Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solution is in the photos Kimer Manufacturing, Inc. has a manufacturing machine that needs attention (Click me icon to view additional information) Kimer expects the

Solution is in the photos

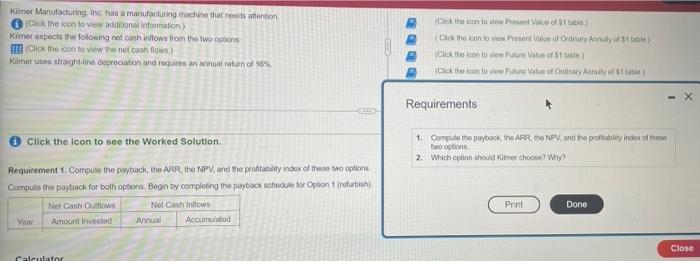

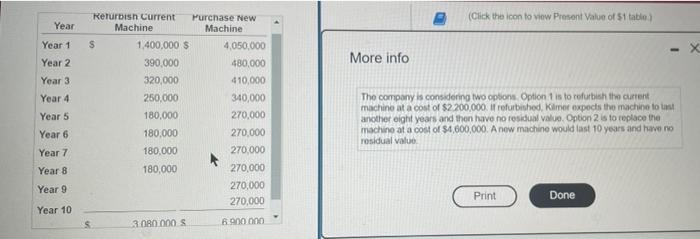

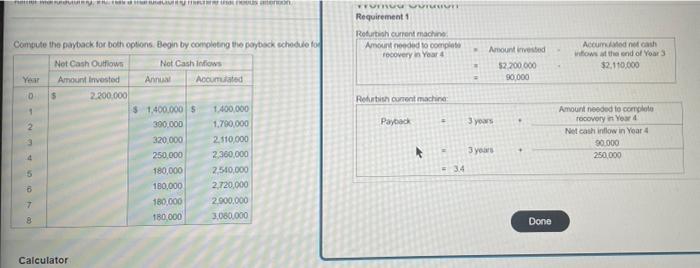

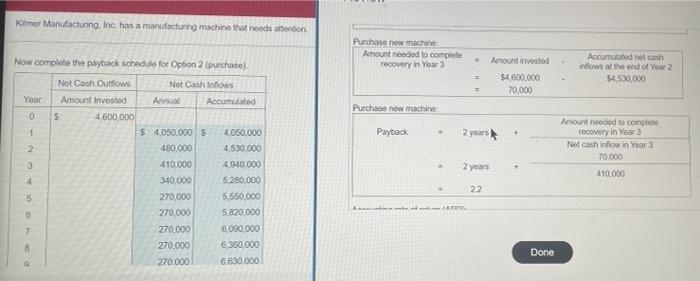

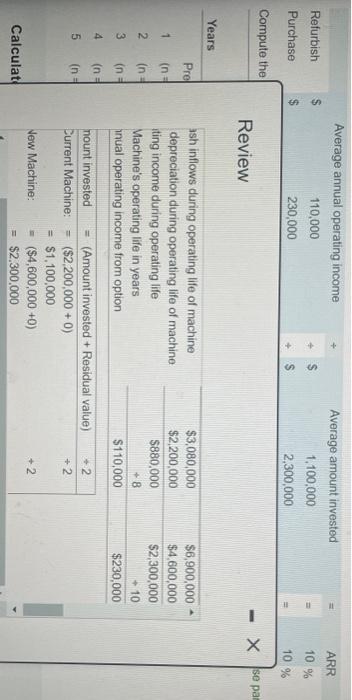

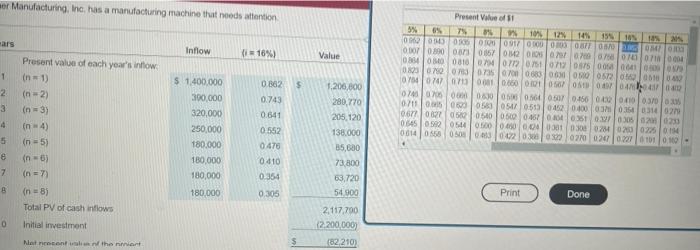

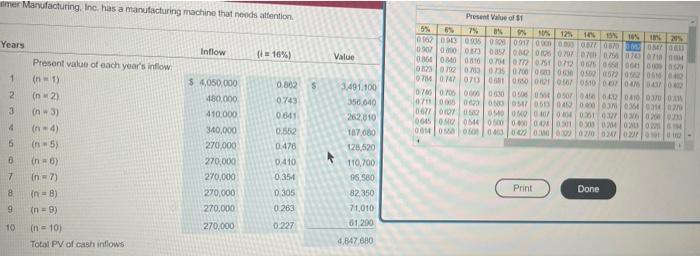

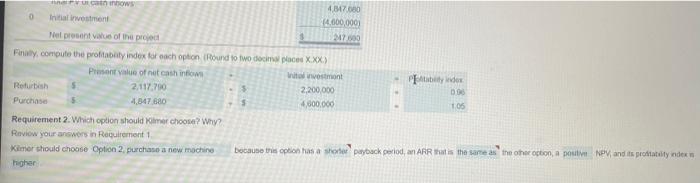

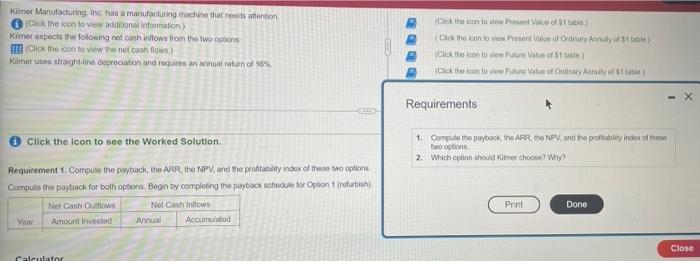

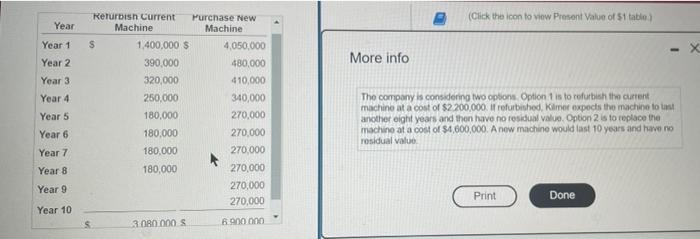

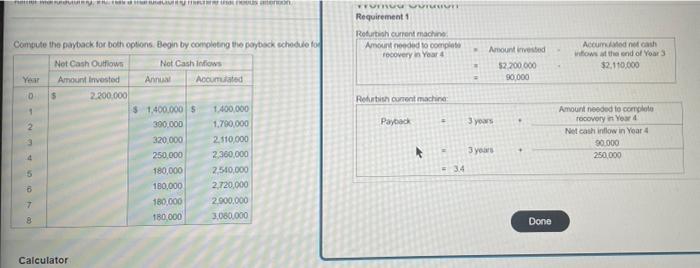

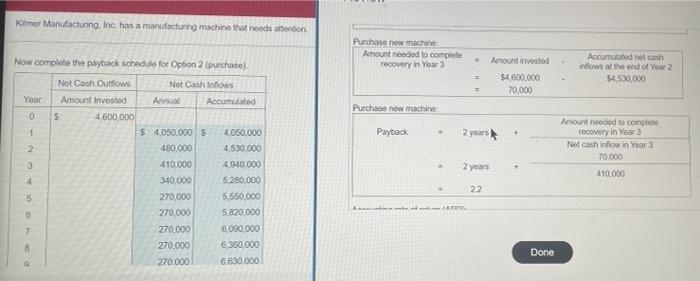

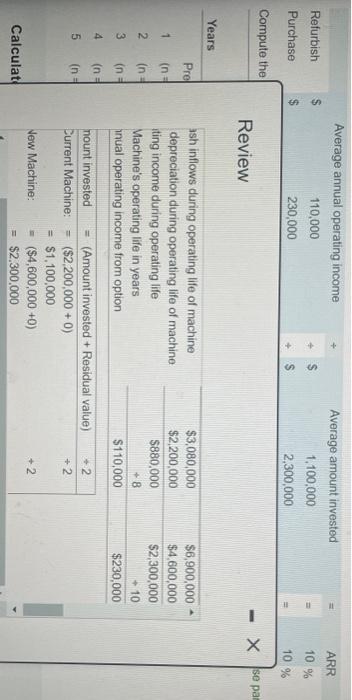

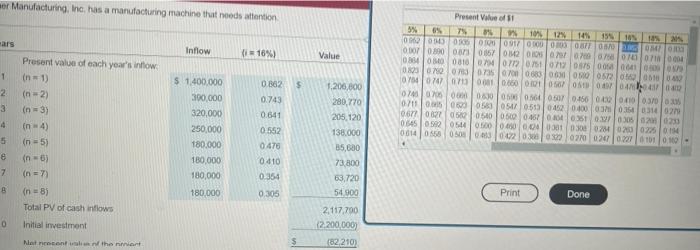

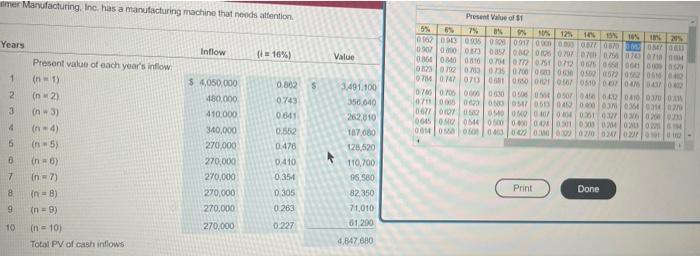

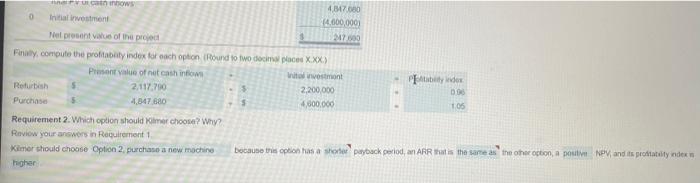

Kimer Manufacturing, Inc. has a manufacturing machine that needs attention (Click me icon to view additional information) Kimer expects the following net cash inllows from the two options Click the icon to view the net cash flows) Kilmar uses straight line depreciation and requires an annual return of 10% (Click the icon to wow Present vite of 51 Click the icon to view Prodent Value of ordinary Annuity of the Ciek te konto view Futuro Vile or tale Click then to view Future Value of Ordinary Armaty of Stati Requirements Click the icon to see the worked Solution 1. Compute the payback to ARR, the NP, and the profitability index of more Iwo options 2. Which option should Kime choose Requirement 1. Compute the payback, the ARR the NPV, and the profitability index of these two options Computo the payback for both options Begin by completing the payback schedule for Option refurbish Net Cash Outflow Not Cash Infowe Yaar Amount Investad Anna Accumulated Print Done Close Calculator (Click the icon to view Present Value of 51 table) Year Year 1 Year 2 Year 3 More info Year 4 Year 5 Year 6 Year 7 Refurbish Current Purchase New Machine Machine s 1,400,000 $ 4,050,000 