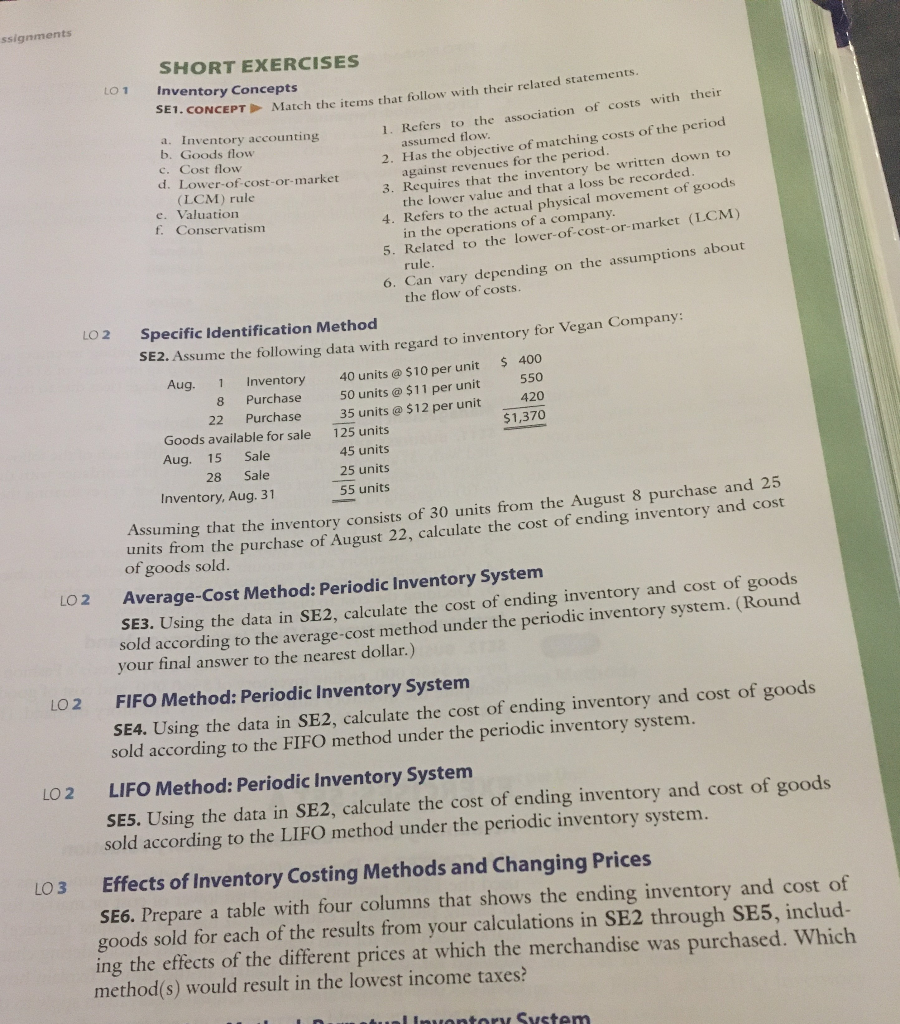

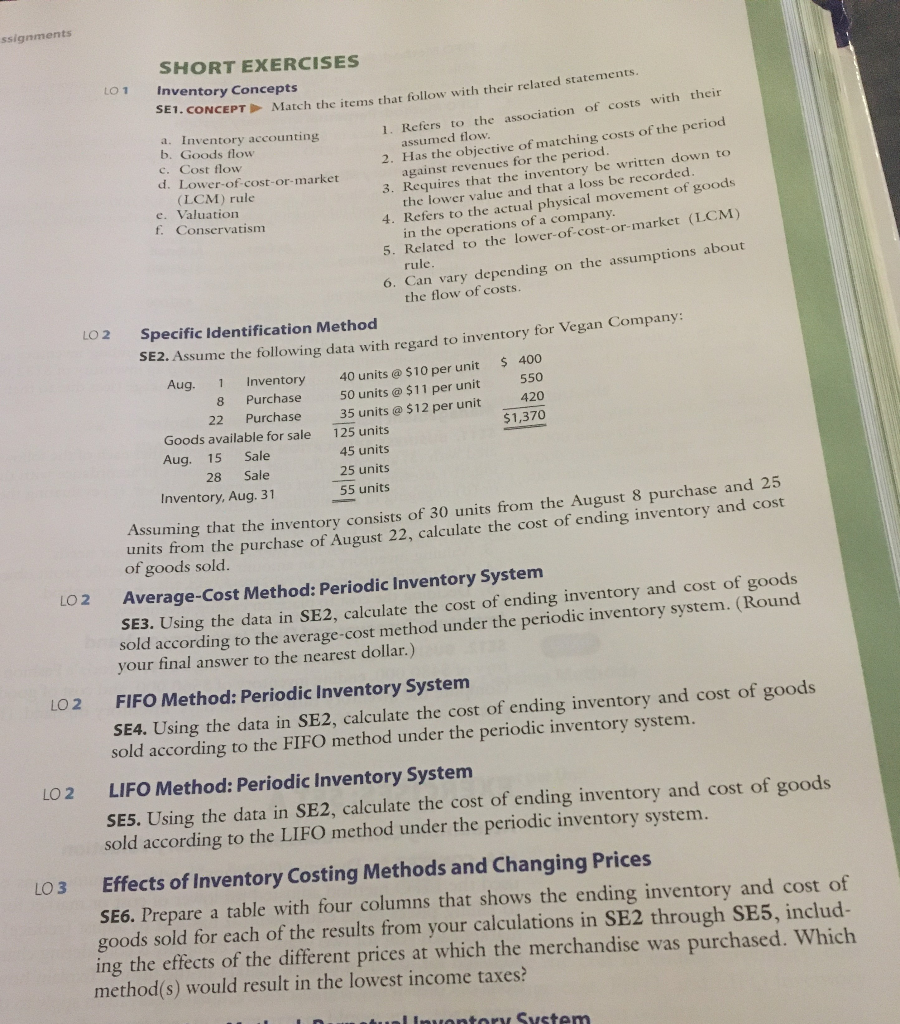

ssignments LO 1 SHORT EXERCISES Inventory Concepts SE1. CONCEPT Match the items that follow with their related statements. a. Inventory accounting 1. Refers to the association of costs with their b. Goods flow assumed flow. c. Cost flow 2. Has the objective of matching costs of the period d. Lower-of-cost-or-market against revenues for the period. (LCM) rule 3. Requires that the inventory be written down to e. Valuation the lower value and that a loss be recorded. f. Conservatism 4. Refers to the actual physical movement of goods in the operations of a company. 5. Related to the lower-of cost-or-market (LCM) rule. 6. Can vary depending on the assumptions about the flow of costs. LO 2 Specific Identification Method SE2. Assume the following data with regard to inventory for Vegan Company: Aug. Inventory $ 400 40 units @ $10 per unit Purchase 50 units @ $11 per unit 550 Purchase 35 units @ $12 per unit 420 Goods available for sale 125 units $1,370 Aug. 15 Sale 45 units 28 Sale 25 units Inventory, Aug. 31 55 units Assuming that the inventory consists of 30 units from the August 8 purchase and 25 units from the purchase of August 22, calculate the cost of ending inventory and cost of goods sold. Average-Cost Method: Periodic Inventory System SE3. Using the data in SE2, calculate the cost of ending inventory and cost of goods sold according to the average-cost method under the periodic inventory system. (Round your final answer to the nearest dollar.) 1 8 22 LO 2 LO 2 LO 2 FIFO Method: Periodic Inventory System SE4. Using the data in SE2, calculate the cost of ending inventory and cost of goods sold according to the FIFO method under the periodic inventory system. LIFO Method: Periodic Inventory System SE5. Using the data in SE2, calculate the cost of ending inventory and cost of goods sold according to the LIFO method under the periodic inventory system. Effects of Inventory Costing Methods and Changing Prices SE6. Prepare a table with four columns that shows the ending inventory and cost of goods sold for each of the results from your calculations in SE2 through SE5, includ- ing the effects of the different prices at which the merchandise was purchased. Which method(s) would result in the lowest income taxes? LO 3 dual Inuontory System