Solve Q.1 to Q. 6

Please solve this case study soon as possible only 1.5 hours left . Thank you so much in advance

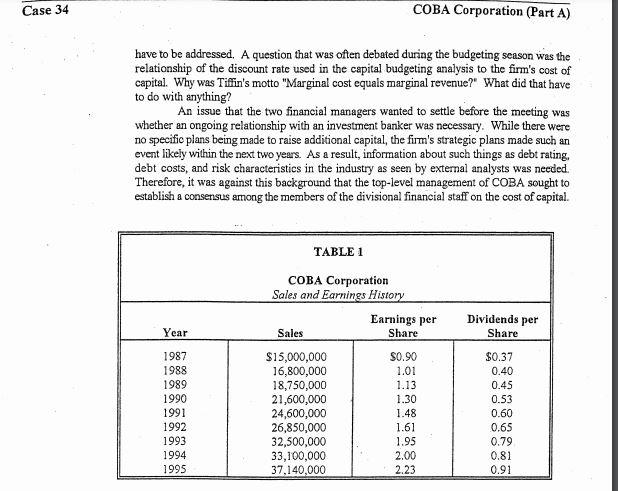

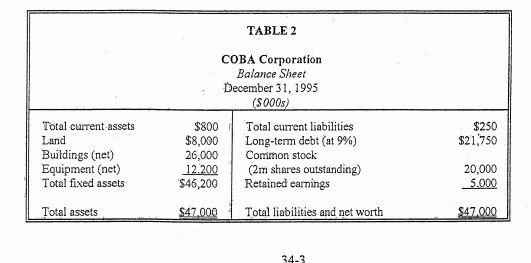

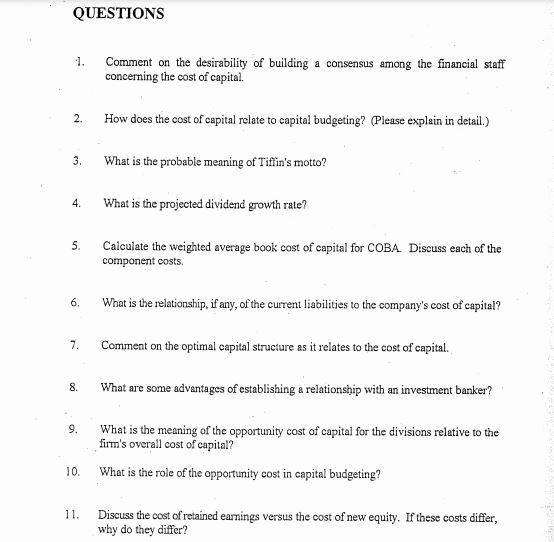

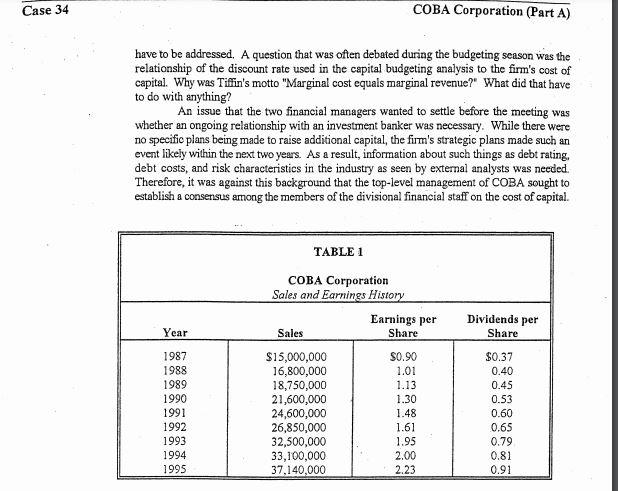

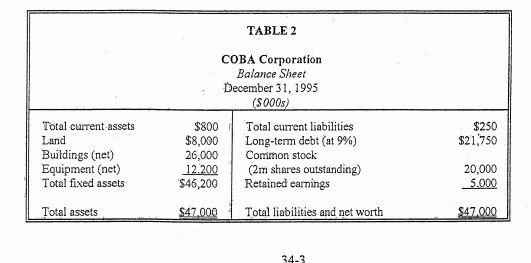

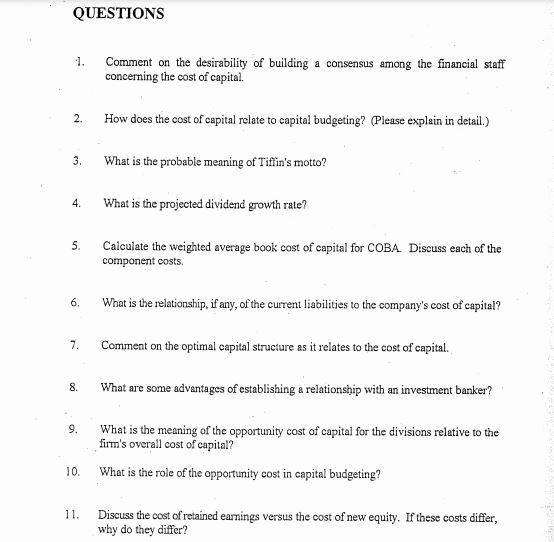

COBA Corporation (Part A) W. F. Kenner, president and general manager of COBA Corporation paced back and forth as he considered the business awaiting him in the afternoon meeting. The meeting was to include Julie Tilfin, COBA's treasurer, Jan Bergerson, COBA's controller, and Kenner. The discussion was to center around the calculation of the appropriate cost of capital for the corporation. The company, whose name was formed from the names of the smaller enterprises that were combined to form the present company, manufactured a variety of items for the health care industry. The firm's operations were divided into two segments: Division A, which manufactured hospital clothing such as surgical gowns, masks, and other outer covering for surgical staff, and Division B, which manufactured sterilized items such as scalpels and hypodermic needles The present company was formed in 1978. Its stock was first offered to the public the following year. The company joined several more well-established firms in an industry that had experienced steady growth since the 1950s. The industry was characterized by efficient production practices, prompt delivery of its products, and limited flexibility in terms of pricing the various products. COBA's manufacturing operations were modern and efficient by industry standards The two operating divisions were located in the same city and the corporate office was in the suburban northern end of the city. The company's sales and earnings had increased at a significant rate over the past few years; Table 1 illustrates that trend. Given the sales and earnings growth experienced by COBA, finding viable internal investments (capital budgeting projects) was not a problem for the company. It was the issue of capital budgeting, however, which had given rise to the upcoming meeting. During the company's brief history its proposed capital budget was developed in the following manner: (1) Tiffin and Bergerson developed a funding plan for the company. That is, they determined the amount of funds available for investment in property, plant, and equipment and the source of those funds for the coming fiscal year. (2) The divisions developed a capital needs plan based upon the marketing research and replacement expenditure information put together by the division controller. (3) The division budgets were modified to conform to the funding pian developed by Tiffin and Bergerson. (4) The final capital budget represented those expenditures for each division selected based upon their net present value (NPV) or their internal rate of return (IRR). It was the task of the company's treasurer and controller to assess the primary influences upon the company's stock price, risk and return (COBA operated without a vice president of finance; those duties, planning and policy-setting, were shared by Tiffin and Bergerson) Tiitin and Bergerson both held degrees in finance; therefore, they understood the relationship among risk, return, marginal cost, and marginal revenue. More important, they understood how those factors affected the continued success of the firm. It was now necessary to explain these considerations to certain division personnel who were in need of a clearer orientation concerning the finance function within the firm. This effort was part of a plan by the treasurer and controller to have marketing research, cost accounting, and finance all on the same wave length,' as Bergerson had put it. The overall purpose of the orientation was to improve coordination and planning of capital expenditures within each division. It was seen also as an opportunity to bring Kenner up-to-date on the details of financial