Answered step by step

Verified Expert Solution

Question

1 Approved Answer

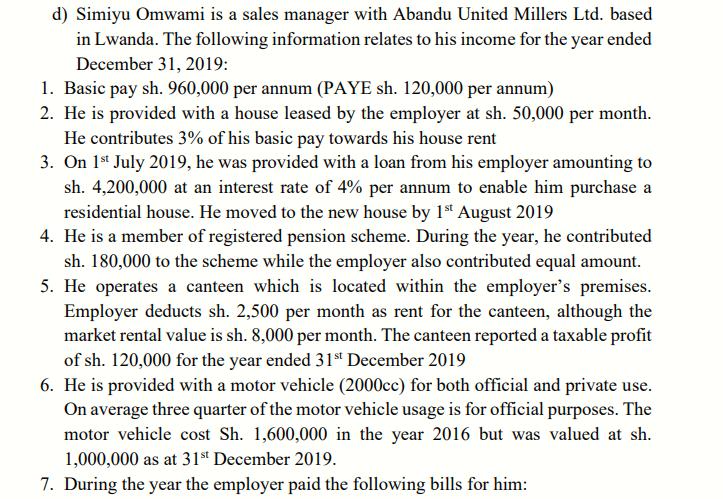

Simiyu Omwami is a sales manager with Abandu United Millers Ltd. based in Lwanda. The following information relates to his income for the year

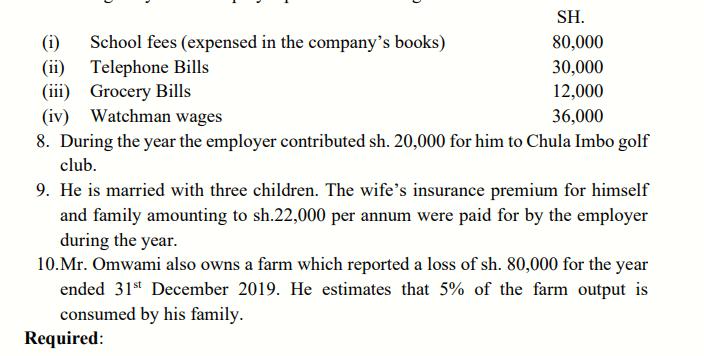

Simiyu Omwami is a sales manager with Abandu United Millers Ltd. based in Lwanda. The following information relates to his income for the year ended December 31, 2019: 1. Basic pay sh. 960,000 per annum (PAYE sh. 120,000 per annum) 2. He is provided with a house leased by the employer at sh. 50,000 per month. He contributes 3% of his basic pay towards his house rent 3. On 1st July 2019, he was provided with a loan from his employer amounting to sh. 4,200,000 at an interest rate of 4% per annum to enable him purchase a residential house. He moved to the new house by 1st August 2019 4. He is a member of registered pension scheme. During the year, he contributed sh. 180,000 to the scheme while the employer also contributed equal amount. 5. He operates a canteen which is located within the employer's premises. Employer deducts sh. 2,500 per month as rent for the canteen, although the market rental value is sh. 8,000 per month. The canteen reported a taxable profit of sh. 120,000 for the year ended 31st December 2019 6. He is provided with a motor vehicle (2000cc) for both official and private use. On average three quarter of the motor vehicle usage is for official purposes. The motor vehicle cost Sh. 1,600,000 in the year 2016 but was valued at sh. 1,000,000 as at 31st December 2019. 7. During the year the employer paid the following bills for him: SH. 80,000 30,000 12,000 36,000 (i) School fees (expensed in the company's books) (ii) Telephone Bills (iii) Grocery Bills (iv) Watchman wages 8. During the year the employer contributed sh. 20,000 for him to Chula Imbo golf club. 9. He is married with three children. The wife's insurance premium for himself and family amounting to sh.22,000 per annum were paid for by the employer during the year. 10. Mr. Omwami also owns a farm which reported a loss of sh. 80,000 for the year ended 31st December 2019. He estimates that 5% of the farm output is consumed by his family. Required: (i) Taxable income of Simiyu Omwami for the year ended 31st December 2019. (11 marks) Tax payable (if any) from the income computed in (1) above. (4 marks)

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started