solve the following

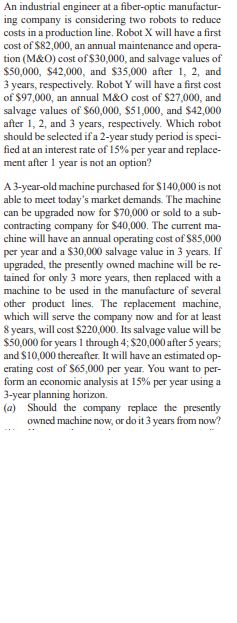

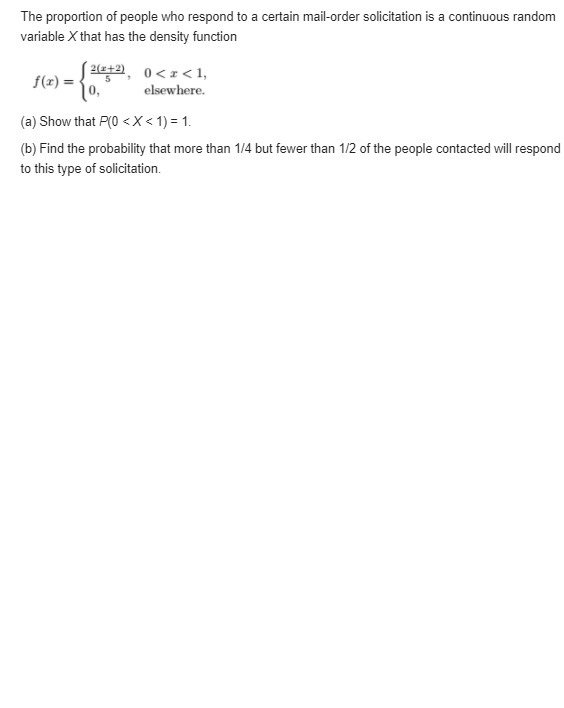

A certain polymer is used for evacuation systems for aircraft. It is important that the polymer be resistant to the aging process. Twenty specimens of the polymer were used in an experiment. Ten were assigned randomly to be exposed to an accelerated batch aging process that involved exposure to high temperatures for 10 days. Measurements of tensile strength of the specimens were made, and the following data were recorded on tensile strength in psi: No aging: 227 222 218 217 225 218 216 229 228 221 Aging: 219 214 215 211 209 218 203 204 201 205 (a) Do a dot plot of the data. (b) From your plot, does it appear as if the aging process has had an effect on the tensile strength of thispolymer? Explain. (c) Calculate the sample mean tensile strength of the two samples. (d) Calculate the median for both. Discuss the similarity or lack of similarity between the mean andmedian of each group.The following measurements were recorded for the drying time, in hours, of a certain brand of latex paint. 3.4 2.5 4.8 2.9 3.6 2.8 3.3 5.6 3.7 2.8 4.4 4.0 5.2 3.0 4.8 Assume that the measurements are a simple random sample. (a) What is the sample size for the above sample? (b) Calculate the sample mean for these data. (c) Calculate the sample median. (d) Plot the data by way of a dot plot. (e) Compute the 20% trimmed mean for the above data set. (f) Is the sample mean for these data more or less descriptive as a center of location than the trimmed mean?Claudia works with Lockheed-Martin (LMCO) in the aircraft maintenance division. She is preparing for what she and her boss, the division chief, hope to be a new 10-year defense con- tract with the U.S. Air Force on C-5A cargo aircraft. A key piece of equipment for maintenance operations is an avionics circuit diagnostics system. The current system was purchased 7 years ago on an earlier contract. It has no capital recovery costs remaining, and the following are reliable estimates: current market value = $70,000, remaining life of 3 more years, no salvage value, and AOC = $30,000 per year. The only options for this system are to replace it now or retain it for the full 3 additional years. Claudia has found that there is only one good challenger system. Its cost estimates are: first cost = $750,000, life = 10 years, S = 0, and AOC = $50,000 per year. Realizing the importance of accurate defender alternative cost estimates, Claudia asked the division chief what system would be a logical follow-on to the current one 3 years hence, if LMCO wins the contract. The chief predicted LMCO would purchase the very system she had identified as the challenger, because it is the best on the market. The company would keep it for the entire 10 additional years for use on an extension of this contract or some other applica- tion that could recover the remaining 3 years of invested capital. Claudia interpreted the re- sponse to mean that the last 3 years would also be capital recovery years, but on some project other than this one. Claudia's estimate of the first cost of this same system 3 years from now is $900,000. Additionally, the $50,000 per year AOC is the best estimate at this time. The division chief mentioned any study had to be conducted using the interest rate of 10%, as mandated by the U.S. Office of Management and Budget (OMB). Perform a replacement study for the fixed contract period of 10 years.In a replacement study, what is