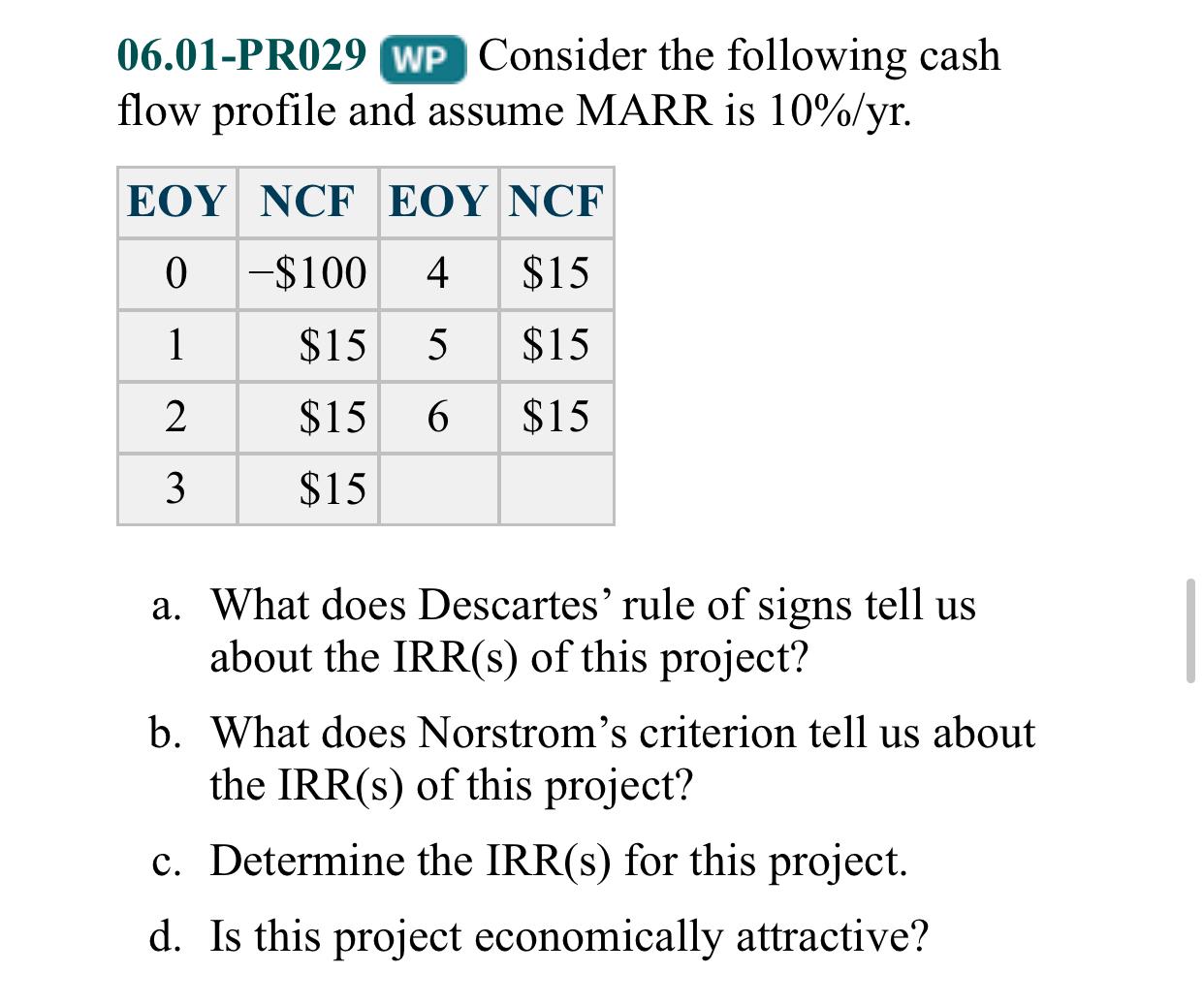

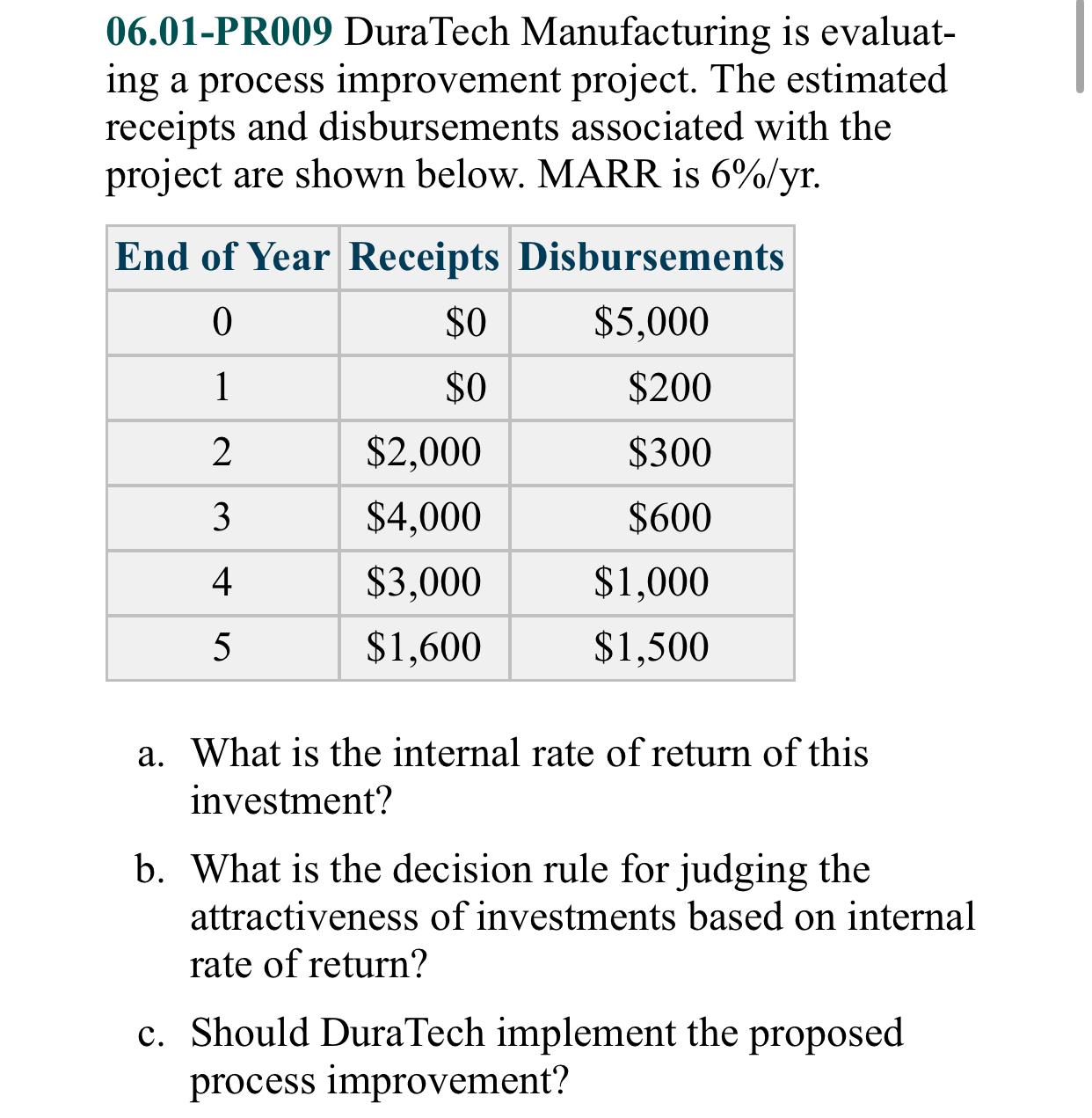

solve in detail

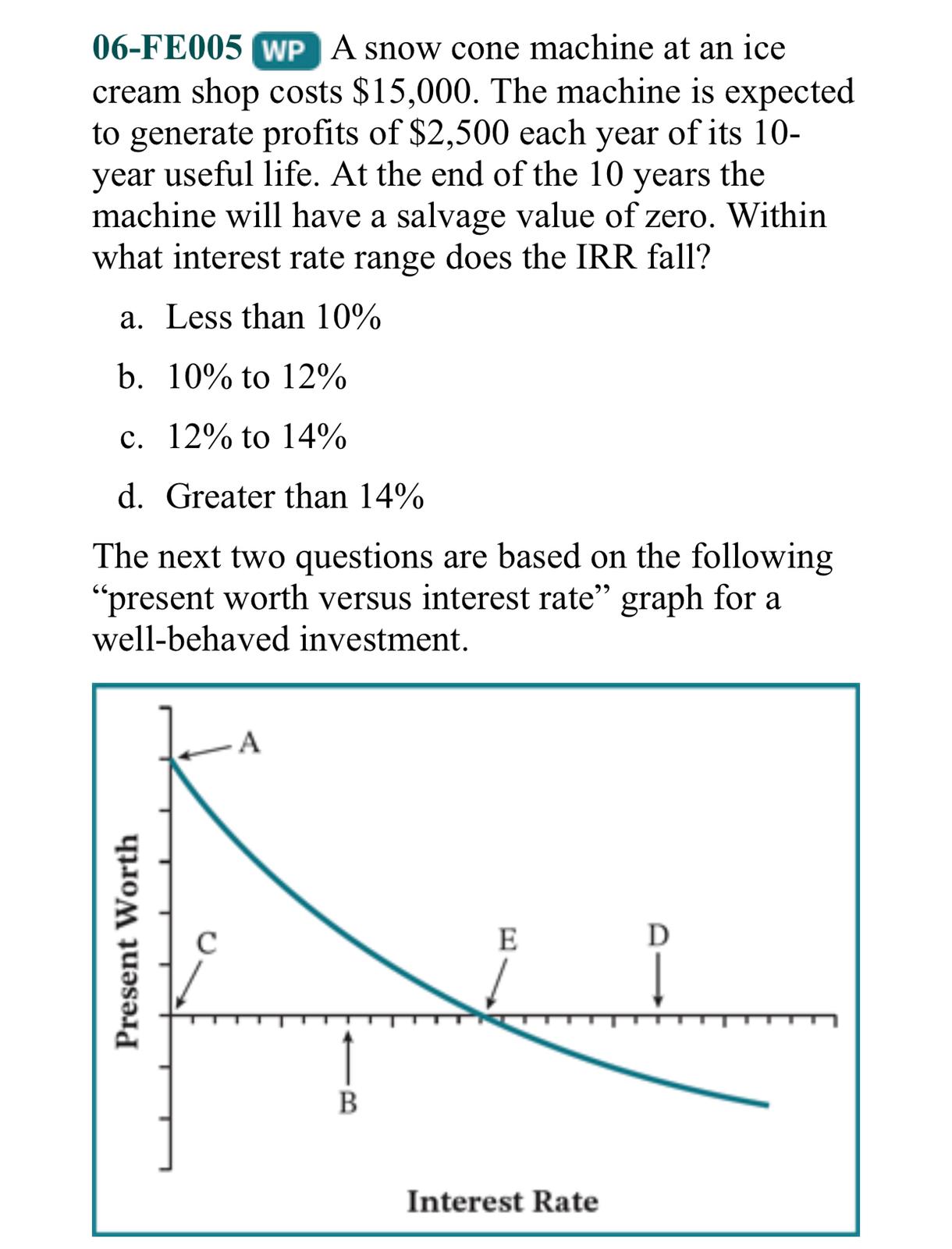

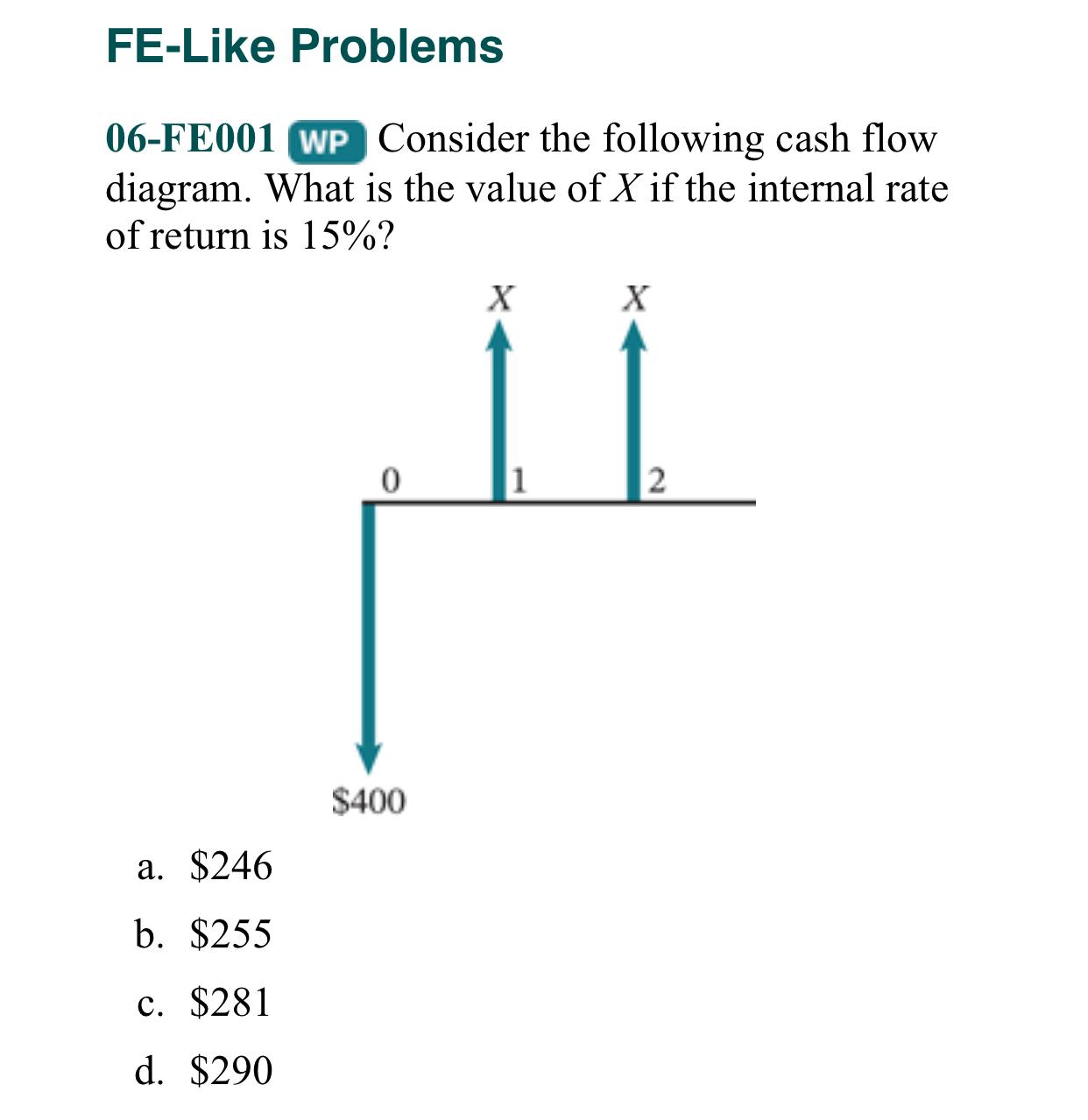

06-FE005 WP A snow cone machine at an ice cream shop costs $15,000. The machine is expected to generate profits of $2,500 each year of its 10- year useful life. At the end of the 10 years the machine will have a salvage value of zero. Within what interest rate range does the IRR fall? a. Less than 10% b. 10% to 12% c. 12% to 14% d. Greater than 14% The next two questions are based on the following "present worth versus interest rate" graph for a well-behaved investment. Present Worth E B Interest Rate06-FE005 WP A snow cone machine at an ice cream shop costs $15,000. The machine is expected to generate profits of $2,500 each year of its 10- year useful life. At the end of the 10 years the machine will have a salvage value of zero. Within what interest rate range does the IRR fall? a. Less