decisionmaking within the firm. The focus of the discussion was to be upon the firm's historical or book cost of capital as represented by the capital structure shown in Table 2. Tiffin and Bergerson wanted to make sure that each functional department understood why the cost of capital calculation was important and how the cost was calculated. For example, one member of the Division A accounting staff had frequently questioned the assumed relationship between the cost of capital and the required return on the firm's capital budgeting projects. In terms of a further clarification of the cost of capital issue, the difference between the two divisions held some relevance. Division A was the 'mature portion of the firm's business. That is, its growth prospects were not outstanding and most incremental cash flows from the division were based upon the replacement type of expenditure. This refetred to the pursuit of better ways to manufacture standard items for an existing market. Cash flows from Division A were stable. By contrast, Division B was experiencing rapid growth and there were many high- retum projects available to the division. The question of the opportunity cost of capital versus the firm's overall cost of capital warranted discussion among the division's financial analysts. To add to the list of things that needed to be clarified, the component costs of capitalthe cost of individual capital items, debt, equity, and preferred stock-needed to be understood. As an example, in cost of equity calculations, the dividend model, also called the Gordon Model, was the company's preferred method for determining the equity cost. The questions concerning the use of the dividend model often centered around the calculations of the growth component of common stock returns. There were, of course, other questions related to the cost of capital calculations. In a seminar that he had attended at a local university, Kenner heard a heated argument between two of the participants over the role of the firm's capital structure, divisional risk, and the difference between the book value capital costs and the market value capital costs as an influence on capital costs. On occasion, Kenner would run these ideas and concerns past Tiffin and Bergerson to gauge their thinking on them. As a result, the two managers believed these same issues would be raised in the meeting. In the case of COBA, and specifically for the upcoming meeting the following facts were believed to be useful by Tiffin and Bergerson. A study of each division's cash flows over a period of five to seven years verified the difference in variability of the two divisions' cash flows. The two managers concluded that this had some effect upon the cost of capital for the divisions. The managers defined cash flow as the sum of profit after tax, plus depreciation, the variability in cash flow was measured by the standard deviation. The firm has had no additional issuance of stock since its inception. Investment in new assets had been accomplished through the retention of approximately 60 percent of earnings after tax, and borrowing on a long-term basis. The current stock price, at year-end 1995, was $20 per share. The firm was in the 35 percent tax bracket (including federal, state, and local taxes). While the foregoing information provided a useful background against which Tiffin and Bergerson might explain the cost of capital concept, there were more specific areas that would 34-2 Case 34 COBA Corporation (Part A) have to be addressed. A question that was often debated during the budgeting season was the relationship of the discount rate used in the capital budgeting analysis to the firm's cost of capital. Why was Tiffin's motto "Marginal cost equals marginal revenue?" What did that have to do with anything? An issue that the two financial managers wanted to settle before the meeting was whether an ongoing relationship with an investment banker was necessary. While there were no specific plans being made to raise additional capital, the