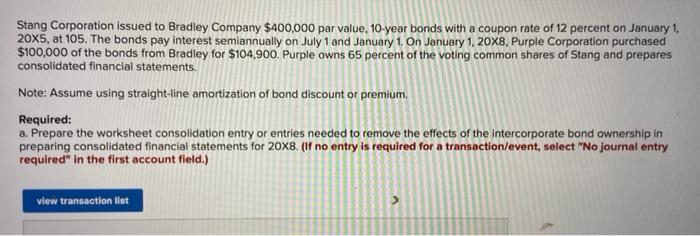

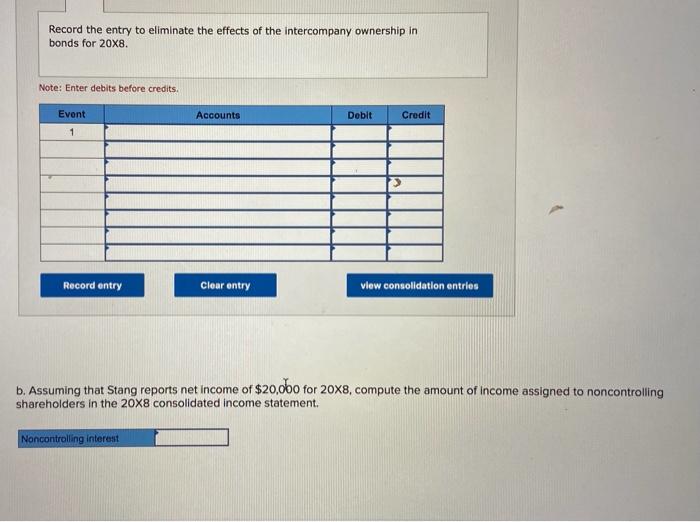

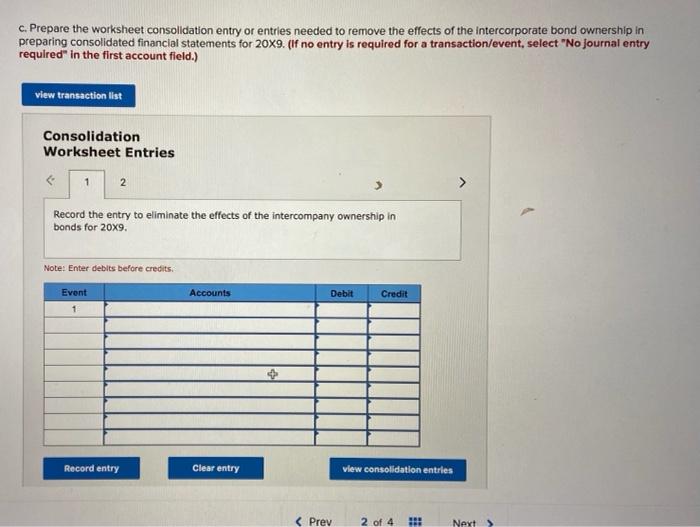

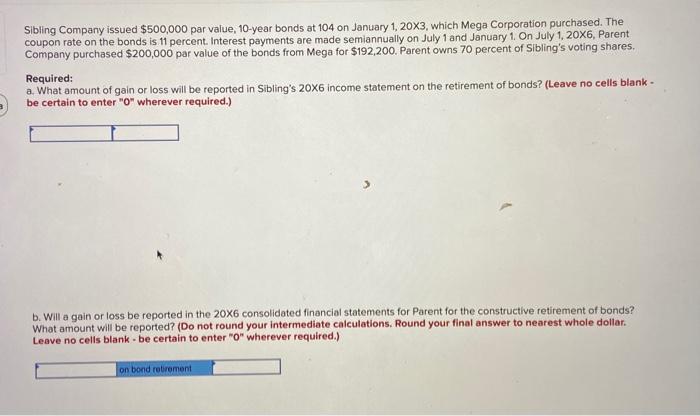

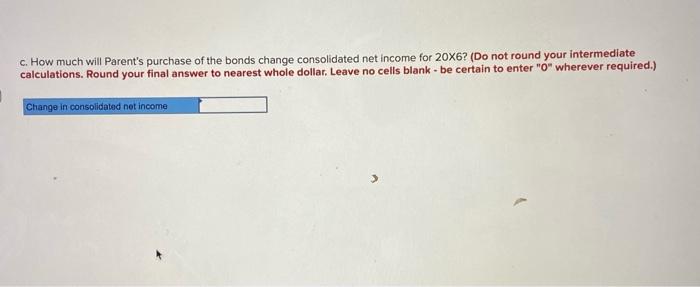

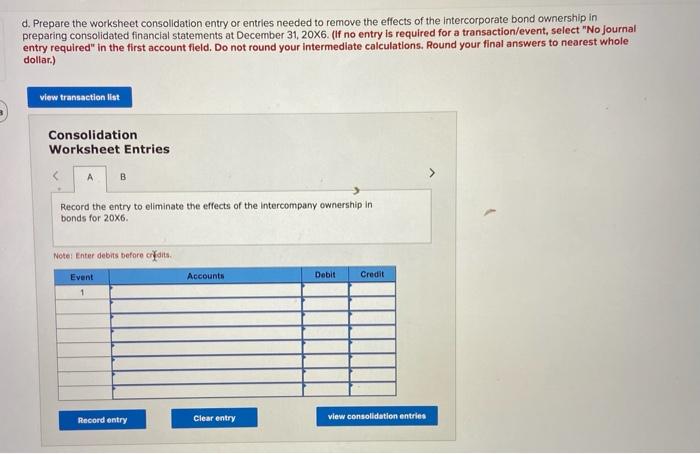

Stang Corporation issued to Bradley Company $400,000 par value, 10-year bonds with a coupon rate of 12 percent on January 1, 20X5, at 105. The bonds pay interest semiannually on July 1 and January 1. On January 1, 20x8, Purple Corporation purchased $100,000 of the bonds from Bradley for $104,900. Purple owns 65 percent of the voting common shares of Stang and prepares consolidated financial statements. Note: Assume using straight-line amortization of bond discount or premium Required: a. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20x8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list Record the entry to eliminate the effects of the intercompany ownership in bonds for 20X8. Note: Enter debits before credits. Accounts Debit Credit Event 1 Record entry Clear entry view consolidation entries b. Assuming that Stang reports net income of $20,000 for 20x8, compute the amount of Income assigned to noncontrolling shareholders in the 20X8 consolidated income statement Noncontrolling interest c. Prepare the worksheet consolidation entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements for 20x9. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) view transaction list Consolidation Worksheet Entries 1 2 Record the entry to eliminate the effects of the intercompany ownership in bonds for 20x9. Note: Enter debits before credits Event Accounts Debit Credit 1 Record entry Clear entry view consolidation entries Sibling