390,000 480,000 320,000 410,000 250,000 340,000 180,000 270,000 180,000 270,000 180.000 270,000 180,000 270,000 270,000 270,000 The company is considering two options Option is to refurbish the current machine at a cost of $2200,000. If refurbished, Kilmer expects the machine to another eight years and then have no residual value Option 2 is to replace the machine at a cost of $4,000,000. A new machine would last 10 years and have no rosidual value Year 8 Year 9 Print Done Year 10 3 000 000 $ 69000 Umur Requirement1 Refurbish current machine Amounted to complete recovery in Year Accommodath willows at the end of Yoar 3 $2.110.000 Amount invested 52.200.000 90,000 3 Ye Refurbish comment machine Payback 3 years Compute the payback for both options. Begin by completing the payback school for Not Cash Outflows Not Cash Infos Amount invested Anna Accumulated 0 $ 2.200.000 $ 1.400.000 1.400.000 2 390.000 1.790,000 320.000 2.110,000 250.000 2360,000 180,000 2540,000 180.000 2.720,000 180.000 2.900.000 8 180.000 3.080.000 Amount needed to completo recovery in Your Net cash inflow in Year 4 90.000 250,000 3 3 years 34 5 0400 Done Calculator Kilmer Manufacturing, Inc hos a manufacturing machine that needs attention Purchase machine Amounted to complete recovery in Your 3 Now complete the payback schedule for Option 2 purchase Amount invested Accumulated net inflows at the end of You 2 $4,530,000 $4,600,000 70,000 Year 0 Purchase new machine 1 Payback 2 years 2 Amount needed to complete Tecovery in Year 3 Net cash inflow in Year 3 70,000 410.000 3 Not Cash Outflows Net Cash Intlows Amount Invested Annual Accumulated S 4 600.000 $ 4.050.000 $ 4.050.000 480.000 4.530.000 410.000 4.940.000 340,000 5.280.000 270,000 6.550.000 270.000 5.820.000 270,000 6090.000 270.000 6.360,000 270.000 6.630.000 2 years 4 22 5 5 7 8 Done ARR Refurbish $ Average annual operating income 110,000 230,000 S Average amount invested 1,100,000 2,300,000 10 % Purchase $ 2 10 % Compute the Review X se par Years Pre 1 ash inflows during operating life of machine depreciation during operating life