show calculations

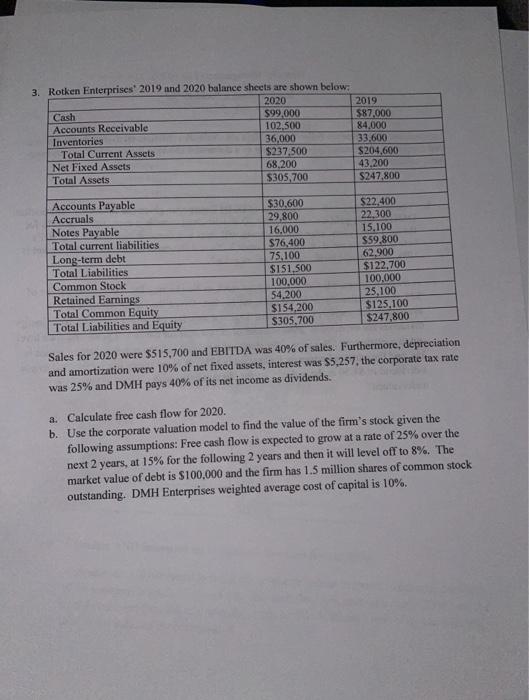

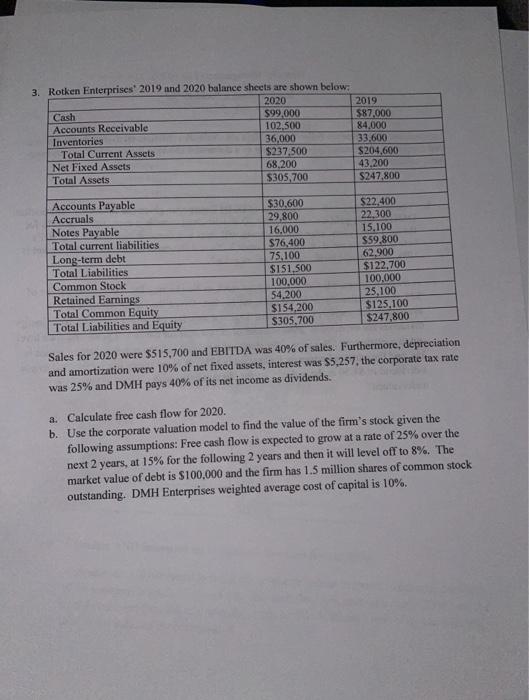

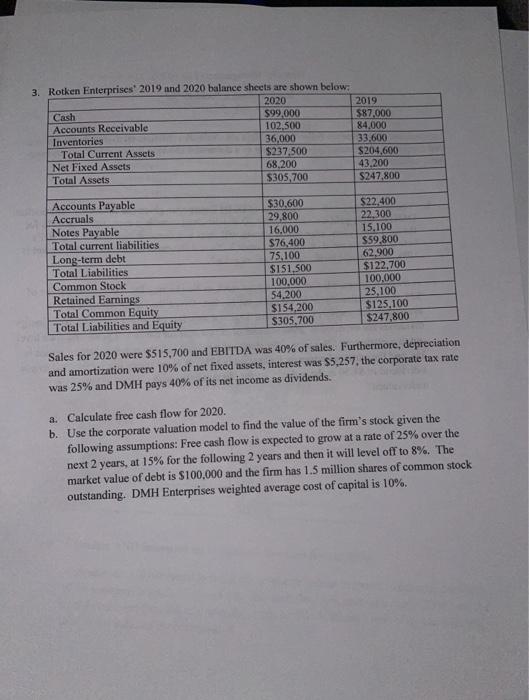

3. Rotken Enterprises 2019 and 2020 balance sheets are shown below: 2020 2019 Cash $99,000 $87,000 Accounts Receivable 102,500 84.000 Inventories 36,000 33.600 Total Current Assets $237.500 $204,600 Net Fixed Assets 68,200 43,200 Total Assets $305,700 S247.800 Accounts Payable Accruals Notes Payable Total current liabilities Long-term debt Total Liabilities Common Stock Retained Earnings Total Common Equity Total Liabilities and Equity $30,600 29,800 16,000 $76,400 75,100 S151.500 100,000 54.200 $154,200 $305,700 $22,400 22.300 15,100 S59,800 62.900 $122.700 100,000 25,100 $125.100 $247,800 Sales for 2020 were $515,700 and EBITDA was 40% of sales. Furthermore, depreciation and amortization were 10% of net fixed assets, interest was $5,257, the corporate tax rate was 25% and DMH pays 40% of its net income as dividends. a. Calculate free cash flow for 2020. b. Use the corporate valuation model to find the value of the firm's stock given the following assumptions: Free cash flow is expected to grow at a rate of 25% over the next 2 years at 15% for the following 2 years and then it will level off to 8%. The market value of debt is $100.000 and the firm has 1.5 million shares of common stock outstanding. DMH Enterprises weighted average cost of capital is 10% 3. Rotken Enterprises 2019 and 2020 balance sheets are shown below: 2020 2019 Cash $99,000 $87,000 Accounts Receivable 102,500 84.000 Inventories 36,000 33.600 Total Current Assets $237.500 $204,600 Net Fixed Assets 68,200 43,200 Total Assets $305,700 S247.800 Accounts Payable Accruals Notes Payable Total current liabilities Long-term debt Total Liabilities Common Stock Retained Earnings Total Common Equity Total Liabilities and Equity $30,600 29,800 16,000 $76,400 75,100 S151.500 100,000 54.200 $154,200 $305,700 $22,400 22.300 15,100 S59,800 62.900 $122.700 100,000 25,100 $125.100 $247,800 Sales for 2020 were $515,700 and EBITDA was 40% of sales. Furthermore, depreciation and amortization were 10% of net fixed assets, interest was $5,257, the corporate tax rate was 25% and DMH pays 40% of its net income as dividends. a. Calculate free cash flow for 2020. b. Use the corporate valuation model to find the value of the firm's stock given the following assumptions: Free cash flow is expected to grow at a rate of 25% over the next 2 years at 15% for the following 2 years and then it will level off to 8%. The market value of debt is $100.000 and the firm has 1.5 million shares of common stock outstanding. DMH Enterprises weighted average cost of capital is 10%