Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show on keys on finanical calculator if possible 23) In addition, the investor expects that she can sell the property at the end of the

show on keys on finanical calculator if possible

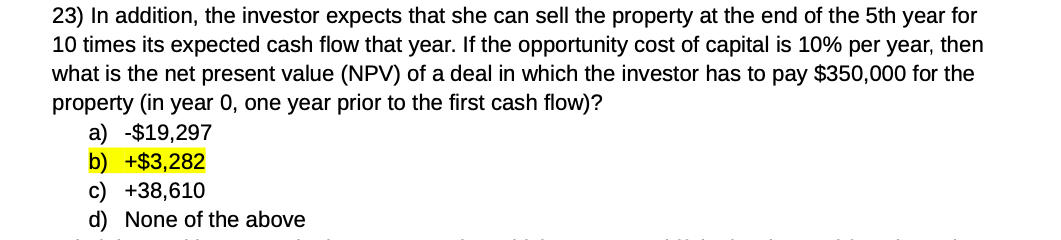

23) In addition, the investor expects that she can sell the property at the end of the 5th year for 10 times its expected cash flow that year. If the opportunity cost of capital is 10% per year, then what is the net present value (NPV) of a deal in which the investor has to pay $350,000 for the property (in year 0 , one year prior to the first cash flow)? a) $19,297 b) +$3,282 c) +38,610 d) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started