Question

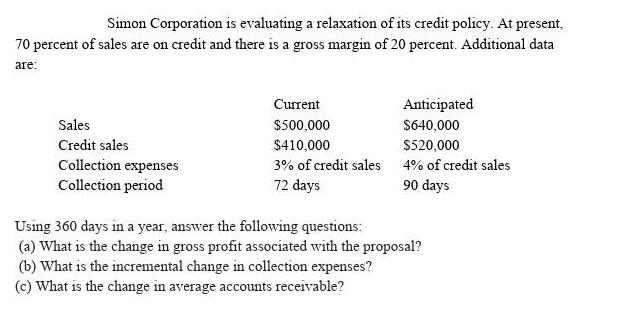

Simon Corporation is evaluating a relaxation of its credit policy. At present. 70 percent of sales are on credit and there is a gross

Simon Corporation is evaluating a relaxation of its credit policy. At present. 70 percent of sales are on credit and there is a gross margin of 20 percent. Additional data are: Current Anticipated Sales $500,000 $640,000 Credit sales $410,000 $520,000 4% of credit sales Collection expenses Collection period 3% of credit sales 72 days 90 days Using 360 days in a year, answer the following questions: (a) What is the change in gross profit associated with the proposal? (b) What is the incremental change in collection expenses? (c) What is the change in average accounts receivable?

Step by Step Solution

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Gross margin for current period 20of sales 20of500000100000 Gross m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Corporate Finance What Companies Do

Authors: John Graham, Scott Smart

3rd edition

9781111532611, 1111222282, 1111532613, 978-1111222284

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App