Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show all work please! Lee Inc. just purchased a digital color printer for $360,000 to launch its 5-year project. This printer will be fully depreciated

Show all work please!

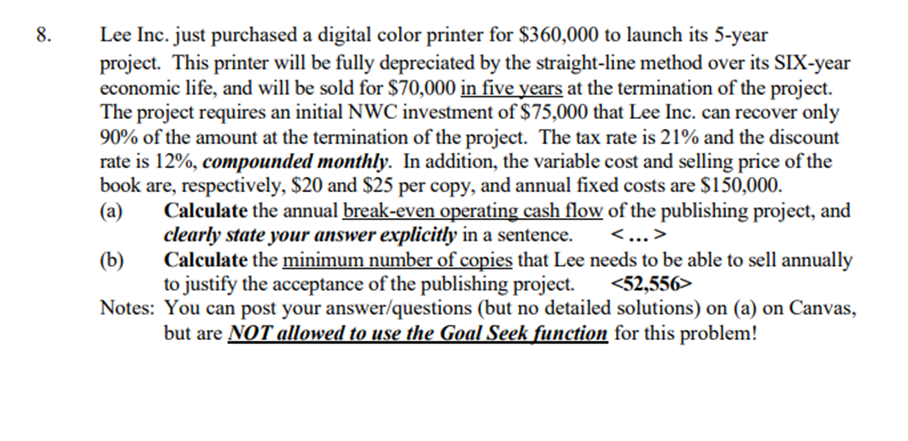

Lee Inc. just purchased a digital color printer for $360,000 to launch its 5-year project. This printer will be fully depreciated by the straight-line method over its SIX-year economic life, and will be sold for $70,000 in five years at the termination of the project. The project requires an initial NWC investment of \$75,000 that Lee Inc. can recover only 90% of the amount at the termination of the project. The tax rate is 21% and the discount rate is 12%, compounded monthly. In addition, the variable cost and selling price of the book are, respectively, $20 and $25 per copy, and annual fixed costs are $150,000. (a) Calculate the annual break-even operating cash flow of the publishing project, and clearly state your answer explicitly in a sentence. ... > (b) Calculate the minimum number of copies that Lee needs to be able to sell annually to justify the acceptance of the publishing project. Notes: You can post your answer/questions (but no detailed solutions) on (a) on Canvas, but are NOT allowed to use the Goal Seek function for this

Lee Inc. just purchased a digital color printer for $360,000 to launch its 5-year project. This printer will be fully depreciated by the straight-line method over its SIX-year economic life, and will be sold for $70,000 in five years at the termination of the project. The project requires an initial NWC investment of \$75,000 that Lee Inc. can recover only 90% of the amount at the termination of the project. The tax rate is 21% and the discount rate is 12%, compounded monthly. In addition, the variable cost and selling price of the book are, respectively, $20 and $25 per copy, and annual fixed costs are $150,000. (a) Calculate the annual break-even operating cash flow of the publishing project, and clearly state your answer explicitly in a sentence. ... > (b) Calculate the minimum number of copies that Lee needs to be able to sell annually to justify the acceptance of the publishing project. Notes: You can post your answer/questions (but no detailed solutions) on (a) on Canvas, but are NOT allowed to use the Goal Seek function for this Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started