Answered step by step

Verified Expert Solution

Question

1 Approved Answer

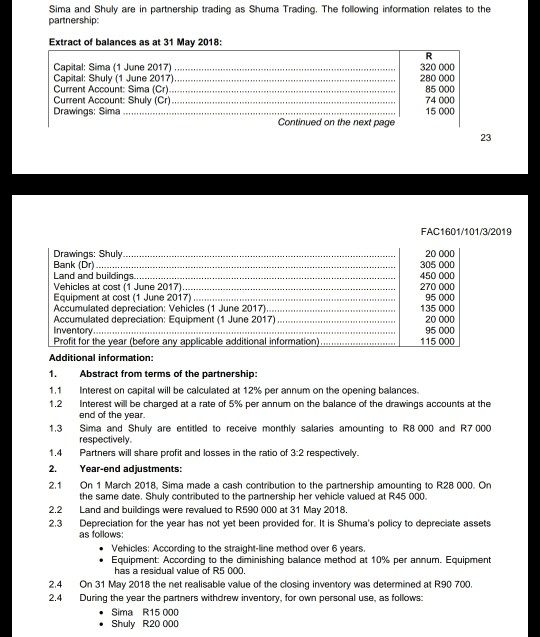

Sima and Shuly are in partnership trading as Shuma Trading. The following information relates to the Extract of balances as at 31 May 2018 Capital:

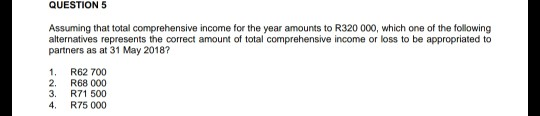

Sima and Shuly are in partnership trading as Shuma Trading. The following information relates to the Extract of balances as at 31 May 2018 Capital: Sima (1 June 2017) Capital: Shuly (1 June 2017) Current Account: Sima (Cr) Current Account: Shuly (Cr) Drawings: Sima 320 000 280 000 85 000 74 000 15 000 Continued on the next page FAC1601/101/3/2019 20 000 305 000 450 000 270 000 95 000 135 000 20000 95 000 115 000 Vehicles at cost (1 June 2017) Equipment at cost (1 June 2017) Accumulated depreciation: Vehicles (1 June 2017) Accumulated depreciation: Equipment (1 June 2017) additional information 1 Abstract from terms of the partnership 1.1 1.2 Interest on capital will be calculated at 12% per annum on the opening balances. Interest will be charged at a rate of 5% per annum on the balance of the drawings accounts at the 1.3 1.4 2. 2.1 Sima and Shuly are entitled to receive monthly salaries amounting to R8 000 and R7 000 Partners will share profit and losses in the ratio of 3:2 respectively Year-end adjustments: On 1 March 2018, Sima made a cash contribution to the partnership amounting to R28 000. On the same date. Shuly contributed to the partnership her vehicle valued at R45 000. Land and buildings were revalued to R590 000 at 31 May 2018. Depreciation for the year has not yet been provided for. It is Shuma's policy to depreciate assets 2.2 2.3 . Vehicles: According to the straight-line method over 6 years. * Equipment According to the diminishing balance method at 10% per annum. Equipment has a residual value of R5 000 2.4 2.4 On 31 May 2018 the net realisable value of the closing inventory was determined at R90 700. During the year the partners withdrew inventory, for own personal use, as follows: QUESTION5 Assuming that total comprehensive income for the year amounts to R320 000, which one of the following alternatives represents the correct amount of total comprehensive income or loss to be appropriated to partners as at 31 May 2018? 1. R62 700 2. R68 000 3. R71 500 4. R75 000 Sima and Shuly are in partnership trading as Shuma Trading. The following information relates to the Extract of balances as at 31 May 2018 Capital: Sima (1 June 2017) Capital: Shuly (1 June 2017) Current Account: Sima (Cr) Current Account: Shuly (Cr) Drawings: Sima 320 000 280 000 85 000 74 000 15 000 Continued on the next page FAC1601/101/3/2019 20 000 305 000 450 000 270 000 95 000 135 000 20000 95 000 115 000 Vehicles at cost (1 June 2017) Equipment at cost (1 June 2017) Accumulated depreciation: Vehicles (1 June 2017) Accumulated depreciation: Equipment (1 June 2017) additional information 1 Abstract from terms of the partnership 1.1 1.2 Interest on capital will be calculated at 12% per annum on the opening balances. Interest will be charged at a rate of 5% per annum on the balance of the drawings accounts at the 1.3 1.4 2. 2.1 Sima and Shuly are entitled to receive monthly salaries amounting to R8 000 and R7 000 Partners will share profit and losses in the ratio of 3:2 respectively Year-end adjustments: On 1 March 2018, Sima made a cash contribution to the partnership amounting to R28 000. On the same date. Shuly contributed to the partnership her vehicle valued at R45 000. Land and buildings were revalued to R590 000 at 31 May 2018. Depreciation for the year has not yet been provided for. It is Shuma's policy to depreciate assets 2.2 2.3 . Vehicles: According to the straight-line method over 6 years. * Equipment According to the diminishing balance method at 10% per annum. Equipment has a residual value of R5 000 2.4 2.4 On 31 May 2018 the net realisable value of the closing inventory was determined at R90 700. During the year the partners withdrew inventory, for own personal use, as follows: QUESTION5 Assuming that total comprehensive income for the year amounts to R320 000, which one of the following alternatives represents the correct amount of total comprehensive income or loss to be appropriated to partners as at 31 May 2018? 1. R62 700 2. R68 000 3. R71 500 4. R75 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started