Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SMGT3356 Business Strategic Assessment Assignment Questions: GAMMA RAY IS THE COMPANY X SO NEED TO ANALYZE THE COMPANY AND ITS STRATEGY IN BSG GAME. What

SMGT3356 Business Strategic Assessment

Assignment Questions:

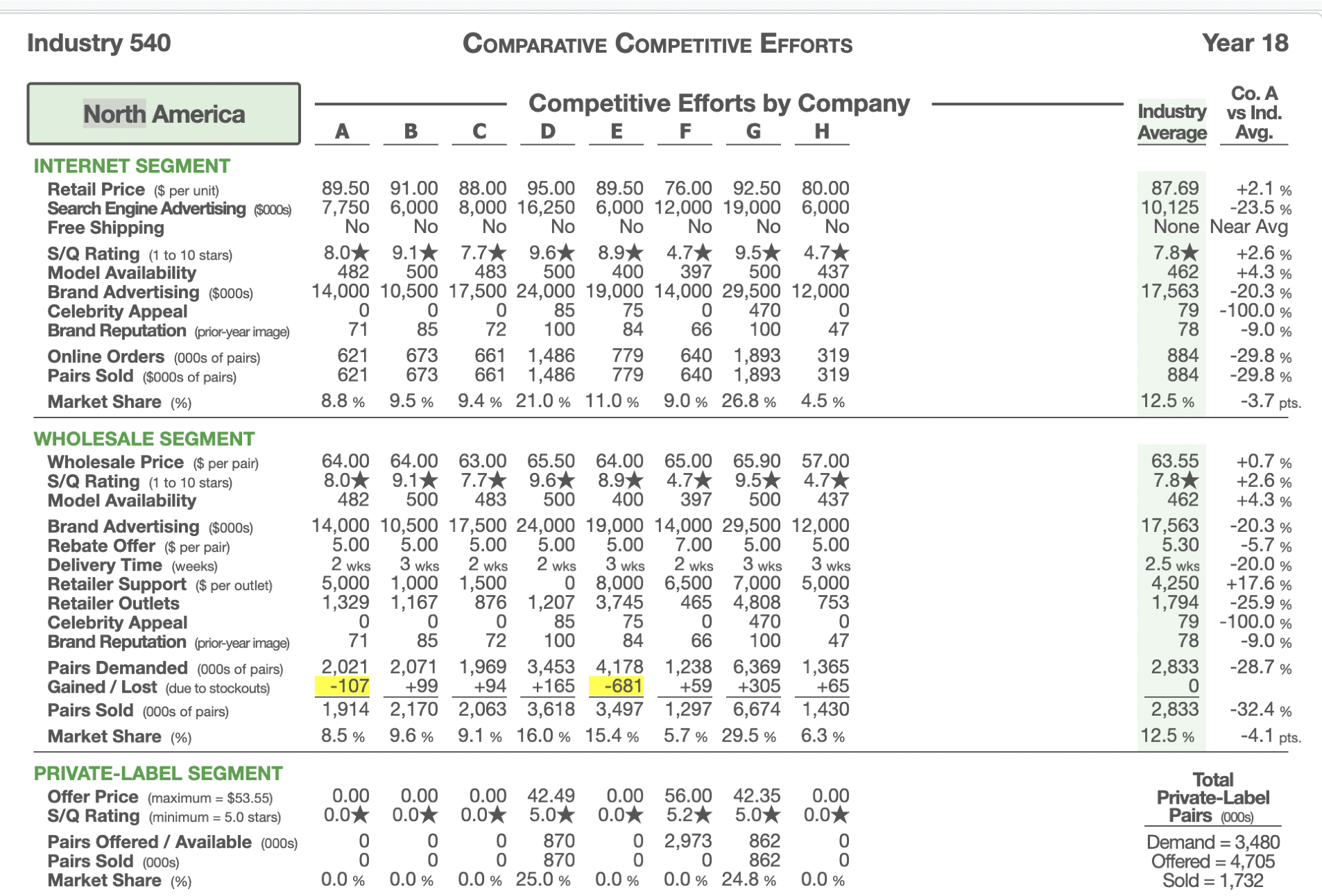

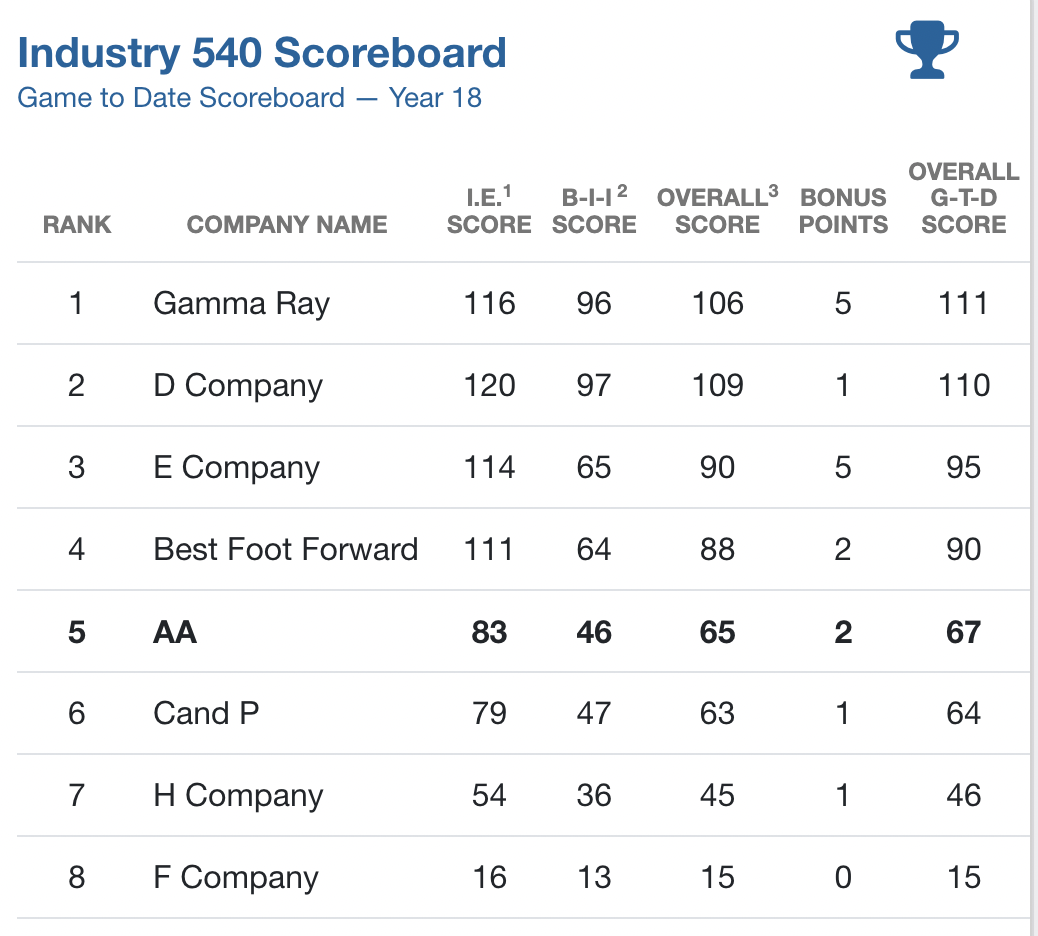

GAMMA RAY IS THE "COMPANY X" SO NEED TO ANALYZE THE COMPANY AND ITS STRATEGY IN BSG GAME.

- What is "Company X's" strategy? Which of the five generic competitive strategies discussed in Chapter 5 most closely fit the competitive approach that "Company X" is taking. What type of competitive advantage is "Company X" trying to achieve?

- What key factors will determine a company's success in the athletic footwear business in the next 3-5 years?

- What grade would you give to "Company X's" management for the job it has done in crafting the company's strategy? What is it that you like or dislike about the strategy? Does "Company X" have a winning strategy?

- What does a SWOT analysis of "Company X" reveal about the overall attractiveness of its situation?

- What is your appraisal of "Company X's" financial performance? How well is the company doing financially? Is there evidence that "Company X's" strategy is working?

- Does 'Company X" have adequate competitive strength to go head-to-head against its rivals? Do a weighted competitive strength assessment using the methodology presented in Table 4.4 on page 113 of Chapter 4 to support your answer. Has 'Company X" built a sustainable competitive advantage in the athletic business? Why or why not/

- What weaknesses or problems do you see that "Company X's" management needs to address?

- What recommendations would you make to "Company X" management to strengthen the company's competitive position and future strategic and financial performance?

"Company X" will be whoever won or is winning in your BSG Industry ('Game"). (You cannot analyze yourself. In this situation analyze the company that has come second.)

The BSA assignment is due after Year 19 or Year 20, when the BSG simulation has concluded, and on or before the Final Examination.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started