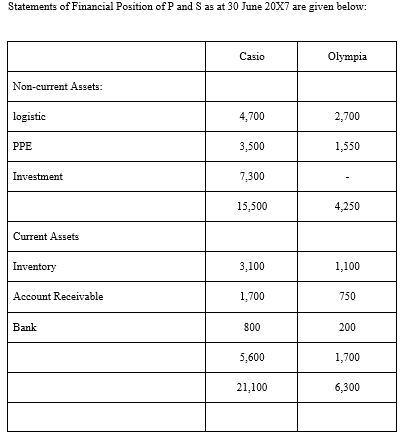

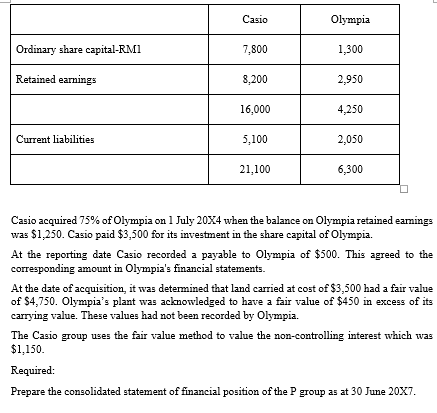

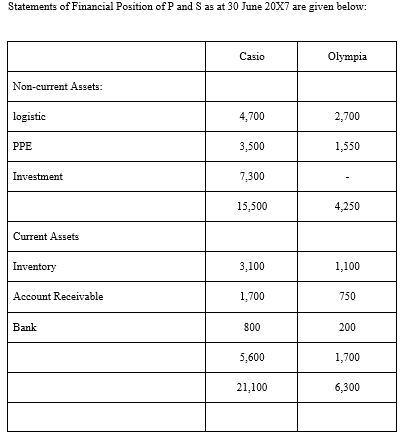

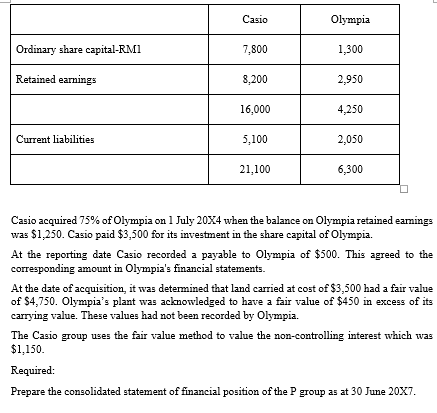

Statements of Financial Position of P and S as at 30 June 20X7 are given below: Casio Olympia Non-current Assets: logistic 4,700 2,700 PPE 3,500 1,550 Investment 7,300 15,500 4,250 Current Assets Inventory 3.100 1,100 Account Receivable 1,700 750 Bank 800 200 5,600 1,700 21,100 6,300 Casio Olympia Ordinary share capital-RMI 7,800 1,300 Retained earnings 8,200 2,950 16,000 4,250 Current liabilities 5.100 2,050 21,100 6,300 Casio acquired 75% of Olympia on 1 July 20X4 when the balance on Olympia retained earings was $1,250. Casio paid $3,500 for its investment in the share capital of Olympia. At the reporting date Casio recorded a payable to Olympia of $500. This agreed to the corresponding amount in Olympia's financial statements. At the date of acquisition, it was determined that land carried at cost of $3,500 had a fair value of $4,750. Olympia's plant was acknowledged to have a fair value of $450 in excess of its carrying value. These values had not been recorded by Olympia. The Casio group uses the fair value method to value the non-controlling interest which was $1,150. Required: Prepare the consolidated statement of financial position of the P group as at 30 June 20x7. Statements of Financial Position of P and S as at 30 June 20X7 are given below: Casio Olympia Non-current Assets: logistic 4,700 2,700 PPE 3,500 1,550 Investment 7,300 15,500 4,250 Current Assets Inventory 3.100 1,100 Account Receivable 1,700 750 Bank 800 200 5,600 1,700 21,100 6,300 Casio Olympia Ordinary share capital-RMI 7,800 1,300 Retained earnings 8,200 2,950 16,000 4,250 Current liabilities 5.100 2,050 21,100 6,300 Casio acquired 75% of Olympia on 1 July 20X4 when the balance on Olympia retained earings was $1,250. Casio paid $3,500 for its investment in the share capital of Olympia. At the reporting date Casio recorded a payable to Olympia of $500. This agreed to the corresponding amount in Olympia's financial statements. At the date of acquisition, it was determined that land carried at cost of $3,500 had a fair value of $4,750. Olympia's plant was acknowledged to have a fair value of $450 in excess of its carrying value. These values had not been recorded by Olympia. The Casio group uses the fair value method to value the non-controlling interest which was $1,150. Required: Prepare the consolidated statement of financial position of the P group as at 30 June 20x7