Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show workings 190 220 20. The directors of Lunar Plc are considering investment in new equipment to increase the firm's flexibility. The finance director has

show workings

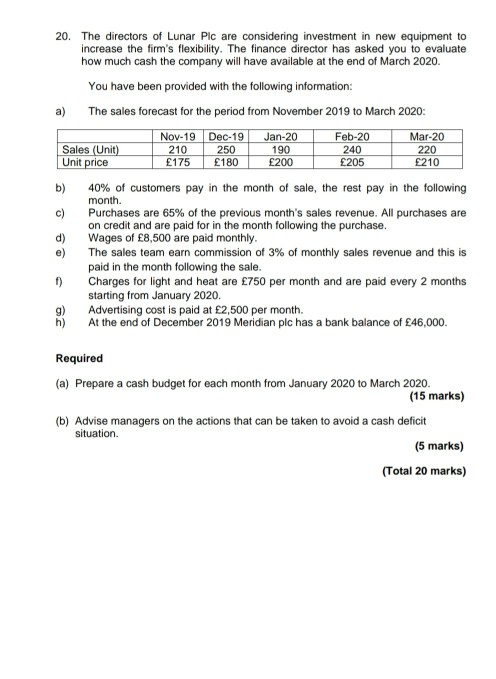

190 220 20. The directors of Lunar Plc are considering investment in new equipment to increase the firm's flexibility. The finance director has asked you to evaluate how much cash the company will have available at the end of March 2020. You have been provided with the following information: a) The sales forecast for the period from November 2019 to March 2020: Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Sales (Unit) 210 250 240 Unit price 175 180 200 205 210 b) 40% of customers pay in the month of sale, the rest pay in the following month. c) Purchases are 65% of the previous month's sales revenue. All purchases are on credit and are paid for in the month following the purchase. Wages of 8,500 are paid monthly. e) The sales team earn commission of 3% of monthly sales revenue and this is paid in the month following the sale. 1) Charges for light and heat are 750 per month and are paid every 2 months starting from January 2020. 9) Advertising cost is paid at 2,500 per month. h) At the end of December 2019 Meridian plc has a bank balance of 46,000. d) Required (a) Prepare a cash budget for each month from January 2020 to March 2020. (15 marks) (b) Advise managers on the actions that can be taken to avoid a cash deficit situation (5 marks) (Total 20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started