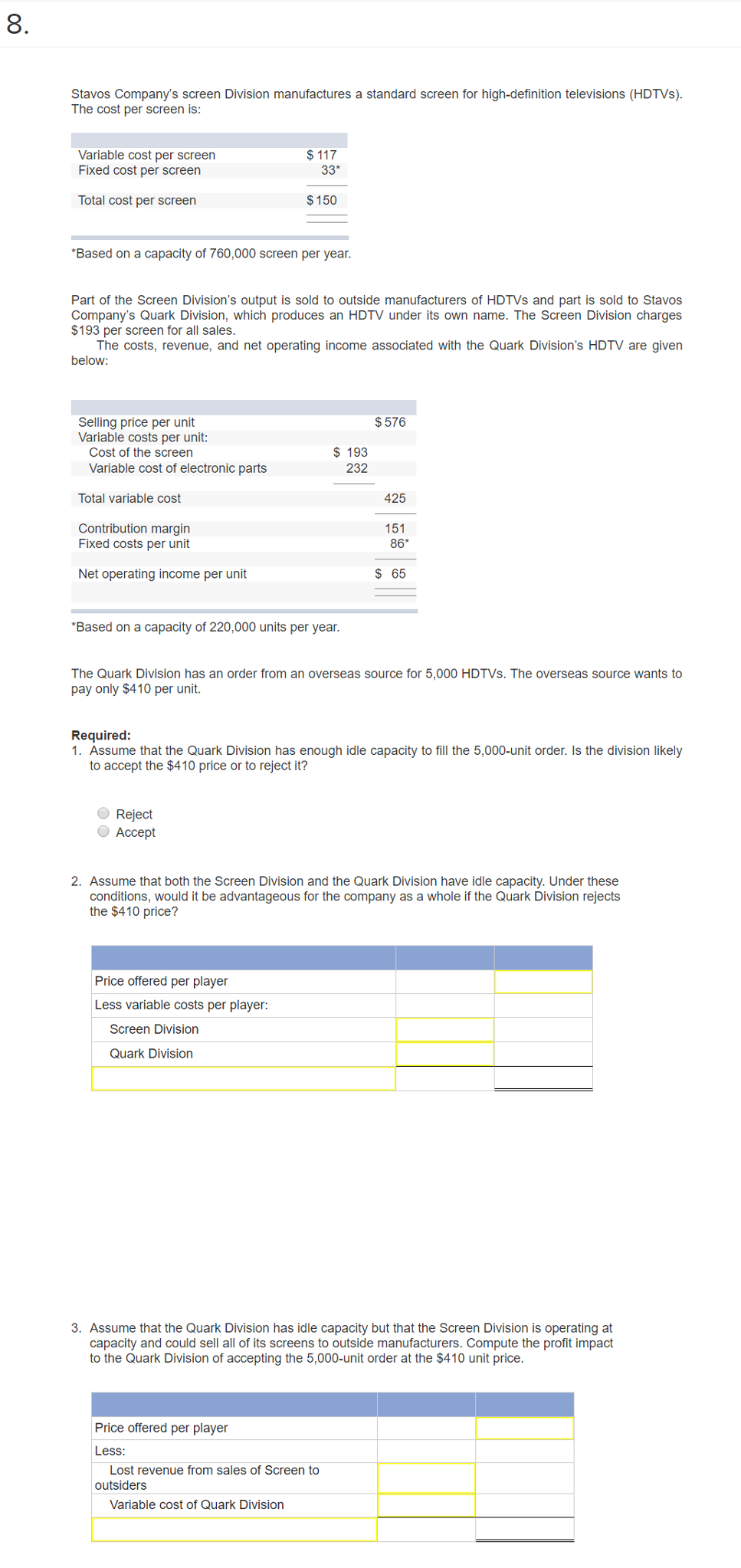

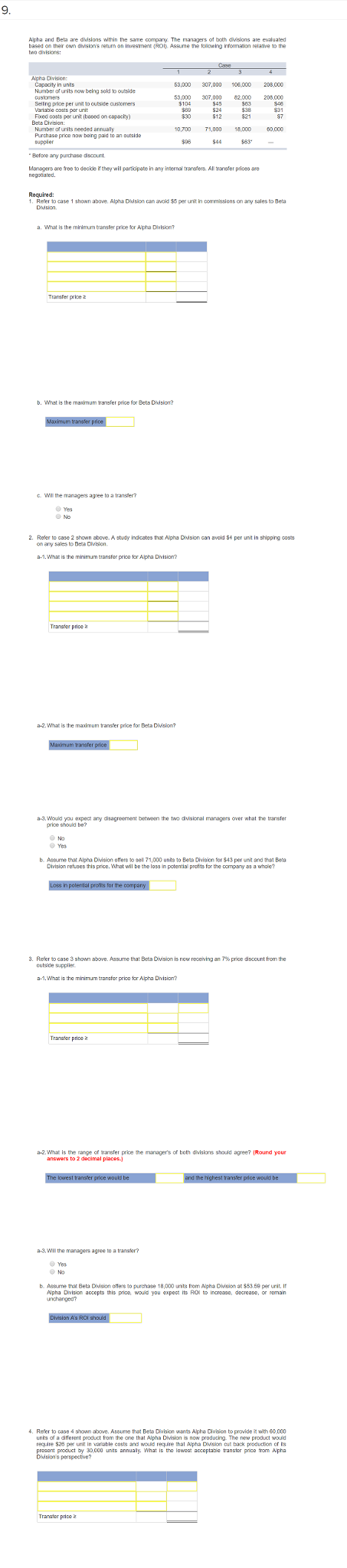

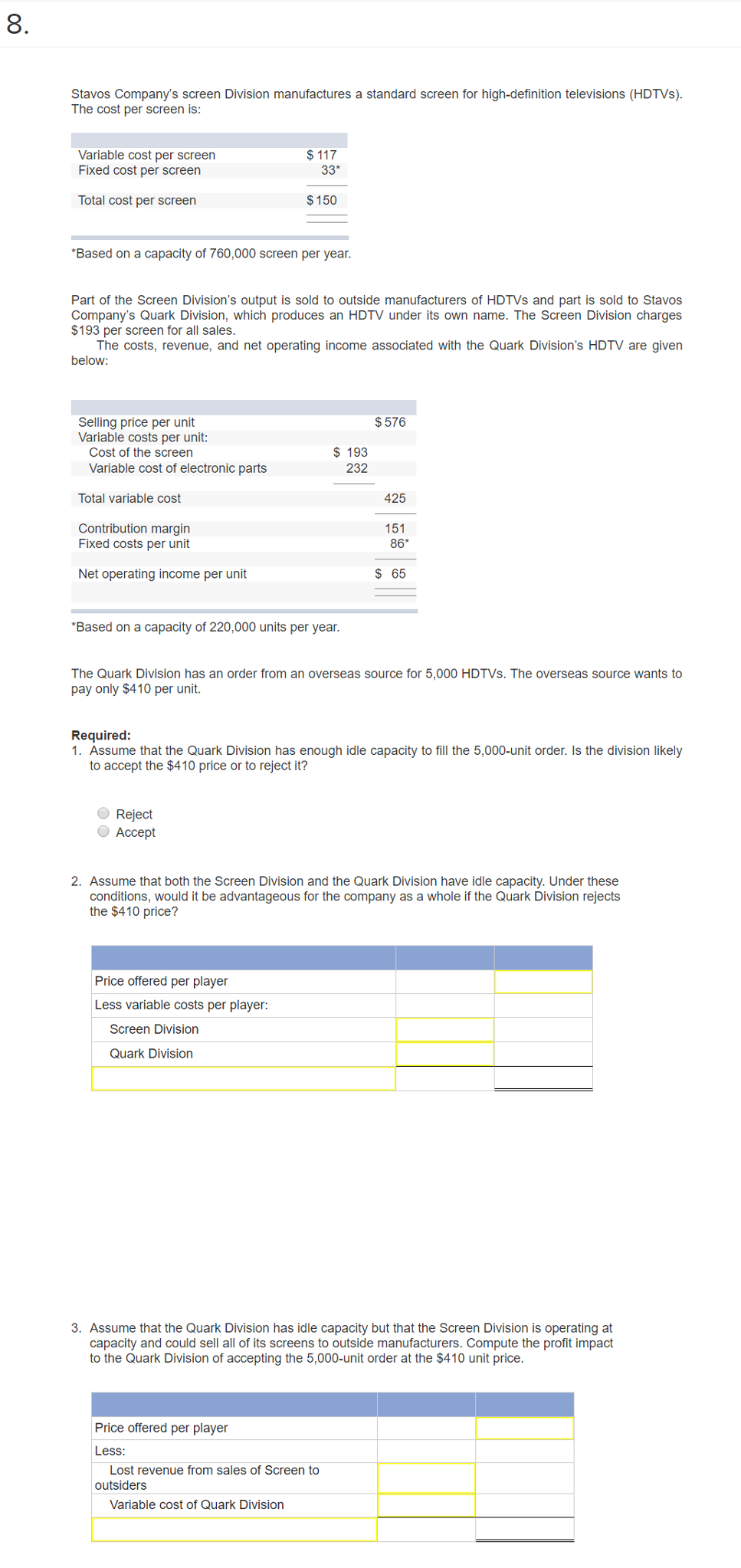

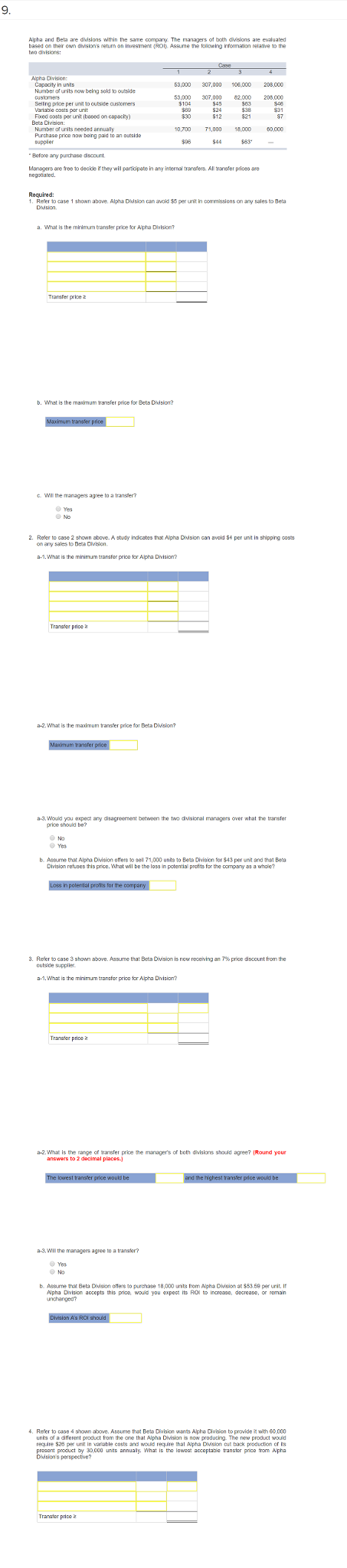

Stavos Company's screen Division manufactures a standard screen for high-definition televisions (HDTVs). The cost per screen is: *Based on a capacity of 760, 000 screen per year. Part of the Screen Division's output is sold to outside manufacturers of HDTVs and part is sold to Stave Company's Quark Division, which produces an HDTV under its own name. The Screen Division charge $193 per screen for all sales. The costs, revenue, and net operating income associated with the Quark Division's HDTV are give below: *Based on a capacity of 220, 000 units per year. The Quark Division has an order from an overseas source for 5, 000 HDTVs. The overseas source wants to pay only $410 per unit. Required: Assume that the Quark Division has enough idle capacity to fill the 5, 000-unit order. Is the division like to accept the $410 price or to reject it? Reject Accept Assume that both the Screen Division and the Quark Division have idle capacity. Under these conditions, would it be advantageous for the company as a whole if the Quark Division rejects