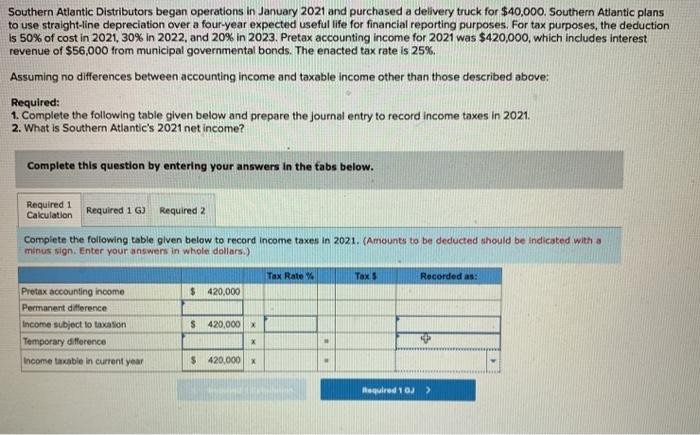

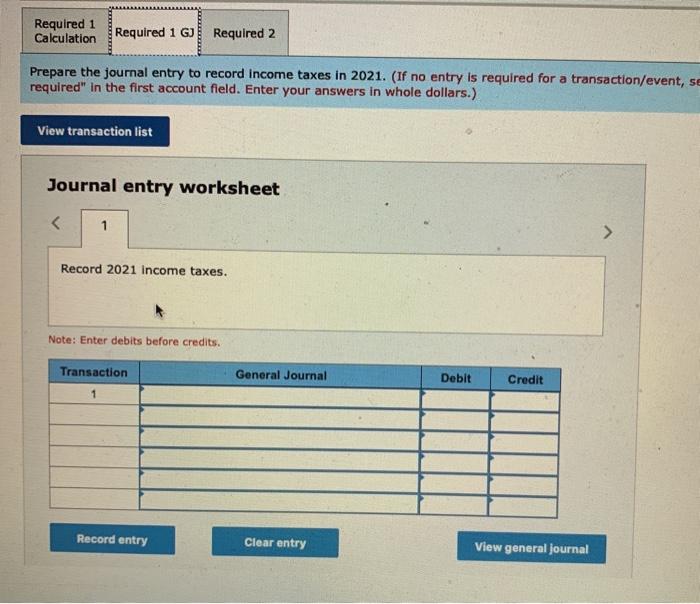

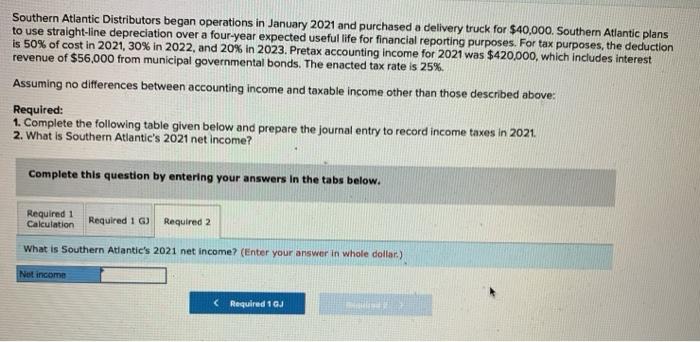

Southern Atlantic Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2021. 30% in 2022, and 20% in 2023. Pretax accounting income for 2021 was $420,000, which includes interest revenue of $56,000 from municipal governmental bonds. The enacted tax rate is 25%. Assuming no differences between accounting income and taxable income other than those described above: Required: 1. Complete the following table given below and prepare the journal entry to record income taxes in 2021 2. What is Southern Atlantic's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculation Required 16 Complete the following table given below to record income taxes in 2021. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in whole dollars.) Tax Rate Taxs Recorded as: $ 420,000 Pretax accounting income Permanent difference Income subject to taxation Temporary difference $ 420,000 X Income taxable in current year $ 420,000 X Required 103 > Required 1 Calculation Required 1 G) Required 2 Prepare the journal entry to record income taxes in 2021. (If no entry is required for a transaction/event, se required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet Record 2021 income taxes. Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal Southern Atlantic Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2021, 30% in 2022, and 20% in 2023. Pretax accounting Income for 2021 was $420,000, which includes interest revenue of $56,000 from municipal governmental bonds. The enacted tax rate is 25%. Assuming no differences between accounting income and taxable income other than those described above: Required: 1. Complete the following table given below and prepare the journal entry to record income taxes in 2021 2. What is Southern Atlantic's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 G) Required 2 What is Southern Atlantic's 2021 net income? (Enter your answer in whole dollar) Not income Required 1GJ