Question

Show all work AS NEAT AS POSSIBLE. 1. A. What are the cash flows associated with each of Adams three car financing options? B. Suppose

Show all work AS NEAT AS POSSIBLE.

1. A. What are the cash flows associated with each of Adams three car financing options?

B. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could easily afford to pay cash for the car without running into debt now or in the foreseeable future. If his cash earns interest at a 5.4% APR (based on monthly compounding) at the bank, what would be his best purchase option for the car?

2. In fact, Adam doesnt have sufficient cash to cover all his debts including his (substantial) student loans. The loans have a 10% APR, and any money spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra $1 today saves Adam roughly $1.10 next year because he can pay down the student loans. So, 10% is Adams time value of money in this case.)

3. Suppose instead Adam has a lot of credit card debt, with an 18% APR, and he doubts he will pay off his debt completely before he pays off the car. What is Adams best option now?

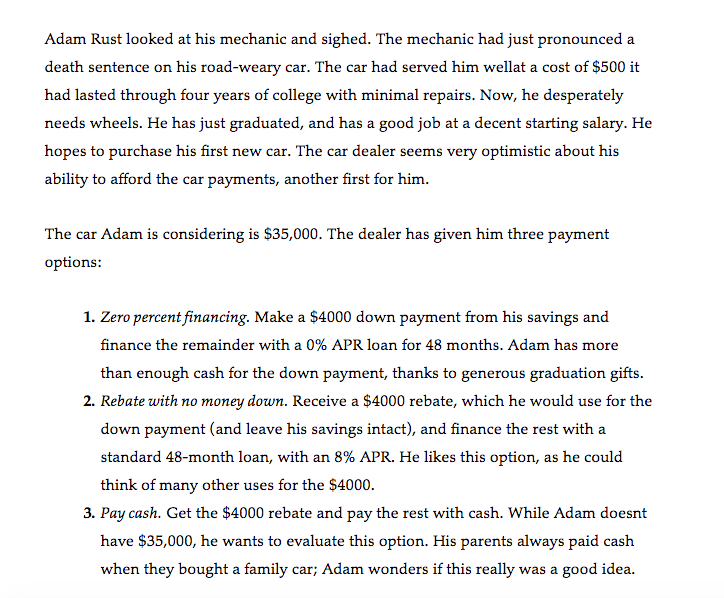

Adam Rust looked at his mechanic and sighed. The mechanic had just pronounced a death sentence on his road-weary car. The car had served him wellat a cost of $500 it had lasted through four years of college with minimal repairs. Now, he desperately needs wheels. He has just graduated, and has a good job at a decent starting salary. He hopes to purchase his first new car. The car dealer seems very optimistic about his ability to afford the car payments, another first for him. The car Adam is considering is $35,000. The dealer has given him three payment options: 1. Zero percent financing. Make a $4000 down payment from his savings and finance the remainder with a 0% APR loan for 48 months. Adam has more than enough cash for the down payment, thanks to generous graduation gifts. 2. Rebate with no money down. Receive a $4000 rebate, which he would use for the down payment (and leave his savings intact), and finance the rest with a standard 48-month loan, with an 8% APR. He likes this option, as he could think of many other uses for the $4000 3. Pay cash. Get the $4000 rebate and pay the rest with cash. While Adam doesnt have $35,000, he wants to evaluate this option. His parents always paid cash when they bought a family car; Adam wonders if this really was a good idea

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started