firm's strategic plans made such an event likely within the next two years. As a result, information about such things as debt rating, debt costs, and risk characteristics in the industry as seen by external analysts was needed. Therefore, it was against this background that the top-level management of COBA sought to establish a consensus among the members of the divisional financial staff on the cost of capital. TABLE 1 COBA Corporation Sales and Earnings History Earnings per Share Dividends per Share Year Sales $0.37 0.40 0.45 1987 1988 1989 1990 1991 1992 1993 $15,000,000 16,800,000 18,750,000 21,600,000 24,600,000 26,850,000 32,500,000 33,100,000 37,140,000 $0.90 1.01 1.13 1.30 1.48 1.61 1.95 2.00 2.23 0.53 0.60 0.65 0.79 0.81 0.91 1994 1995 TABLE 2 COBA Corporation Balance Sheet December 31, 1995 (5000s) $250 $21,750 Total current assets Land Buildings (net) Equipment (net) Total fixed assets $800 $8,000 26,000 12.200 $46,200 Total current liabilities Long-term debt (at 9%) Common stock (2m shares outstanding) Retained earnings 20,000 5.000 Total assets $47.000 Total liabilities and net worth $47.000 34-3 QUESTIONS 1. Comment on the desirability of building a consensus among the financial staff concerning the cost of capital. 2. How does the cost of capital relate to capital budgeting? Please explain in detail.) 3. What is the probable meaning of Tiflin's motto? 4. What is the projected dividend growth rate? 5 Calculate the weighted average book cost of capital for COBA Discuss each of the component costs. 6. What is the relationship, if any, of the current liabilities to the company's cost of capital? 7. Comment on the optimal capital structure as it relates to the cost of capital 8. What are some advantages of establishing a relationship with an investment banker? 9. What is the meaning of the opportunity cost of capital for the divisions relative to the firm's overall cost of capital? 10. What is the role of the opportunity cost in capital budgeting? 11. Discuss the cost of retained earnings versus the cost of new equity. If these costs differ, why do they differ? 12. What, if anything, would cause a fundamental (permanent) change in the firm's cost of capital? COBA Corporation (Part A) W. F. Kenner, president and general manager of COBA Corporation paced back and forth as he considered the business awaiting him in the afternoon meeting. The meeting was to include Julie Tilfin, COBA's treasurer, Jan Bergerson, COBA's controller, and Kenner. The discussion was to center around the calculation of the appropriate cost of capital for the corporation. The company, whose name was formed from the names of the smaller enterprises that were combined to form the present company, manufactured a variety of items for the health care industry. The firm's operations were divided into two segments: Division A, which manufactured hospital clothing such as surgical gowns, masks, and other outer covering for surgical staff, and Division B, which manufactured sterilized items such as scalpels and hypodermic needles The present company was formed in 1978. Its stock was first offered to the public the following year. The company joined several more well-established firms in an industry that had experienced steady growth since the 1950s. The industry was characterized by efficient production practices, prompt delivery of its products, and limited flexibility in terms of pricing the various products. COBA's manufacturing operations were modern and efficient by industry standards The two operating divisions were located in the same city and the corporate office was in the suburban northern end of the city. The company's sales and earnings had increased at a significant rate over the past few years; Table 1 illustrates that trend. Given the sales and earnings growth experienced by COBA, finding viable internal investments (capital budgeting projects) was not a problem for the company. It was the issue of capital budgeting, however, which had given rise to the upcoming meeting. During the