Answered step by step

Verified Expert Solution

Question

1 Approved Answer

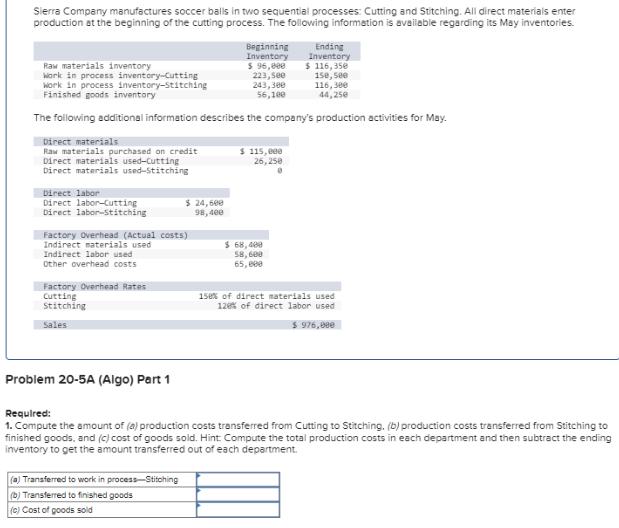

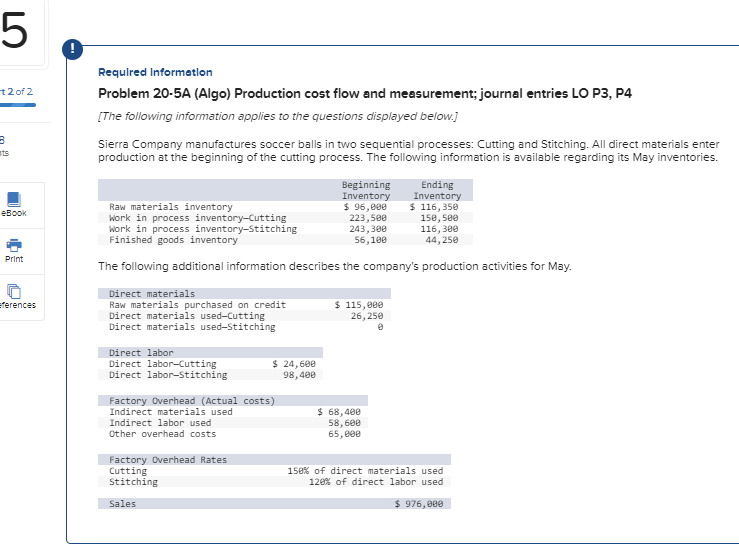

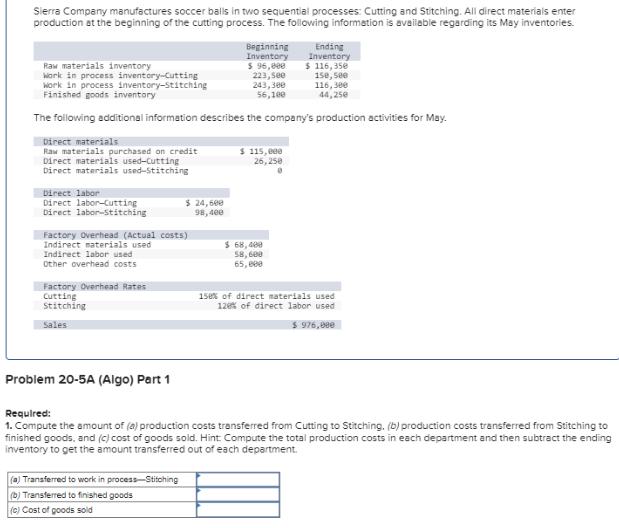

Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process.

