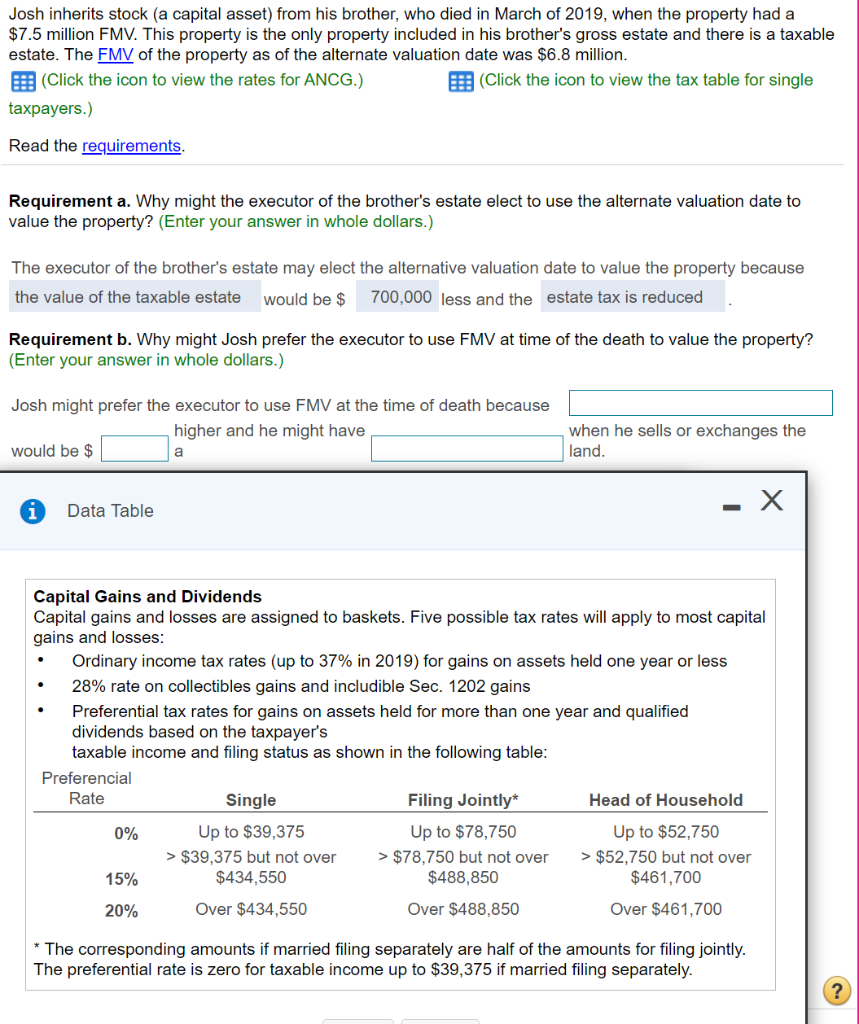

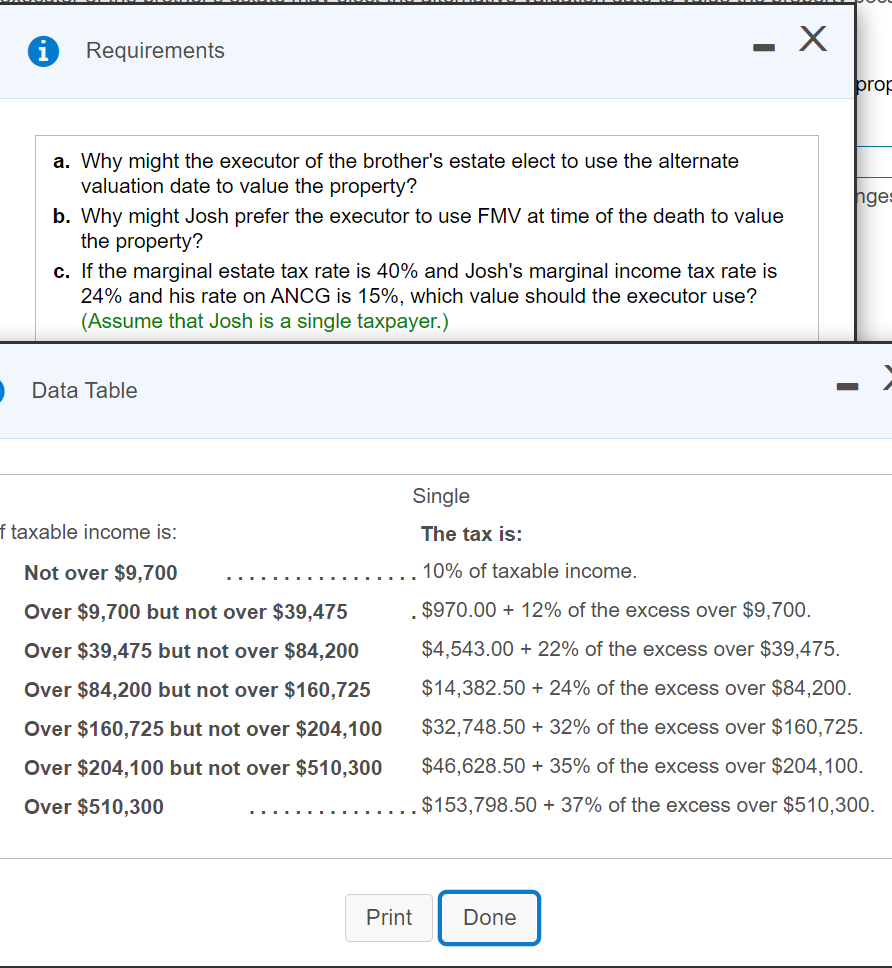

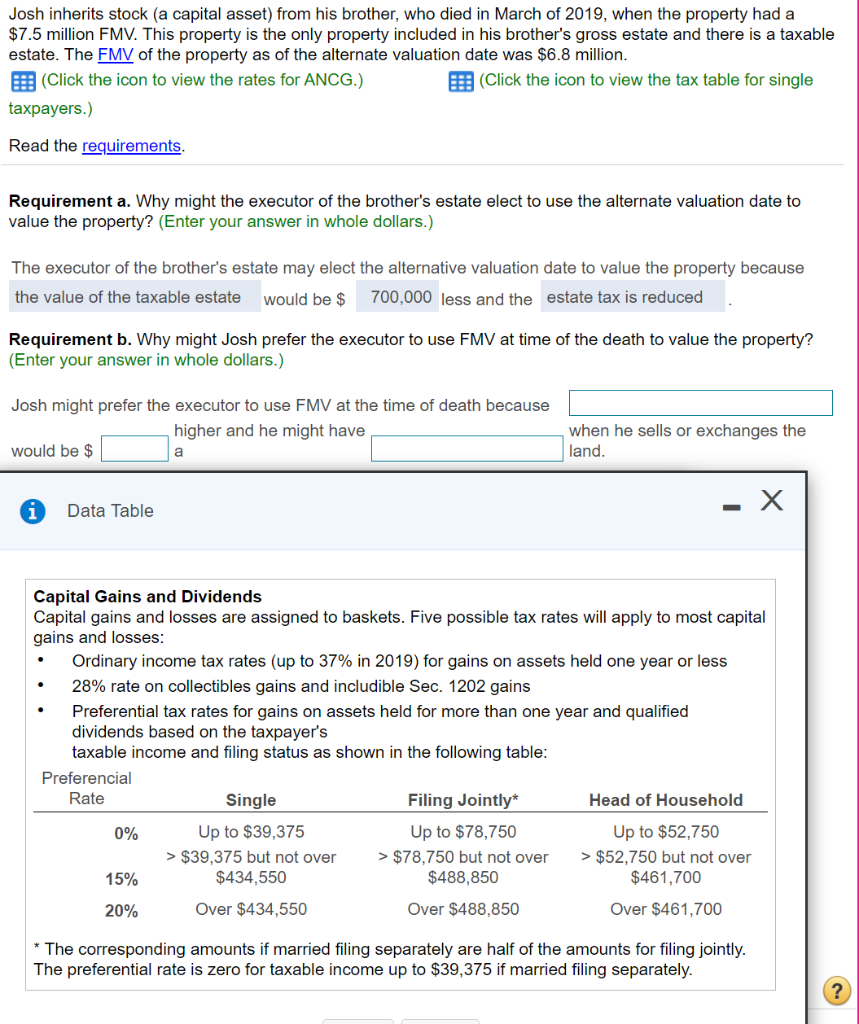

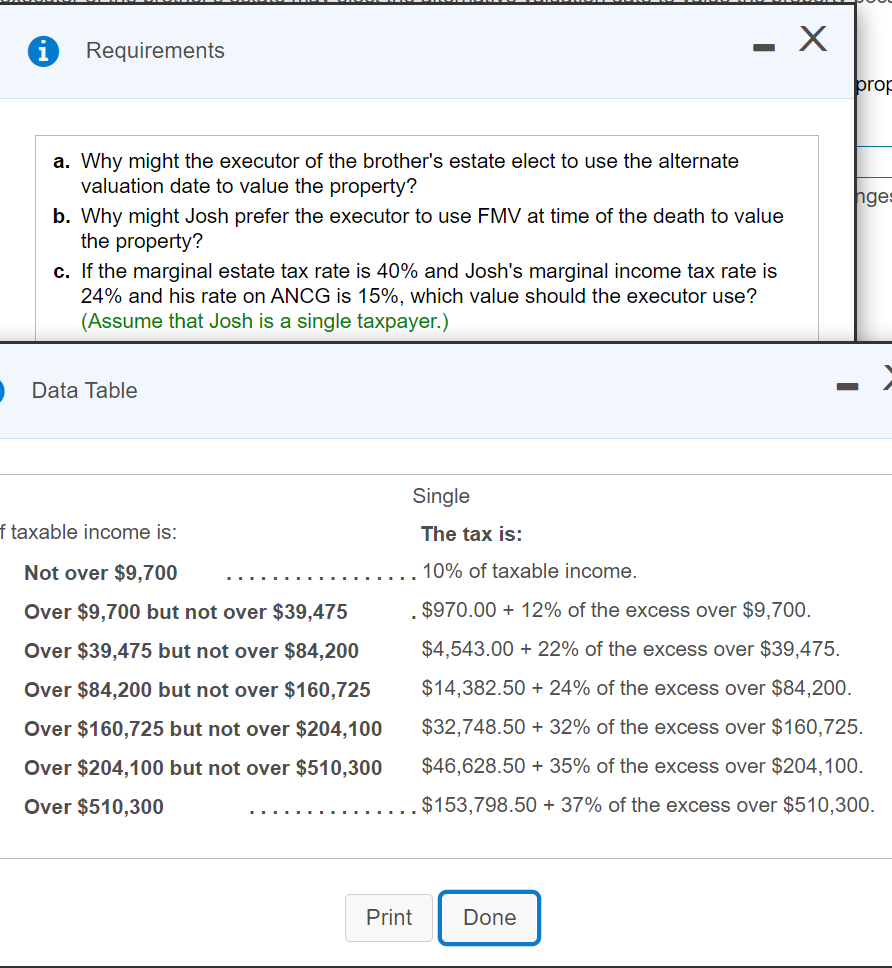

Josh inherits stock (a capital asset) from his brother, who died in March of 2019, when the property had a $7.5 million FMV. This property is the only property included in his brother's gross estate and there is a taxable estate. The FMV of the property as of the alternate valuation date was $6.8 million. (Click the icon to view the rates for ANCG.) (Click the icon to view the tax table for single taxpayers.) Read the requirements. Requirement a. Why might the executor of the brother's estate elect to use the alternate valuation date to value the property? (Enter your answer in whole dollars.) The executor of the brother's estate may elect the alternative valuation date to value the property because the value of the taxable estate