Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sofas and More Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Sofas and More estimated a total

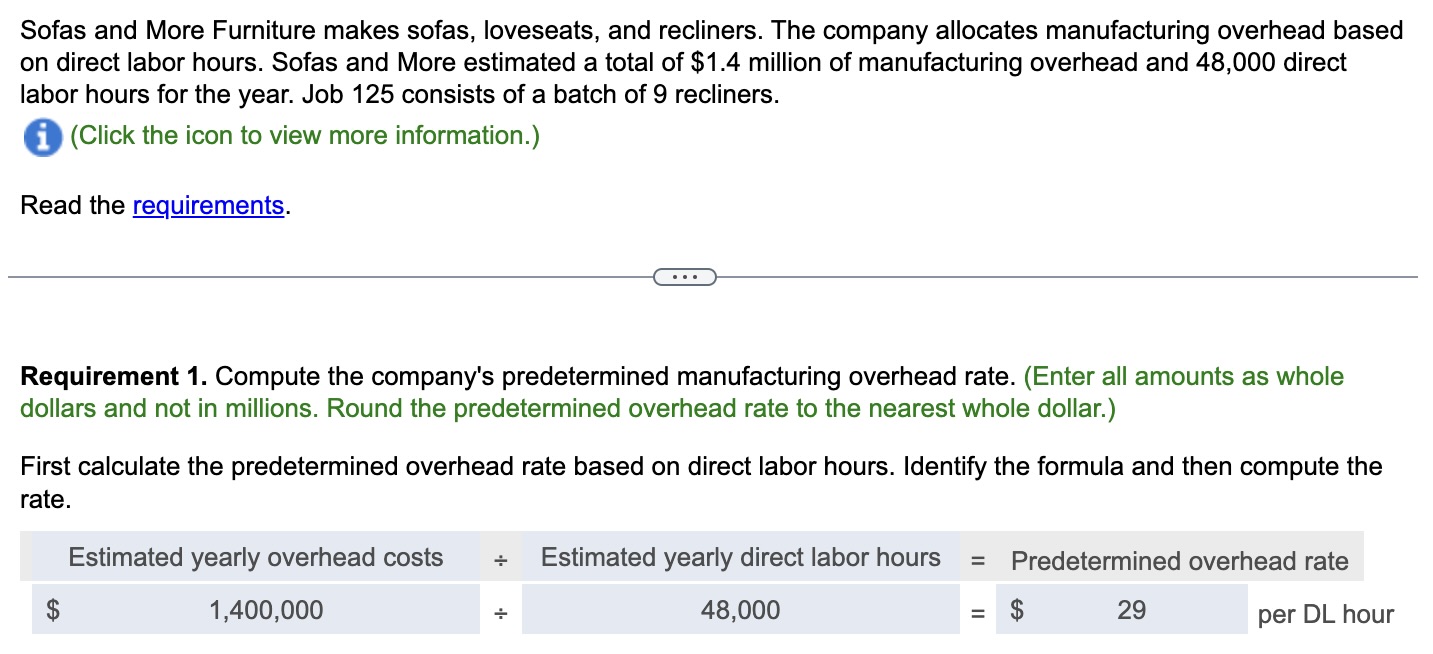

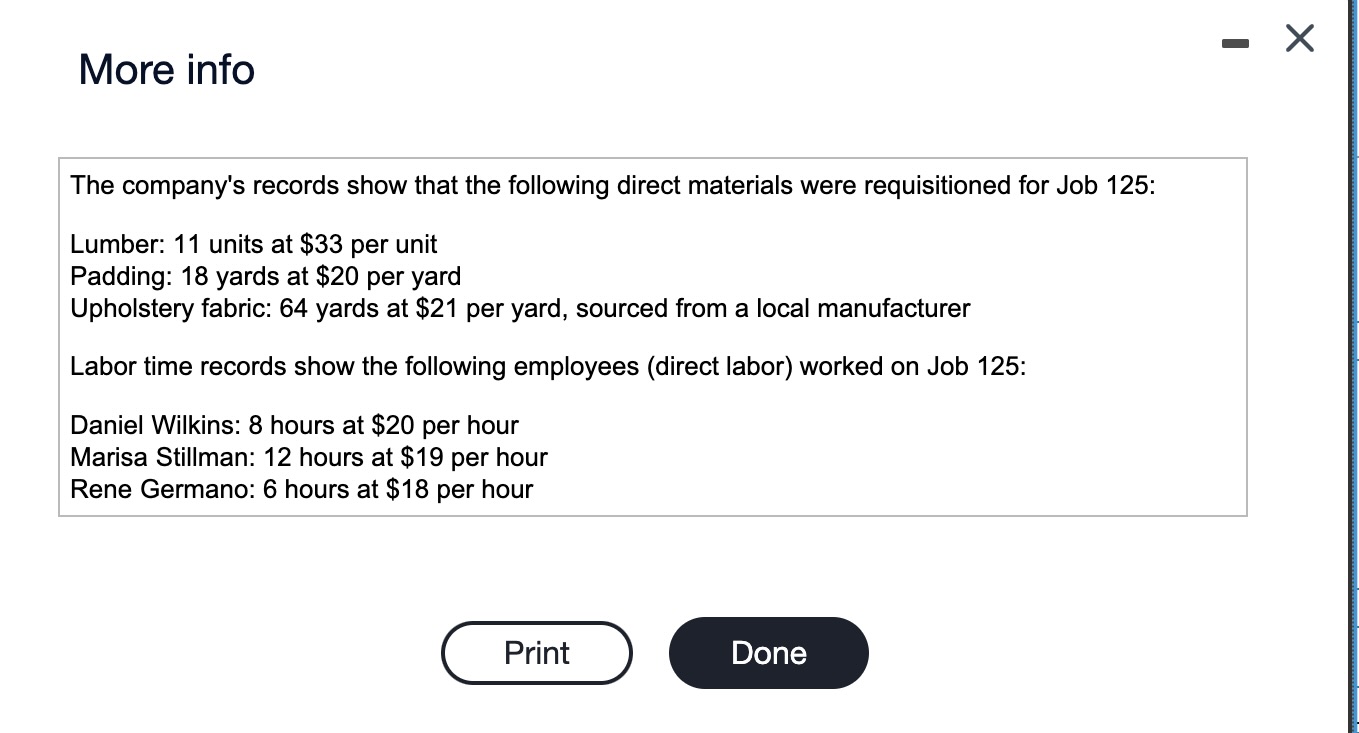

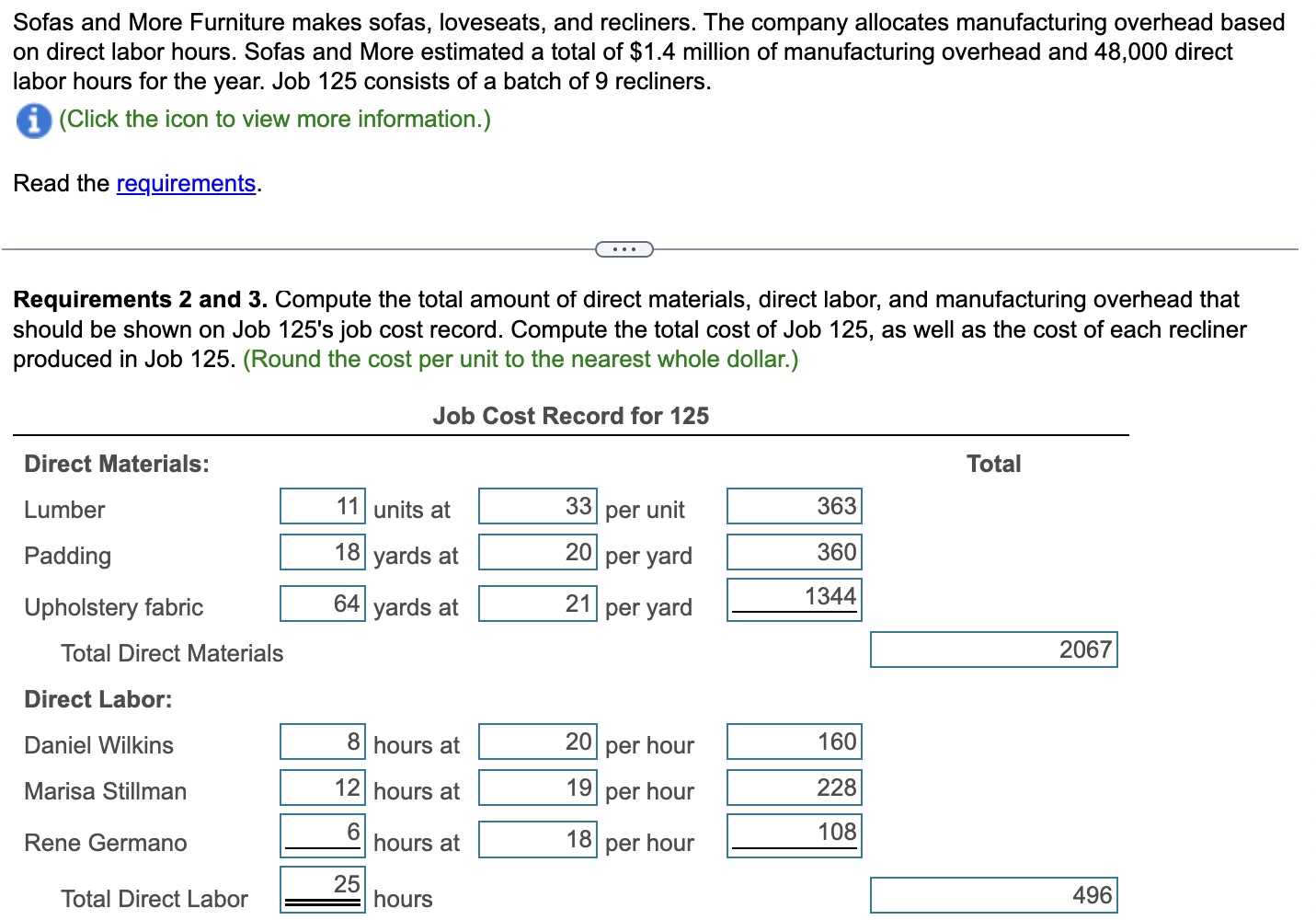

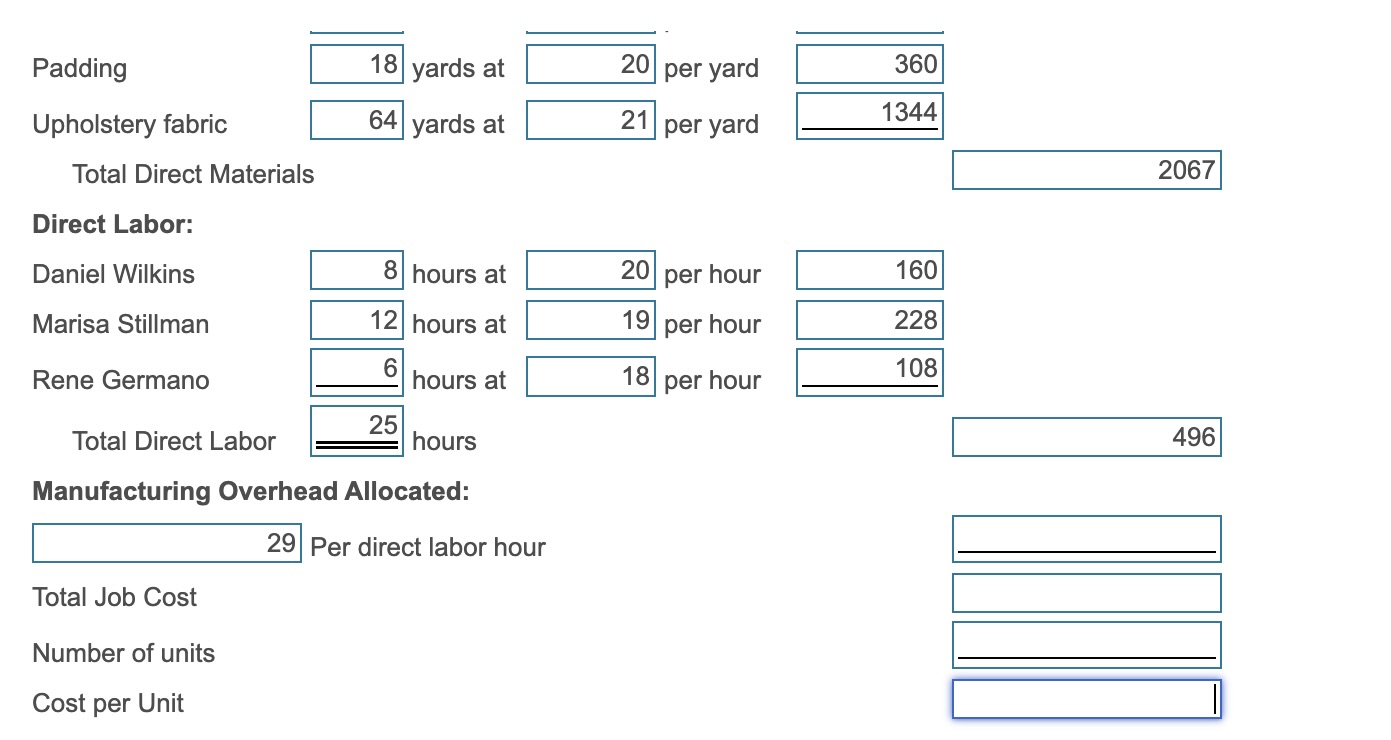

Sofas and More Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Sofas and More estimated a total of $1.4 million of manufacturing overhead and 48,000 direct labor hours for the year. Job 125 consists of a batch of 9 recliners. (Click the icon to view more information.) Read the requirements. Requirement 1. Compute the company's predetermined manufacturing overhead rate. (Enter all amounts as whole dollars and not in millions. Round the predetermined overhead rate to the nearest whole dollar.) First calculate the predetermined overhead rate based on direct labor hours. Identify the formula and then compute the rate. More info The company's records show that the following direct materials were