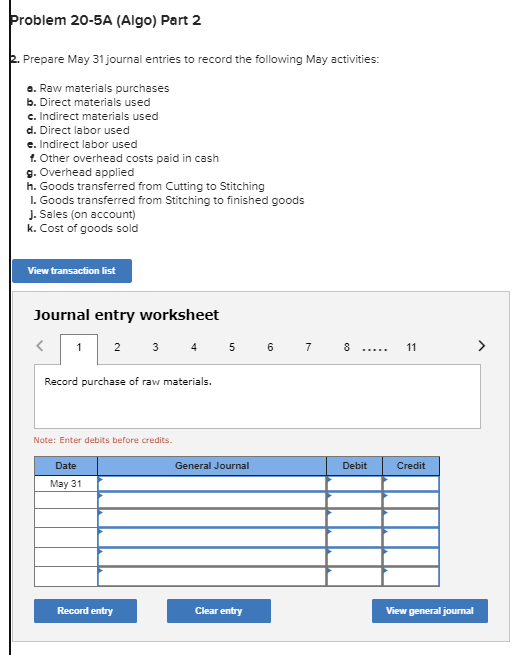

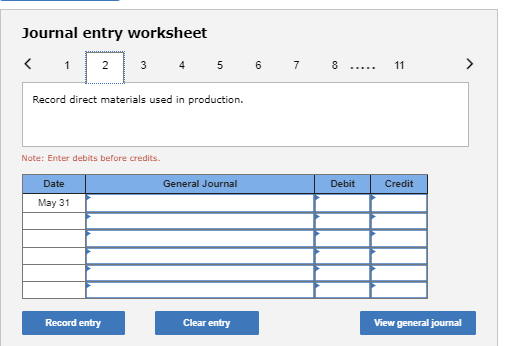

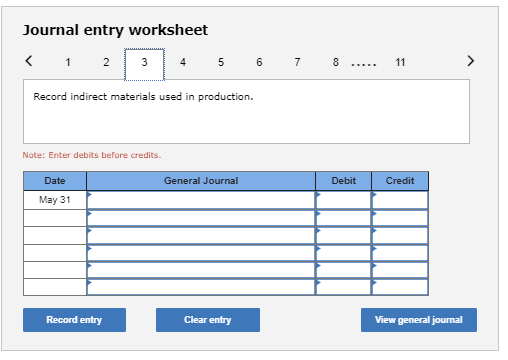

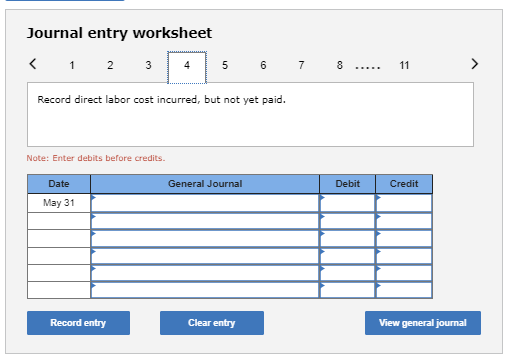

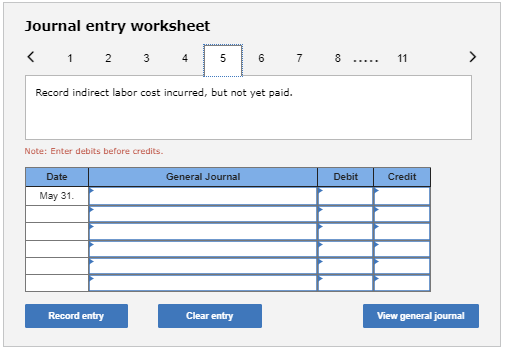

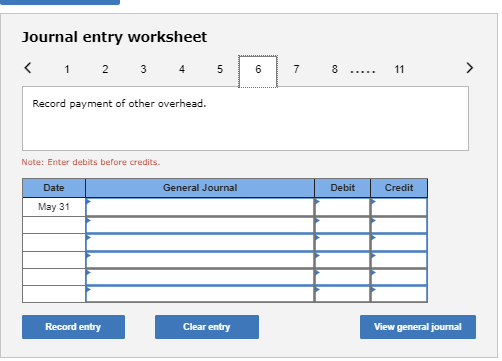

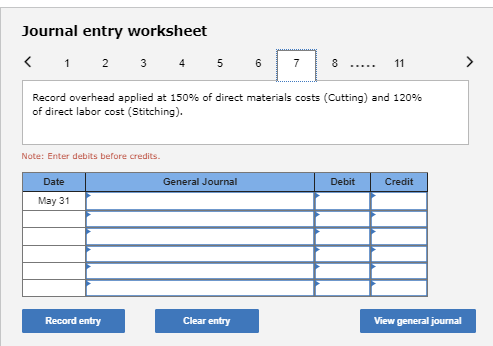

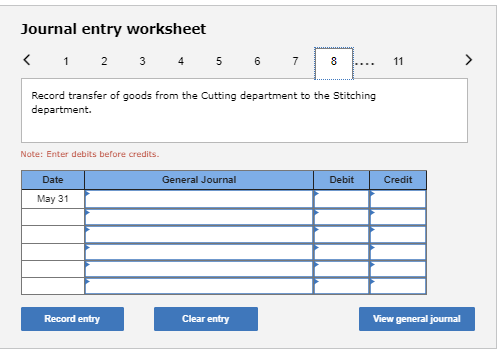

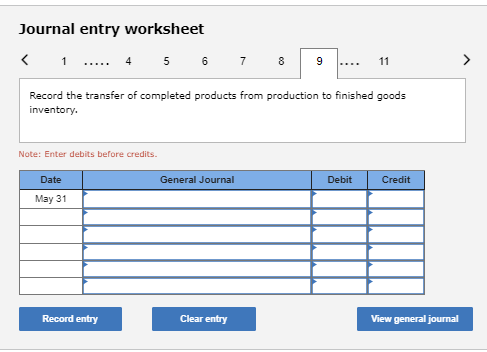

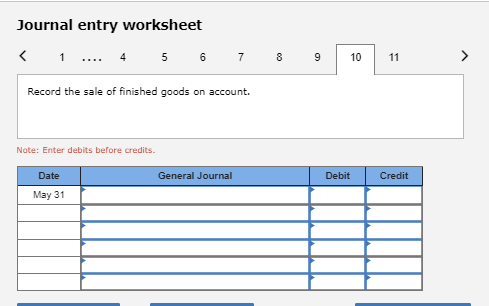

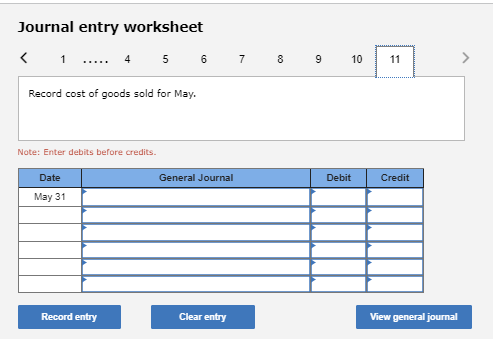

Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory The following additional information describes the company's production activities for May. Direct labor Direct labor-Cutting Direct labor-Stitching Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales Problem 20-5A (Algo) Part 1 $ 24,600 98,400 Beginning Inventory $ 96,800 223,5ee 243,300 56,100 (a) Transferred to work in process-Stitching (b) Transferred to finished goods (c) Cost of goods sold $ 115,000 26,250 Ending Inventory $ 116,350 $ 68,408 58,600 65,000 150, 500 116,300 44,250 158% of direct materials used 12% of direct labor used $ 976,000 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching. (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department. LO 5 t 2 of 2 B ts eBook Print eferences Required Information Problem 20-5A (Algo) Production cost flow and measurement; journal entries LO P3, P4 [The following information applies to the questions displayed below.] Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory The following additional information describes the company's production activities for May. Direct labor Direct labor-Cutting Direct labor-Stitching $ 24,600 98,400 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales Beginning Inventory $ 96,000 223,500 243,300 56,100 $ 115,000 26,250 Ending Inventory $116,350 $ 68,400 58,600 65,000 150,500 116,300 44,250 158% of direct materials used 120% of direct labor used $ 976,000 Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory The following additional information describes the company's production activities for May. Direct labor Direct labor-Cutting Direct labor-Stitching Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales Problem 20-5A (Algo) Part 1 $ 24,600 98,400 Beginning Inventory $ 96,800 223,5ee 243,300 56,100 (a) Transferred to work in process-Stitching (b) Transferred to finished goods (c) Cost of goods sold $ 115,000 26,250 Ending Inventory $ 116,350 $ 68,408 58,600 65,000 150, 500 116,300 44,250 158% of direct materials used 12% of direct labor used $ 976,000 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching. (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department. Problem 20-5A (Algo) Part 2 2. Prepare May 31 journal entries to record the following May activities: a. Raw materials purchases b. Direct materials used c. Indirect materials used d. Direct labor used e. Indirect labor used 1. Other overhead costs paid in cash g. Overhead applied h. Goods transferred from Cutting to Stitching 1. Goods transferred from Stitching to finished goods J. Sales (on account) k. Cost of goods sold View transaction list Journal entry worksheet 2 1 Record purchase of raw materials. 