Company issued $500,000 par value, 10-year bonds at 104 on January 1, 20X3, which Mega Corporation purchased. The coupon rate on the bonds is 11 percent. Interest payments are made semiannually on July 1 and January 1 On July 1, 20X6, Parent Company purchased $200,000 par value of the bonds from Mega for $192,200. Parent owns 70 percent of Sibling's voting shares. Required: a What amount of gain or loss will be reported in Sibling's 20x6 income statement on the retirement of bonds? (Leave no cells blank - be certain to enter "o" wherever required.) b. Will a gain or loss be reported in the 20x6 consolidated financial statements for Parent for the constructive retirement of bonds? What amount will be reported? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar. Leave no cells blank.be certain to enter "0" wherever required.) on bond retirement c. How much will Parent's purchase of the bonds change consolidated net income for 20X6? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar. Leave no cells blank.be certain to enter "0" wherever required.) Change in consolidated not income d. Prepare the worksheet consolidation entry or entries needed to remove the effects of the Intercorporate bond ownership in preparing consolidated financial statements at December 31, 20x6. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Do not round your intermediate calculations. Round your final answers to nearest whole dollar) view transaction list Consolidation Worksheet Entries > B Record the entry to eliminate the effects of the intercompany ownership in bonds for 20x6. Note: Enter debits before oroits Event Accounts Debit Credit 1 Record entry Clear entry view consolidation entries