Answered step by step

Verified Expert Solution

Question

1 Approved Answer

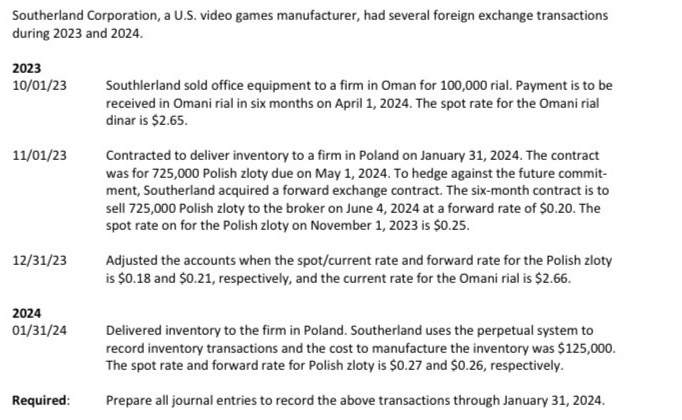

Southerland Corporation, a U.S. video games manufacturer, had several foreign exchange transactions during 2023 and 2024. 2023 10/01/23 11/01/23 12/31/23 2024 01/31/24 Required: Southlerland

Southerland Corporation, a U.S. video games manufacturer, had several foreign exchange transactions during 2023 and 2024. 2023 10/01/23 11/01/23 12/31/23 2024 01/31/24 Required: Southlerland sold office equipment to a firm in Oman for 100,000 rial. Payment is to be received in Omani rial in six months on April 1, 2024. The spot rate for the Omani rial dinar is $2.65. Contracted to deliver inventory to a firm in Poland on January 31, 2024. The contract was for 725,000 Polish zloty due on May 1, 2024. To hedge against the future commit- ment, Southerland acquired a forward exchange contract. The six-month contract is to sell 725,000 Polish zloty to the broker on June 4, 2024 at a forward rate of $0.20. The spot rate on for the Polish zloty on November 1, 2023 is $0.25. Adjusted the accounts when the spot/current rate and forward rate for the Polish zloty is $0.18 and $0.21, respectively, and the current rate for the Omani rial is $2.66. Delivered inventory to the firm in Poland. Southerland uses the perpetual system to record inventory transactions and the cost to manufacture the inventory was $125,000. The spot rate and forward rate for Polish zloty is $0.27 and $0.26, respectively. Prepare all journal entries to record the above transactions through January 31, 2024.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Southerland Corporation Foreign Exchange Transactions 2023 October 1 2023 Debit Accounts Receivable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd84da15f7_961712.pdf

180 KBs PDF File

663dd84da15f7_961712.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started