Question

Sirius Satellite Radio was a satellite radio (SDARS) and online radio service operating in North America, owned by Sirius XM Holdings. Its business model is

Sirius Satellite Radio was a satellite radio (SDARS) and online radio service operating in North America, owned by Sirius XM Holdings.

Its business model is to provide pay-for-service radio, analogous to the business model for premium cable television. Music channels are presented without advertising, while its talk channels, such as Howard Stern's Howard 100 and Howard 101 and Jason Ellis' Faction talk 103, carry commercials. Because all channels are free from FCC content regulation, songs are played unedited for language; talk programs may also feature explicit content if they wish. Subscriptions are prepaid and range in price from US$14.99 monthly (US$9.99 for each additional receiver) to US$699.99 for lifetime (of the receiver equipment). There is a US$15 activation fee for every radio activated. Sirius announced it had achieved its first positive cash flow quarter for the period ending December 2006.

Sirius launched its radio service in four states on February 14, 2002, expanding service to the rest of the contiguous U.S. by July of that year. On October 16, 2006, Sirius announced that it would be launching Sirius Internet Radio, with 78 of its 135 channels being available worldwide on the internet to any of its subscribers with a valid user name and password.

On July 29, 2008, Sirius formally completed its merger with former competitor XM Satellite Radio. The combined company began operating under the name Sirius XM Satellite Radio.[3] On November 12, 2008, Sirius and XM began broadcasting with their new, combined channel lineups. On January 13, 2011, Sirius Satellite Radio was dissolved as a separate entity and merged into Sirius XM Radio, Inc.

Refer to the Sirius 10K filings in 2005 and answer following questions

- Fill out the blanks.

| 2004 | 2005 | |

Net Operating Margin | |||

x Net Operating Asset Turnover | |||

= Return on Net Operating Assets | |||

Net Borrowing Cost (NBC) | |||

Spread (RNOA - NBC) | |||

Financial Leverage (LEV) | |||

ROE = RNOA + LEV*Spread |

- Discuss whether the critical accounting policies of Sirius fairly present Sirius’s financial performance (refer to Sirius 10K filings).

- Analyze growth in revenue and profitability in 2004 and 2005.

- How would you restate Sirius’s accounting results in order to better reflect Sirius’s underlying economic performance?

- Evaluate Economies of Scale and Operating Risks.

- Evaluate credit risks using relevant statistics

- Sirius adjusted 2005 performance by excluding depreciation and equity granted to third parties and employees.

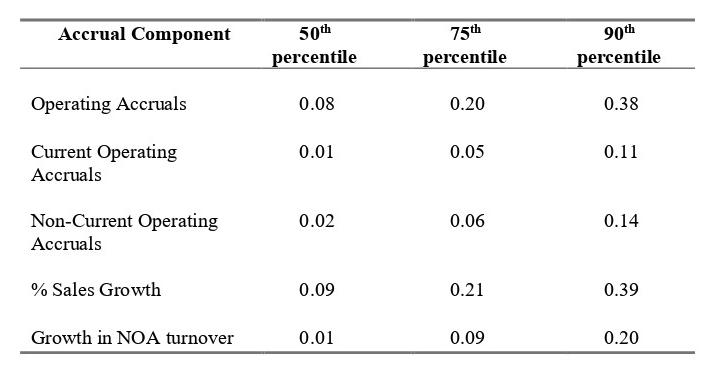

- Calculate each number and discuss the quality of Groupon’s earnings by focusing on accrual quality (Use beginning and ending balance of NOA, COA, and NCOA and show your calculation. To evaluate the earnings quality, refer to the Figure 1 – Percentile Cut-offs for the Historical Distributions of Accruals Components)

Inputs | 2005 |

Net Operating Assets (NOA) | |

Current Net Operating Asset (COA) | |

Noncurrent Net Operating Assets (NCOA) | |

Operating Accruals | |

Current Operating Accruals | |

Noncurrent Operating Accruals |

Accrual Component Operating Accruals Current Operating Accruals Non-Current Operating Accruals % Sales Growth Growth in NOA turnover 50th percentile 0.08 0.01 0.02 0.09 0.01 75th percentile 0.20 0.05 0.06 0.21 0.09 90th percentile 0.38 0.11 0.14 0.39 0.20

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

However I can provide you with some general information and guidance on the topics you mentioned 1 Critical accounting policies To assess whether Siriuss critical accounting policies fairly present it...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started