than 10% b. 10% to 12% c. 12% to 14% d. Greater than 14% The next two questions are based on the following "present worth versus interest rate" graph for a well-behaved investment. Present Worth E B Interest Rate06-FE007 WP The IRR of this investment is located at which point? a. A b. C C. D d. E06-FE007 WP The IRR of this investment is located at which point? a. A b. C C. D d. E06-FE009 WP If the IRR of Alternative A is 18%, the IRR of Alternative B is 16%, and MARR is 12%, which of the following is correct? a. Alternative B is preferred over alternative A b. Alternative A is preferred over alternative B c. Not enough information is given to determine which alternative is preferred d. Neither alternative A nor alternative B is acceptable06-FE009 WP If the IRR of Alternative A is 18%, the IRR of Alternative B is 16%, and MARR is 12%, which of the following is correct? a. Alternative B is preferred over alternative A b. Alternative A is preferred over alternative B c. Not enough information is given to determine which alternative is preferred d. Neither alternative A nor alternative B is acceptableFE-Like Problems 06-FE001 Consider the following cash ow diagram. What is the value of X if the internal rate of return is 15%? a. $246 b. $255 0. $281 (1. $290 06.01-PR029 Wp Consider the following cash flow profile and assume MARR is 10%/yr. EOY NCF EOY NCF O -$100 4 $15 $15 5 $15 2 $15 6 $15 3 $15 a. What does Descartes' rule of signs tell us about the IRR(s) of this project? b. What does Norstrom's criterion tell us about the IRR(s) of this project? c. Determine the IRR(s) for this project. d. Is this project economically attractive?06.01-PR029 Wp Consider the following cash flow profile and assume MARR is 10%/yr. EOY NCF EOY NCF O -$100 4 $15 $15 5 $15 2 $15 6 $15 3 $15 a. What does Descartes' rule of signs tell us about the IRR(s) of this project? b. What does Norstrom's criterion tell us about the IRR(s) of this project? c. Determine the IRR(s) for this project. d. Is this project economically attractive?06.01-PR009 DuraTech Manufacturing is evaluat ing a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 6%/yr. End of Year Receipts Disbursements O $0 $5,000 $0 $200 2 $2,000 $300 w $4,000 $600 4 $3,000 $1,000 5 $1,600 $1,500 a. What is the internal rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on internal rate of return? c. Should DuraTech implement the proposed process improvement?06.01-PR009 DuraTech Manufacturing is evaluat ing a process improvement project. The estimated receipts and disbursements associated with the project are shown below. MARR is 6%/yr. End of Year Receipts Disbursements O $0 $5,000 $0 $200 2 $2,000 $300 w $4,000 $600 4 $3,000 $1,000 5 $1,600 $1,500 a. What is the internal rate of return of this investment? b. What is the decision rule for judging the attractiveness of investments based on internal rate of return? c. Should DuraTech implement the proposed process improvement