the $410 price? Assume that the Quark Division has idle capacity but that the Screen Division is operating at capacity and could sell all of its screens to outside manufacturers. Compute the profit impact to the Quark Division of accepting the 5, 000-unit order at the $410 unit price. Alpha and Beta are divisions with the same company. The managers of both divisions are evaluated based on their own division's return on investment(ROI). Assume the following information relative to the two divisions: Before any purchase discount. Managers are tree to decide if they will participate in any interval transfers. All transfer prices are negosiated. Required: Refer to case 1 shown above. Alpha Division can be avoid $5 per unit in commission on any statea to Beta Division. What is the minimum transfer price for Alpha Division? What is the maximum transfer price for Beta Division? Will the managers agree to a transfer? Yes No Refer to case 2 shown above. A study indicates that Alpha Division can avoid $4 per unit in shopping costs on any sales to Beta Division. What is the minimum transfer prior for Alpha Division? What is the maximum transfer price for Beta Division? Would you expect any disagreement between the two divisions over what are transfer price should be? No Yes Assume that Alpha Division offers to sell 71, 000 units to Beta Division for $43 per unit and that Beta Division refuses this price. What will be the less in potential profits for the company as a whole? Refer to case 3 shown above. Assume that Beta Division is now receiving an 7% price discount from the outside supplier. What is the minimum transfer price for Alpha Division? What is the range of transfer price the manager's of both divisions should agree? Will the managers agree to a transfer? Yes No Assume that Bete Division offers to purchase 18, 000 units from Alpha Division at $53.69 per unit. If Alpha Division accepts this price, would you expects its ROI to increase, decrease, or roman unchanged? Refer 10 case 4 shown above, Assume that Beta Division wants Alpha Division to provide it with 60, 000 units of a different product from the one unit Alpha Division is now producing. The new product would require $20 per unit in variable costs and would required that Alpha Division out back production of its present product by 30, 000 units annually. What is the lowest acceptatic transfer price from Alpha Division's perspective