Question

*Show work* 1 ) What is the variable cost per unit of direct materials, direct material, and variable factory overhead all added up according to

*Show work*

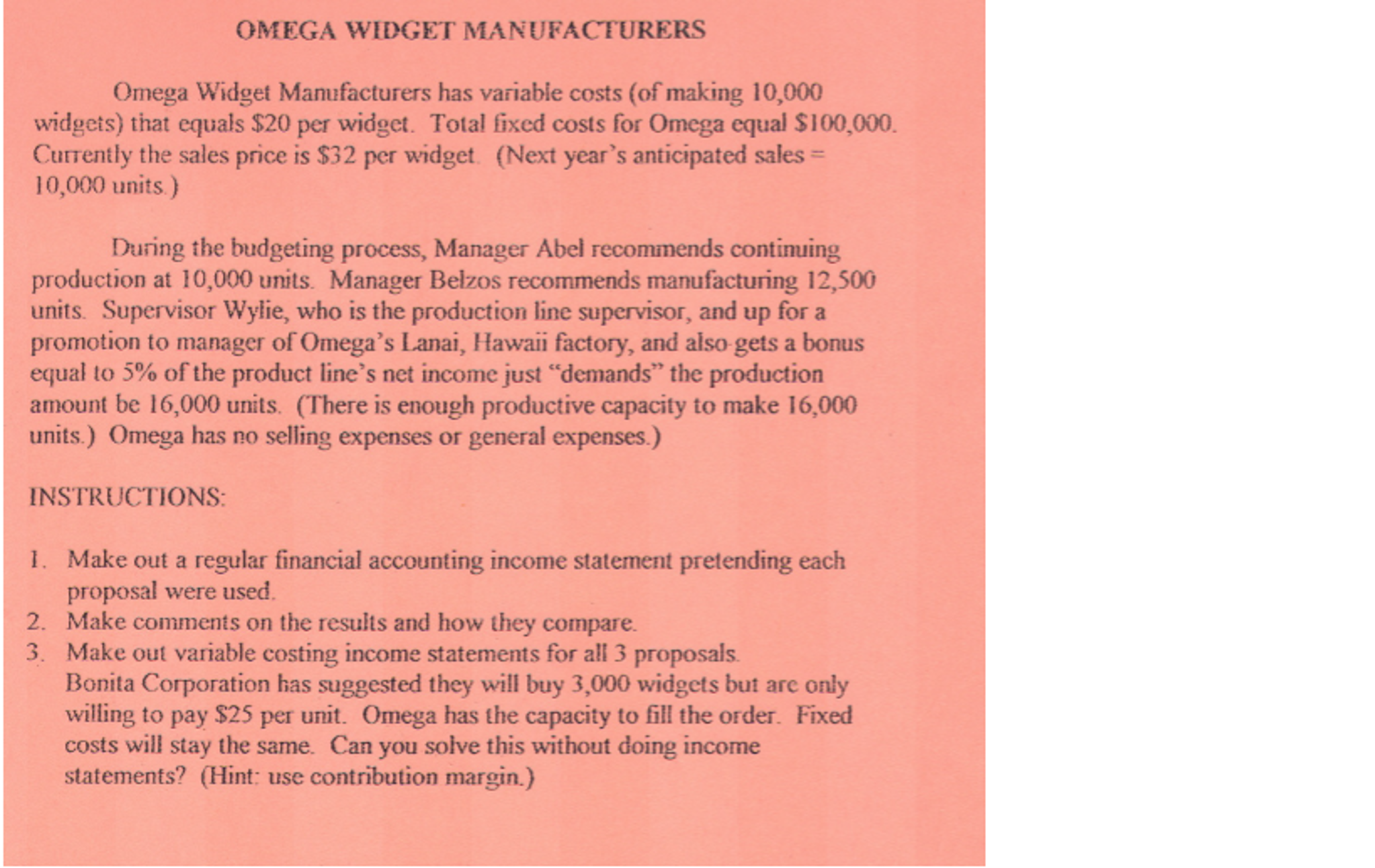

1 ) What is the variable cost per unit of direct materials, direct material, and variable factory overhead all added up according to the problem ? 2) What is the variable cost per unit of direct materials, direct material, and variable factory overhead all added up be if they produce 10,000 units; 12,500; 16,000; 25,000 ?

3) What will total fixed cost factory overhead cost if they produce 10,000 units; 12,500 ; 16,000 ; 25000?

4) How much in sales has Omega predicted for next year - even if they manufacture 10,000 units,12,500,16,000

5) What will the per unit fixed factory overhead cost be if 10,000 units;12,500;16,000 are made and each unit just absorb its share of that $100,000 fixed manufacturing cost?

6) If the firm make 10,000 units;12,500; 16,000 then what is the full cost of one manufactured unit ?

7) what is total cost of good sold expense under full costing if 10,000 units;12,500;16,000 are made and only 10,000 units are sold ?

8) What is net income under full costing if 10,000 units;12,500;16,000 are manufactured and only 10,000 units are sold?

9) What is the same variable costing net income for all 3 levels of manufacturing - regardless of how many units are manufactured but when only 10,000 units are solds ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started