of machine iting income during operating life Machine's operating life in years inual operating income from option $3,080,000 $2,200,000 $880,000 - 8 $110,000 $6,900,000 $4,600,000 $2,300,000 - 10 $230,000 in in in (ne in 2 3 4 5 mount invested Current Machine: +2 + 2 (Amount invested + Residual value) ($2,200,000 + 0) $1,100,000 ($4,600,000 +0) $2.300.000 New Machine: + 2 Calculat aer Manufacturing, Inc. has a manufacturing machine that needs attention Present of 5% 6% 7 8% 10% 12% 149 154 10 OOO000170000 OBTOOOO W WS ars Inflow (16%) Value OM OS 0810072050075 0507007350700068305720001 TO POD WOWOWO 700 2900120000 2000 SO w 200 7950209010000 Soroco DOO 99000 1990 19000W $ 1 2 3 4 5 e 7 Present value of each year's intow In 1) (n=2) In = 3) in 4) (n = 5) in = 6) (n=7) $ 1.400.000 300.000 320,000 250.000 180.000 180.000 180,000 0.362 0.743 0.641 0.552 0470 ) u () 1.200,000 280,770 205,120 138.000 85,600 73 800 63,720 54 900 01100011 0513000000015031002 06710621 005000500045700300302002 0452 050 000 000 3002840200260 001405500000 2000 2700 27021101010 0410 0.354 8 180.000 0.305 Print Done (n = 8) Total PV of cash inflows Initial investment 0 2.117,700 (2.200.000 82.210) Na ten the nort $ mer Manufacturing, Inc. has a manufacturing machine that needs attention Present Value of 11 5% 6% 79 09 9 0% 125 10 10 25 0902090 ONS ON 0917 OSOBOM 090700003520105 000 0000 0010 07120 WE MI Inflow (16%) Value 2000 WOW air OVC W20701010100010 NOVO $ Iw) 070 0.706 00000000000000 07 08 07 050 0.00 COCOOOOOoon 1200 00450560500000000001400 OOOOO 0400 000 000 Years Present value of each year's inflow 1 (n-1) 2 (n 2) 3 (n-3) 4 in 4) 5 (n.5) 6 in = 6) 7 In - 7) 8 in = 8) 9 (n=9) 10 (n = 10) Total PV of cash inflows $ 4,050,000 180,000 410,000 3440,000 270.000 270,000 270,000 270.000 270.000 270,000 0.802 0.743 0.641 0.552 0.478 0.410 0,354 0.305 0.263 3.491.100 350.040 262.810 187.080 126,620 119,700 65,580 82350 71,010 01 200 Print Done 0.227 4.847 680 w 4,547.00 0 Initial investment 14,000,000 Nel present value of the pro 270 Finally, compute the profitabaty index for each option