Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ST-3. You've been assigned to evaluate a project for your firm that requires an initial investment of $200,000, is expected to last for 10 years,

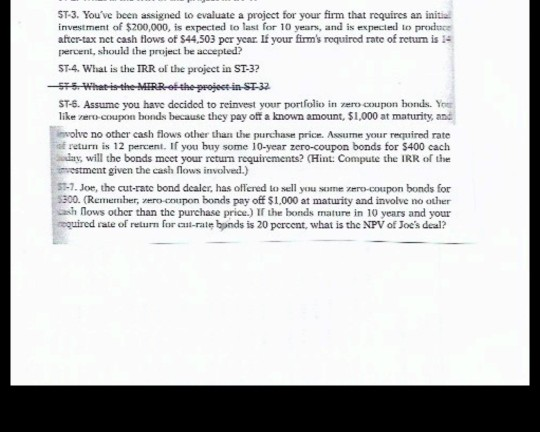

ST-3. You've been assigned to evaluate a project for your firm that requires an initial investment of $200,000, is expected to last for 10 years, and is expected to produce after-tax net cash flows of $44,503 per year. If your firm's required rate of return is 14 percent, should the project be accepted? ST-4. What is the IRR of the project in ST-3? -976. What is the MIRR- the project-in-ST-32 ST-6. Assume you have decided to reinvest your portfolio in ero coupon bonds. You like zero-coupon bonds because they pay off a known amount, $1,000 at maturity, and involve no other cash flows other than the purchase price. Assume your required rate of return is 12 percent. If you buy some 10-year zero-coupon bonds for $400 cach day, will the bonds meet your return requirements? (Hint: Compute the IRR of the estment given the cash flows involved.) 51-7. Joe, the cut-rate bond dealer, has offered to sell you some ro-coupon bonds for 5300. (Remember, nero-coupon bonds pay off $1,000 at maturity and involve no other a lows other than the purchase price.) If the bonds mature in 10 years and your quired rate of return for Citrate bonds is 20 percent, what is the NPV of Joe's deal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started