would be $ 700,000 less and the estate tax is reduced Requirement b. Why might Josh prefer the executor to use FMV at time of the death to value the property? (Enter your answer in whole dollars.) Josh might prefer the executor to use FMV at the time of death because higher and he might have would be $ when he sells or exchanges the land. a x Data Table Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Rate Single Filing Jointly* Head of Household 0% Up to $39,375 Up to $78,750 Up to $52,750 > $39,375 but not over > $78,750 but not over > $52,750 but not over 15% $434,550 $488,850 $461,700 20% Over $434,550 Over $488,850 Over $461,700 * The corresponding amounts if married filing separately are half of the amounts for filing jointly. The preferential rate is zero for taxable income up to $39,375 if married filing separately. - X Requirements prog nge: a. Why might the executor of the brother's estate elect to use the alternate valuation date to value the property? b. Why might Josh prefer the executor to use FMV at time of the death to value the property? c. If the marginal estate tax rate is 40% and Josh's marginal income tax rate is 24% and his rate on ANCG is 15%, which value should the executor use? (Assume that Josh is a single taxpayer.) Data Table Single f taxable income is: The tax is: Not over $9,700 10% of taxable income. Over $9,700 but not over $39,475 Over $39,475 but not over $84,200 $970.00 + 12% of the excess over $9,700. $4,543.00 + 22% of the excess over $39,475. Over $84,200 but not over $160,725 $14,382.50 + 24% of the excess over $84,200. Over $160,725 but not over $204,100 $32,748.50 + 32% of the excess over $160,725. Over $204,100 but not over $510,300 $46,628.50 + 35% of the excess over $204,100. $153,798.50 + 37% of the excess over $510,300. Over $510,300 Print Done