Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sparrow Boat Building Limited is in the business of building yachts. The company currently manufactures the engines they use in the yachts but are

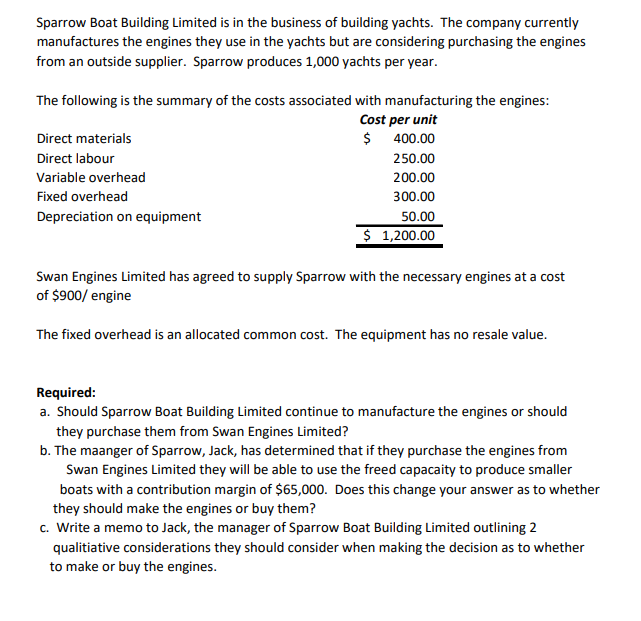

Sparrow Boat Building Limited is in the business of building yachts. The company currently manufactures the engines they use in the yachts but are considering purchasing the engines from an outside supplier. Sparrow produces 1,000 yachts per year. The following is the summary of the costs associated with manufacturing the engines: Cost per unit $ 400.00 Direct materials Direct labour 250.00 Variable overhead 200.00 Fixed overhead 300.00 Depreciation on equipment 50.00 $ 1,200.00 Swan Engines Limited has agreed to supply Sparrow with the necessary engines at a cost of $900/ engine The fixed overhead is an allocated common cost. The equipment has no resale value. Required: a. Should Sparrow Boat Building Limited continue to manufacture the engines or should they purchase them from Swan Engines Limited? b. The maanger of Sparrow, Jack, has determined that if they purchase the engines from Swan Engines Limited they will be able to use the freed capacaity to produce smaller boats with a contribution margin of $65,000. Does this change your answer as to whether they should make the engines or buy them? c. Write a memo to Jack, the manager of Sparrow Boat Building Limited outlining 2 qualitiative considerations they should consider when making the decision as to whether to make or buy the engines.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Comparative Cost Manufacture Purchase Cost to be incurred Cost Per Unit Cost to be in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started