meant by "taking the nonowner's viewpoint"? An asset that was purchased 3 years ago for $100,000 is becoming obsolete faster than ex- pected. The company thought the asset would last 5 years and that its book value would decrease by $20,000 each year and, therefore, be worthless at the end of year 5. In considering a more versatile, more reliable high-tech replacement, the company discovered that the presently owned asset has a market value of only $15,000. If the replacement is purchased immediately at a first cost of $75,000 and if it will have a lower annual worth, what is the amount of the sunk cost? Assume the company's MARR is 15% per year. As a muscle car aficionado, a friend of yours likes to restore cars of the 60s and 70s and sell them for a profit. He started his latest project (a 1965 Shelby GT350) four months ago and has a total of $126,000 invested so far. Another opportunity has come up (a 1969 Dodge Charger) that he is think- ing of buying because he believes he could sell it for a profit of $60,000 after it is completely re- stored. To do so, however, he would have to sell the unfinished Shelby first. He thought that the completely restored Shelby would be worth $195,000, resulting in a tidy profit of $22,000, but in its half-restored condition, the most he could get now is $115,000. In discussing the situation with you, he stated that if he could sell the Shelby now and buy the Charger at a reduced price, he would make up for the money he will lose in selling the Shelby at a lower-than-desired price. (a) What is wrong with this thinking? (b) What is his sunk cost in the Shelby?An industrial engineer at a fiber-optic manufactur ing company is considering two robots to reduce costs in a production line. Robot X will have a first cost of $82,000, an annual maintenance and opera- tion (M&O) cost of $30,000, and salvage values of $50,000, $42,000, and $35,000 after 1, 2, and 3 years, respectively. Robot Y will have a first cost of $97,000, an annual M&O cost of $27,000, and salvage values of $60,000, $51,000, and $42,000 after 1, 2, and 3 years, respectively. Which robot should be selected if a 2-year study period is speci- fied at an interest rate of 15% per year and replace- ment after 1 year is not an option? A 3-year-old machine purchased for $140,000 is not able to meet today's market demands. The machine can be upgraded now for $70,000 or sold to a sub- contracting company for $40,000. The current ma- chine will have an annual operating cost of $85,000 per year and a $30,000 salvage value in 3 years. If upgraded, the presently owned machine will be re- tained for only 3 more years, then replaced with a machine to be used in the manufacture of several other product lines. The replacement machine, which will serve the company now and for at least 8 years, will cost $220,000. Its salvage value will be $50,000 for years I through 4; $20,000 after 5 years; and $10,000 thereafter. It will have an estimated op- crating cost of $65,000 per year. You want to per- form an economic analysis at 15% per year using a 3-year planning horizon. (a) Should the company replace the presently owned machine now, or do it 3 years from now?Find the cumulative distribution function of the random variable X representing the number of defectives in Exercise 3.11. Then using F(x), find (a) P(X = 1); (b) P(0 2).The proportion of people who respond to a certain mail-order solicitation is a continuous random variable X that has the density function f(x) = 2(3+2) 0