Round to two decimoce XXX) Present Value of net cash into it investment Pably der Refurbish 2.117.790 2,200,000 000 Purchase 4.847.680 4,800.000 105 Requirement 2. Which option should Kimer choose? Why? Roviow your answers in Requirement1 Kilmer should choose Option 2. purchase a new machine because this option has a shorter payback period, an ARR is the same as the other option, a posil NPV and its portatility index higher Kimer Manufacturing, Inc. has a manufacturing machine that needs attention (Click me icon to view additional information) Kimer expects the following net cash inllows from the two options Click the icon to view the net cash flows) Kilmar uses straight line depreciation and requires an annual return of 10% (Click the icon to wow Present vite of 51 Click the icon to view Prodent Value of ordinary Annuity of the Ciek te konto view Futuro Vile or tale Click then to view Future Value of Ordinary Armaty of Stati Requirements Click the icon to see the worked Solution 1. Compute the payback to ARR, the NP, and the profitability index of more Iwo options 2. Which option should Kime choose Requirement 1. Compute the payback, the ARR the NPV, and the profitability index of these two options Computo the payback for both options Begin by completing the payback schedule for Option refurbish Net Cash Outflow Not Cash Infowe Yaar Amount Investad Anna Accumulated Print Done Close Calculator (Click the icon to view Present Value of 51 table) Year Year 1 Year 2 Year 3 More info Year 4 Year 5 Year 6 Year 7 Refurbish Current Purchase New Machine Machine s 1,400,000 $ 4,050,000 390,000 480,000 320,000 410,000 250,000 340,000 180,000 270,000 180,000 270,000 180.000 270,000 180,000 270,000 270,000 270,000 The company is considering two options Option is to refurbish the current machine at a cost of $2200,000. If refurbished, Kilmer expects the machine to another eight years and then have no residual value Option 2 is to replace the machine at a cost of $4,000,000. A new machine would last 10 years and have no rosidual value Year 8 Year 9 Print Done Year 10 3 