Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sirrr plzz can u make it quick Take me to the text Bertrand Company has has calculated the gross pay of one of its employees

sirrr plzz can u make it quick

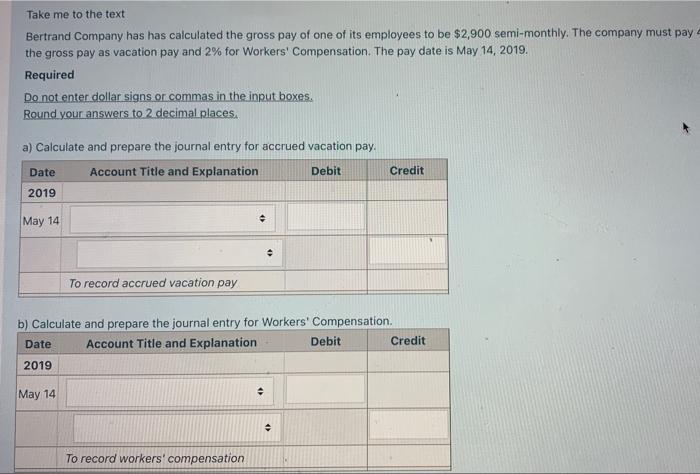

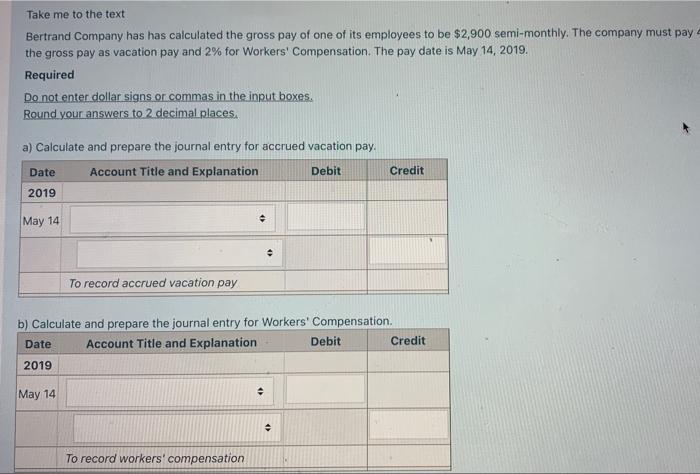

Take me to the text Bertrand Company has has calculated the gross pay of one of its employees to be $2,900 semi-monthly. The company must pay the gross pay as vacation pay and 2% for Workers' Compensation. The pay date is May 14, 2019. Required Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. a) Calculate and prepare the journal entry for accrued vacation pay. Date Account Title and Explanation Debit Credit 2019 May 14 To record accrued vacation pay b) Calculate and prepare the journal entry for Workers' Compensation. Date Account Title and Explanation Debit Credit 2019 May 14 To record workers' compensation Take me to the text Bertrand Company has has calculated the gross pay of one of its employees to be $2,900 semi-monthly. The company must pay the gross pay as vacation pay and 2% for Workers' Compensation. The pay date is May 14, 2019. Required Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. a) Calculate and prepare the journal entry for accrued vacation pay. Date Account Title and Explanation Debit Credit 2019 May 14 To record accrued vacation pay b) Calculate and prepare the journal entry for Workers' Compensation. Date Account Title and Explanation Debit Credit 2019 May 14 To record workers' compensation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started