Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show excel formulas in calculations and =formulatext or explain 3 (a) The Shanghal Door Company (SDC) has consistently paid out 40 per cent of its

show excel formulas in calculations and =formulatext or explain

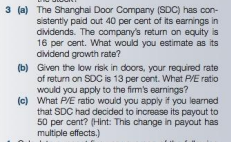

3 (a) The Shanghal Door Company (SDC) has consistently paid out 40 per cent of its earnings in dididends. The company's return on equity is 16 par cent. What would you estimate as its dididend growth rate? (b) Given the low risk in doors, your required rate of return on SDC is 13 per cent. What P/E ratio would you apply to the firm's earnings? (c) What P/E ratio would you apply if you learned that SDC had decided to increase its payout to 50 per cent? (Hint: This change in payout has multiple effects.) 3 (a) The Shanghal Door Company (SDC) has consistently paid out 40 per cent of its earnings in dididends. The company's return on equity is 16 par cent. What would you estimate as its dididend growth rate? (b) Given the low risk in doors, your required rate of return on SDC is 13 per cent. What P/E ratio would you apply to the firm's earnings? (c) What P/E ratio would you apply if you learned that SDC had decided to increase its payout to 50 per cent? (Hint: This change in payout has multiple effects.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started