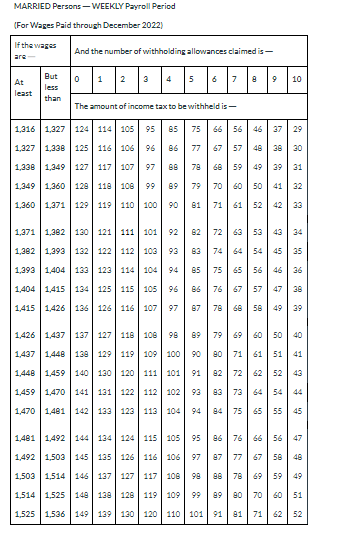

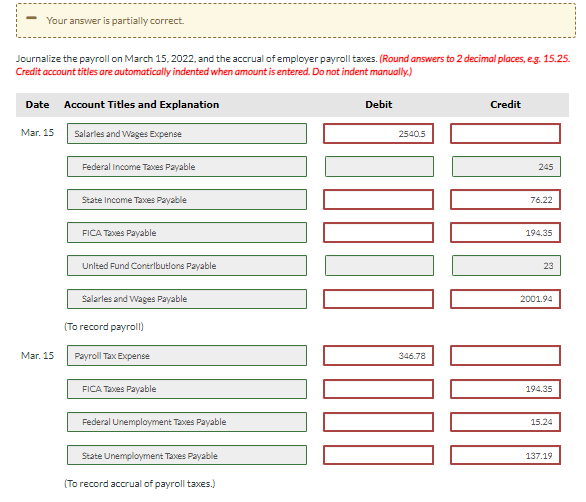

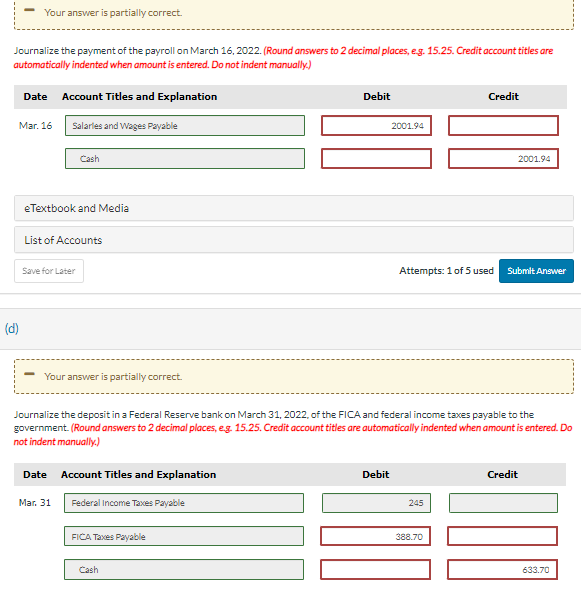

Sheridan Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. MARRIED Persons - W/EEKLY Payroll Period Journalize the payment of the payroll on March 16, 2022. (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) eTextbook and Media Attempts: 1 of 5 used (d) Journalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income taxes payable to the government. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Sheridan Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. MARRIED Persons - W/EEKLY Payroll Period Journalize the payment of the payroll on March 16, 2022. (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) eTextbook and Media Attempts: 1 of 5 used (d) Journalize the deposit in a Federal Reserve bank on March 31, 2022, of the FICA and federal income taxes payable to the government. (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. (Round answers to 2 decimal places, eg. 15.25. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started