company's brief history its proposed capital budget was developed in the following manner: (1) Tiffin and Bergerson developed a funding plan for the company. That is, they determined the amount of funds available for investment in property, plant, and equipment and the source of those funds for the coming fiscal year. (2) The divisions developed a capital needs plan based upon the marketing research and replacement expenditure information put together by the division controller. (3) The division budgets were modified to conform to the funding pian developed by Tiffin and Bergerson. (4) The final capital budget represented those expenditures for each division selected based upon their net present value (NPV) or their internal rate of return (IRR). It was the task of the company's treasurer and controller to assess the primary influences upon the company's stock price, risk and return (COBA operated without a vice president of finance; those duties, planning and policy-setting, were shared by Tiffin and Bergerson) Tiitin and Bergerson both held degrees in finance; therefore, they understood the relationship among risk, return, marginal cost, and marginal revenue. More important, they understood how those factors affected the continued success of the firm. It was now necessary to explain these considerations to certain division personnel who were in need of a clearer orientation concerning the finance function within the firm. This effort was part of a plan by the treasurer and controller to have marketing research, cost accounting, and finance all on the same wave length,' as Bergerson had put it. The overall purpose of the orientation was to improve coordination and planning of capital expenditures within each division. It was seen also as an opportunity to bring Kenner up-to-date on the details of financial decisionmaking within the firm. The focus of the discussion was to be upon the firm's historical or book cost of capital as represented by the capital structure shown in Table 2. Tiffin and Bergerson wanted to make sure that each functional department understood why the cost of capital calculation was important and how the cost was calculated. For example, one member of the Division A accounting staff had frequently questioned the assumed relationship between the cost of capital and the required return on the firm's capital budgeting projects. In terms of a further clarification of the cost of capital issue, the difference between the two divisions held some relevance. Division A was the 'mature portion of the firm's business. That is, its growth prospects were not outstanding and most incremental cash flows from the division were based upon the replacement type of expenditure. This refetred to the pursuit of better ways to manufacture standard items for an existing market. Cash flows from Division A were stable. By contrast, Division B was experiencing rapid growth and there were many high- retum projects available to the division. The question of the opportunity cost of capital versus the firm's overall cost of capital warranted discussion among the division's financial analysts. To add to the list of things that needed to be clarified, the component costs of capitalthe cost of individual capital items, debt, equity, and preferred stock-needed to be understood. As an example, in cost of equity calculations, the dividend model, also called the Gordon Model, was the company's preferred method for determining the equity cost. The questions concerning the use of the dividend model often centered around the calculations of the growth component of common stock returns. There were, of course, other questions related to the cost of capital calculations. In a seminar that he had attended at a local university, Kenner heard a heated argument between two of the participants over the role of the firm's capital structure, divisional risk, and the difference between the book value capital costs and the market value capital costs as an influence on capital costs. On occasion, Kenner