requisitioned for Job 125 : Lumber: 11 units at $33 per unit Padding: 18 yards at $20 per yard Upholstery fabric: 64 yards at $21 per yard, sourced from a local manufacturer Labor time records show the following employees (direct labor) worked on Job 125: Daniel Wilkins: 8 hours at $20 per hour Marisa Stillman: 12 hours at $19 per hour Rene Germano: 6 hours at $18 per hour Sofas and More Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Sofas and More estimated a total of $1.4 million of manufacturing overhead and 48,000 direct labor hours for the year. Job 125 consists of a batch of 9 recliners. (Click the icon to view more information.) Read the requirements. Requirements 2 and 3. Compute the total amount of direct materials, direct labor, and manufacturing overhead that should be shown on Job 125's job cost record. Compute the total cost of Job 125, as well as the cost of each recliner produced in Job 125. (Round the cost per unit to the nearest whole dollar.) Manufacturing Overhead Allocated: \begin{tabular}{ll} \hline & 29 Per direct labor hour \\ Total Job Cost \\ Number of units \\ Cost per Unit \end{tabular}

Sofas and More Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Sofas and More estimated a total of $1.4 million of manufacturing overhead and 48,000 direct labor hours for the year. Job 125 consists of a batch of 9 recliners. (Click the icon to view more information.) Read the requirements. Requirement 1. Compute the company's predetermined manufacturing overhead rate. (Enter all amounts as whole dollars and not in millions. Round the predetermined overhead rate to the nearest whole dollar.) First calculate the predetermined overhead rate based on direct labor hours. Identify the formula and then compute the rate. More info The company's records show that the following direct materials were requisitioned for Job 125 : Lumber: 11 units at $33 per unit Padding: 18 yards at $20 per yard Upholstery fabric: 64 yards at $21 per yard, sourced from a local manufacturer Labor time records show the following employees (direct labor) worked on Job 125: Daniel Wilkins: 8 hours at $20 per hour Marisa Stillman: 12 hours at $19 per hour Rene Germano: 6 hours at $18 per hour Sofas and More Furniture makes sofas, loveseats, and recliners. The company allocates manufacturing overhead based on direct labor hours. Sofas and More estimated a total of $1.4 million of manufacturing overhead and 48,000 direct labor hours for the year. Job 125 consists of a batch of 9 recliners. (Click the icon to view more information.) Read the requirements. Requirements 2 and 3. Compute the total amount of direct materials, direct labor, and manufacturing overhead that should be shown on Job 125's job cost record. Compute the total cost of Job 125, as well as the cost of each recliner produced in Job 125. (Round the cost per unit to the nearest whole dollar.) Manufacturing Overhead Allocated: \begin{tabular}{ll} \hline & 29 Per direct labor hour \\ Total Job Cost \\ Number of units \\ Cost per Unit \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started