000 000 $ 69000 Umur Requirement1 Refurbish current machine Amounted to complete recovery in Year Accommodath willows at the end of Yoar 3 $2.110.000 Amount invested 52.200.000 90,000 3 Ye Refurbish comment machine Payback 3 years Compute the payback for both options. Begin by completing the payback school for Not Cash Outflows Not Cash Infos Amount invested Anna Accumulated 0 $ 2.200.000 $ 1.400.000 1.400.000 2 390.000 1.790,000 320.000 2.110,000 250.000 2360,000 180,000 2540,000 180.000 2.720,000 180.000 2.900.000 8 180.000 3.080.000 Amount needed to completo recovery in Your Net cash inflow in Year 4 90.000 250,000 3 3 years 34 5 0400 Done Calculator Kilmer Manufacturing, Inc hos a manufacturing machine that needs attention Purchase machine Amounted to complete recovery in Your 3 Now complete the payback schedule for Option 2 purchase Amount invested Accumulated net inflows at the end of You 2 $4,530,000 $4,600,000 70,000 Year 0 Purchase new machine 1 Payback 2 years 2 Amount needed to complete Tecovery in Year 3 Net cash inflow in Year 3 70,000 410.000 3 Not Cash Outflows Net Cash Intlows Amount Invested Annual Accumulated S 4 600.000 $ 4.050.000 $ 4.050.000 480.000 4.530.000 410.000 4.940.000 340,000 5.280.000 270,000 6.550.000 270.000 5.820.000 270,000 6090.000 270.000 6.360,000 270.000 6.630.000 2 years 4 22 5 5 7 8 Done ARR Refurbish $ Average annual operating income 110,000 230,000 S Average amount invested 1,100,000 2,300,000 10 % Purchase $ 2 10 % Compute the Review X se par Years Pre 1 ash inflows during operating life of machine depreciation during operating life of machine iting income during operating life Machine's operating life in years inual operating income from option $3,080,000 $2,200,000 $880,000 - 8 $110,000 $6,900,000 $4,600,000 $2,300,000 - 10 $230,000 in in in (ne in 2 3 4 5 mount invested Current Machine: +2 + 2 (Amount invested + Residual value) ($2,200,000 + 0) $1,100,000 ($4,600,000 +0) $2.300.000 New Machine: + 2 Calculat aer Manufacturing, Inc. has a manufacturing machine that needs attention Present of 5% 6% 7 8% 10% 12% 149 