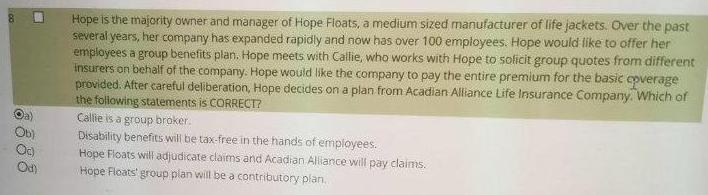

Question: Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company

Hope is the majority owner and manager of Hope Floats, a medium sized manufacturer of life jackets. Over the past several years, her company has expanded rapidly and now has over 100 employees. Hope would like to offer her employees a group benefits plan. Hope meets with Callie, who works with Hope to solicit group quotes from different insurers on behalf of the company. Hope would like the company to pay the entire premium for the basic cpverage provided. After careful deliberation, Hope decides on a plan from Acadian Alliance Life Insurance Company. Which of the foliowing statements is CORRECT? Callie is a group broker. Disability benefits will be tax-free in the hands of employees. Hope Floats will adjudicate claims and Acadian Alliance will pay claims. Hope Floats' group plan will be a contributory plan. Ob) Oc)

Step by Step Solution

3.53 Rating (170 Votes )

There are 3 Steps involved in it

First of all let us understand the meaning of Group benefit plan A group benefit plan is an ... View full answer

Get step-by-step solutions from verified subject matter experts