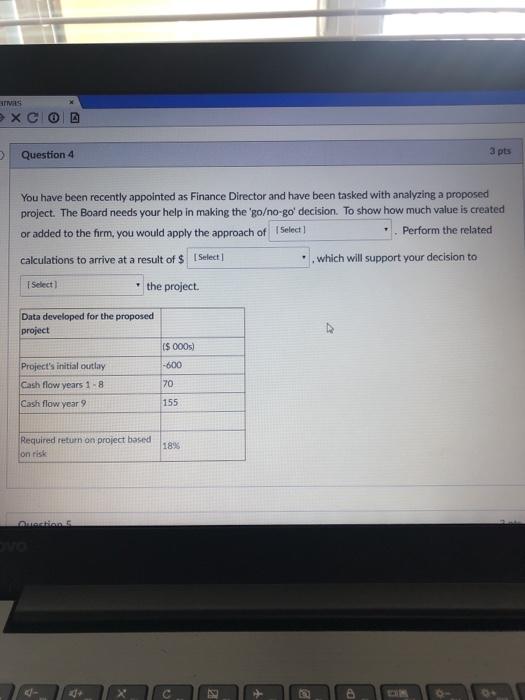

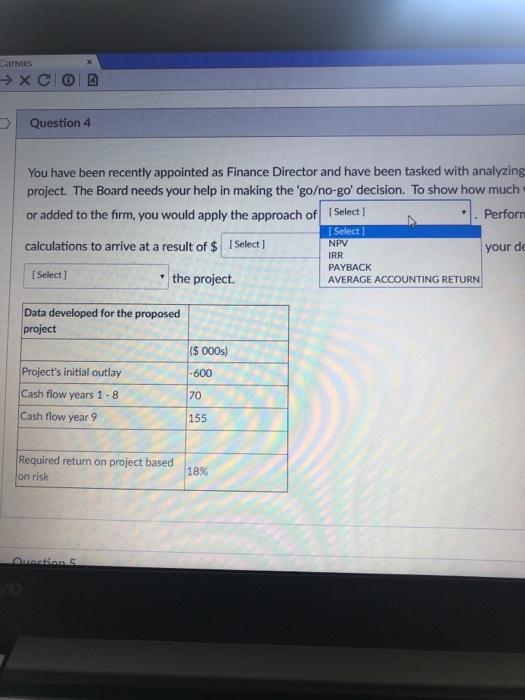

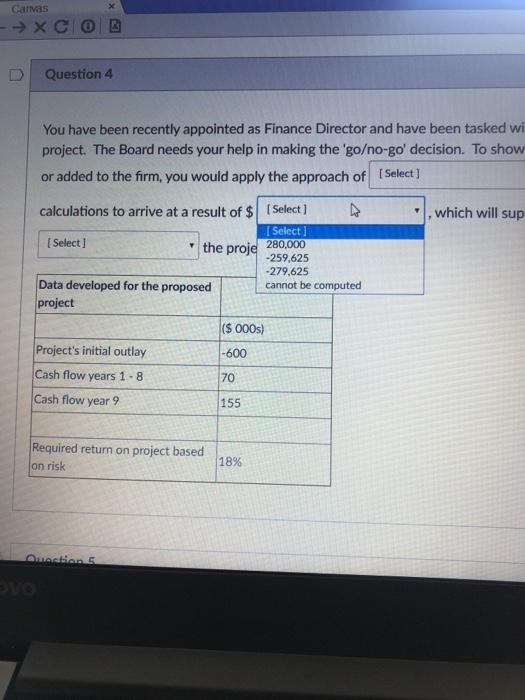

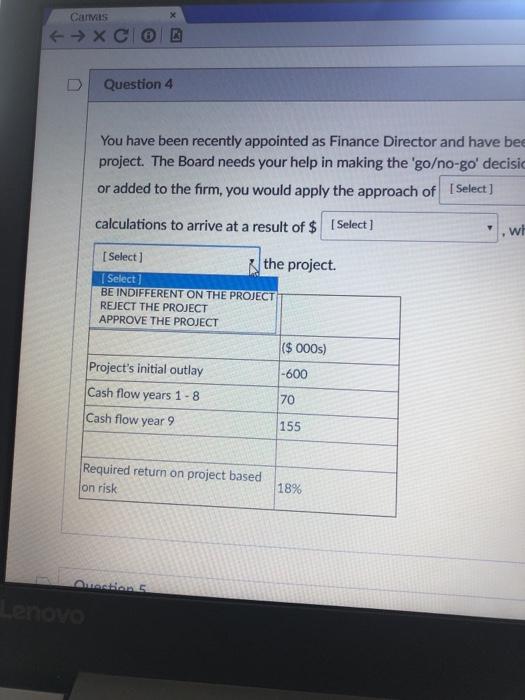

SIS 2 XCO Question 4 a pts You have been recently appointed as Finance Director and have been tasked with analyzing a proposed project. The Board needs your help in making the 'goo-go' decision. To show how much value is created or added to the firm, you would apply the approach of Select] Perform the related calculations to arrive at a result of $ Select .. which will support your decision to Select the project Data developed for the proposed project ($ 000) -600 Project's initial outlay Cash flow years 1-8 Cash flow year 9 70 155 Required return on project based fon risk 18% tian - Carvas > XC Question 4 You have been recently appointed as Finance Director and have been tasked with analyzing project. The Board needs your help in making the 'goo-go' decision. To show how much or added to the firm, you would apply the approach of Select ] Perfor Select calculations to arrive at a result of $ [Select) your de NPV IRR PAYBACK AVERAGE ACCOUNTING RETURN Select] the project. Data developed for the proposed project ($ 000s) Project's initial outlay -600 Cash flow years 1-8 70 Cash flow year 155 Required return on project based on risk 18% wstians Canvas -> XCO B Question 4 You have been recently appointed as Finance Director and have been tasked wi project. The Board needs your help in making the 'goo-go' decision. To show or added to the firm, you would apply the approach of Select] , which will sup calculations to arrive at a result of $ (Select] [ Select] Select) the proje 280,000 -259,625 -279.625 Data developed for the proposed cannot be computed project ($ 000s) Project's initial outlay -600 Cash flow years 1 - 8 70 Cash flow year 9 155 Required return on project based on risk 18% Ouacions X Canvas - 9X C 6 Question 4 You have been recently appointed as Finance Director and have bee project. The Board needs your help in making the 'goo-go' decisic or added to the firm, you would apply the approach of Select] calculations to arrive at a result of $ Select] WH [Select) the project Select) BE INDIFFERENT ON THE PROJECT REJECT THE PROJECT APPROVE THE PROJECT ($ 000s) -600 Project's initial outlay Cash flow years 1 - 8 Cash flow year 9 70 155 Required return on project based fon risk 18% cons Lenovo