154 10 OOO000170000 OBTOOOO W WS ars Inflow (16%) Value OM OS 0810072050075 0507007350700068305720001 TO POD WOWOWO 700 2900120000 2000 SO w 200 7950209010000 Soroco DOO 99000 1990 19000W $ 1 2 3 4 5 e 7 Present value of each year's intow In 1) (n=2) In = 3) in 4) (n = 5) in = 6) (n=7) $ 1.400.000 300.000 320,000 250.000 180.000 180.000 180,000 0.362 0.743 0.641 0.552 0470 ) u () 1.200,000 280,770 205,120 138.000 85,600 73 800 63,720 54 900 01100011 0513000000015031002 06710621 005000500045700300302002 0452 050 000 000 3002840200260 001405500000 2000 2700 27021101010 0410 0.354 8 180.000 0.305 Print Done (n = 8) Total PV of cash inflows Initial investment 0 2.117,700 (2.200.000 82.210) Na ten the nort $ mer Manufacturing, Inc. has a manufacturing machine that needs attention Present Value of 11 5% 6% 79 09 9 0% 125 10 10 25 0902090 ONS ON 0917 OSOBOM 090700003520105 000 0000 0010 07120 WE MI Inflow (16%) Value 2000 WOW air OVC W20701010100010 NOVO $ Iw) 070 0.706 00000000000000 07 08 07 050 0.00 COCOOOOOoon 1200 00450560500000000001400 OOOOO 0400 000 000 Years Present value of each year's inflow 1 (n-1) 2 (n 2) 3 (n-3) 4 in 4) 5 (n.5) 6 in = 6) 7 In - 7) 8 in = 8) 9 (n=9) 10 (n = 10) Total PV of cash inflows $ 4,050,000 180,000 410,000 3440,000 270.000 270,000 270,000 270.000 270.000 270,000 0.802 0.743 0.641 0.552 0.478 0.410 0,354 0.305 0.263 3.491.100 350.040 262.810 187.080 126,620 119,700 65,580 82350 71,010 01 200 Print Done 0.227 4.847 680 w 4,547.00 0 Initial investment 14,000,000 Nel present value of the pro 270 Finally, compute the profitabaty index for each option Round to two decimoce XXX) Present Value of net cash into it investment Pably der Refurbish 2.117.790 2,200,000 000 Purchase 4.847.680 4,800.000 105 Requirement 2. Which option should Kimer choose? Why? Roviow your answers in Requirement1 Kilmer should choose Option 2. purchase a new machine because this option has a shorter payback period, an ARR is the same as the other option, a posil NPV and its portatility index higher

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started