3 4 5 6 Note: Enter debits before credits. Date May 31 Record entry General Journal Clear entry 7 8 co Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 Record direct materials used in production. Note: Enter debits before credits. Date May 31 4 5 6 Record entry General Journal Clear entry 7 8 I Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 Note: Enter debits before credits. Record indirect materials used in production. Date May 31 4 Record entry 5 6 General Journal Clear entry 7 8 ***** Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 Note: Enter debits before credits. Record direct labor cost incurred, but not yet paid. Date May 31 4 Record entry 5 6 General Journal Clear entry 7 8 T Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 4 Note: Enter debits before credits. Record indirect labor cost incurred, but not yet paid. Date May 31. 5 Record entry General Journal 6 Clear entry 7 8 Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 4 5 Record payment of other overhead. Note: Enter debits before credits. Date May 31 Record entry General Journal Clear entry 6 7 8 Debit 11 Credit View general journal Journal entry worksheet < 1 2 3 4 5 Note: Enter debits before credits. Date May 31 Record entry Record overhead applied at 150% of direct materials costs (Cutting) and 120% of direct labor cost (Stitching). General Journal 6 Clear entry 7 8 11 Debit Credit View general journal Journal entry worksheet < 1 2 3 4 5 Note: Enter debits before credits. Date May 31 Record transfer of goods from the Cutting department to the Stitching department. Record entry General Journal 6 Clear entry 7 8 Debit 11 Credit View general journal Journal entry worksheet < 1 Record the transfer of completed products from production to finished goods inventory. Note: Enter debits before credits. Date May 31 4 5 6 7 Record entry General Journal Clear entry 8 9 Debit 11 Credit View general journal Journal entry worksheet < 5 1 ... 4 Record the sale of finished goods on account. Note: Enter debits before credits. 6 7 8 Date May 31 General Journal 9 Debit 10 11 Credit Journal entry worksheet 1 .... 4 5 6 7 8 9 10 Record cost of goods sold for May. Note: Enter debits before credits. Date May 31 Record entry General Journal Clear entry Debit 11 Credit View general journal

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cost of goods transferred to finished goods and cost of goods Beginning work in process inventory Cutting 223500 Direct Material used in production 26...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started