would run these ideas and concerns past Tiffin and Bergerson to gauge their thinking on them. As a result, the two managers believed these same issues would be raised in the meeting. In the case of COBA, and specifically for the upcoming meeting the following facts were believed to be useful by Tiffin and Bergerson. A study of each division's cash flows over a period of five to seven years verified the difference in variability of the two divisions' cash flows. The two managers concluded that this had some effect upon the cost of capital for the divisions. The managers defined cash flow as the sum of profit after tax, plus depreciation, the variability in cash flow was measured by the standard deviation. The firm has had no additional issuance of stock since its inception. Investment in new assets had been accomplished through the retention of approximately 60 percent of earnings after tax, and borrowing on a long-term basis. The current stock price, at year-end 1995, was $20 per share. The firm was in the 35 percent tax bracket (including federal, state, and local taxes). While the foregoing information provided a useful background against which Tiffin and Bergerson might explain the cost of capital concept, there were more specific areas that would 34-2 Case 34 COBA Corporation (Part A) have to be addressed. A question that was often debated during the budgeting season was the relationship of the discount rate used in the capital budgeting analysis to the firm's cost of capital. Why was Tiffin's motto "Marginal cost equals marginal revenue?" What did that have to do with anything? An issue that the two financial managers wanted to settle before the meeting was whether an ongoing relationship with an investment banker was necessary. While there were no specific plans being made to raise additional capital, the firm's strategic plans made such an event likely within the next two years. As a result, information about such things as debt rating, debt costs, and risk characteristics in the industry as seen by external analysts was needed. Therefore, it was against this background that the top-level management of COBA sought to establish a consensus among the members of the divisional financial staff on the cost of capital. TABLE 1 COBA Corporation Sales and Earnings History Earnings per Share Dividends per Share Year Sales $0.37 0.40 0.45 1987 1988 1989 1990 1991 1992 1993 $15,000,000 16,800,000 18,750,000 21,600,000 24,600,000 26,850,000 32,500,000 33,100,000 37,140,000 $0.90 1.01 1.13 1.30 1.48 1.61 1.95 2.00 2.23 0.53 0.60 0.65 0.79 0.81 0.91 1994 1995 TABLE 2 COBA Corporation Balance Sheet December 31, 1995 (5000s) $250 $21,750 Total current assets Land Buildings (net) Equipment (net) Total fixed assets $800 $8,000 26,000 12.200 $46,200 Total current liabilities Long-term debt (at 9%) Common stock (2m shares outstanding) Retained earnings 20,000 5.000 Total assets $47.000 Total liabilities and net worth $47.000 34-3 QUESTIONS 1. Comment on the desirability of building a consensus among the financial staff concerning the cost of capital. 2. How does the cost of capital relate to capital budgeting? Please explain in detail.) 3. What is the probable meaning of Tiflin's motto? 4. What is the projected dividend growth rate? 5 Calculate the weighted average book cost of capital for COBA Discuss each of the component costs. 6. What is the relationship, if any, of the current liabilities to the company's cost of capital? 7. Comment on the optimal capital structure as it relates to the cost of capital 8. What are some advantages of establishing a relationship with an investment banker? 9. What is the meaning of the opportunity cost of capital for the divisions relative to the firm's overall cost of capital? 10. What is the role of the opportunity cost in capital budgeting? 11. Discuss the cost of retained earnings versus the cost of new equity. If these costs differ, why do they differ? 12. What, if anything, would cause a fundamental (permanent) change in the firm's cost of capital