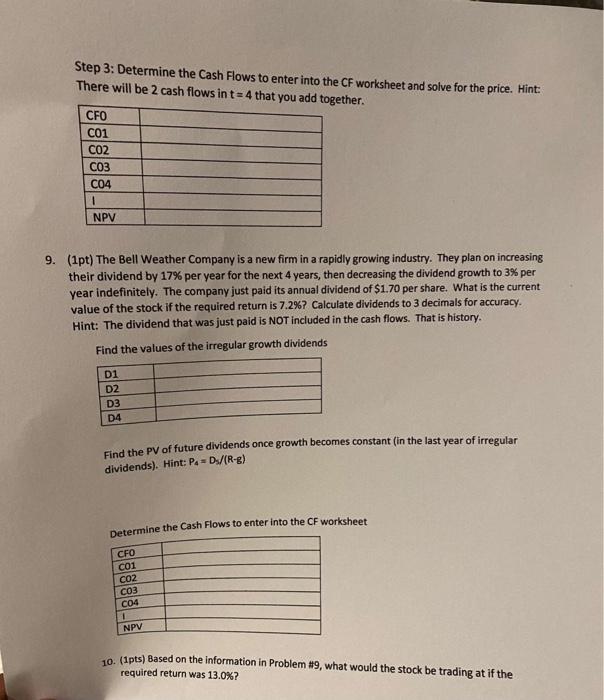

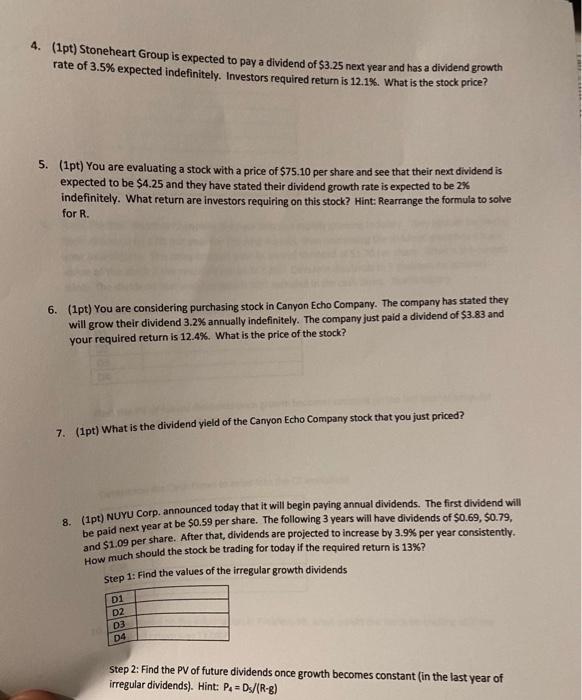

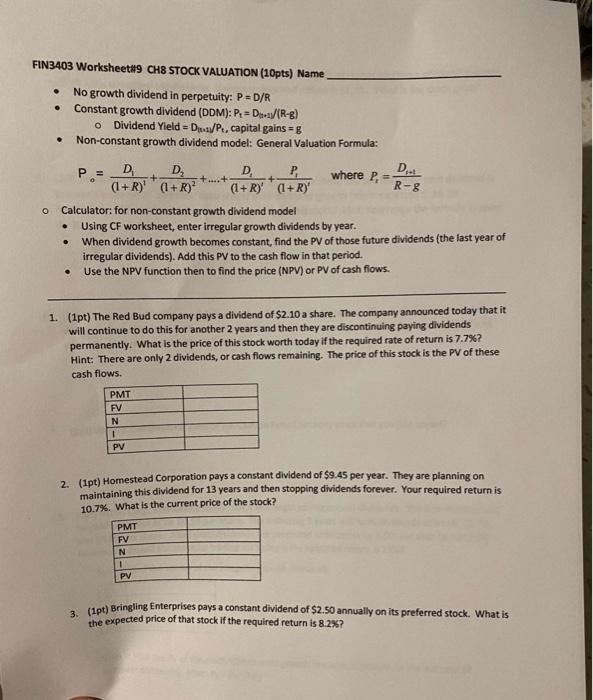

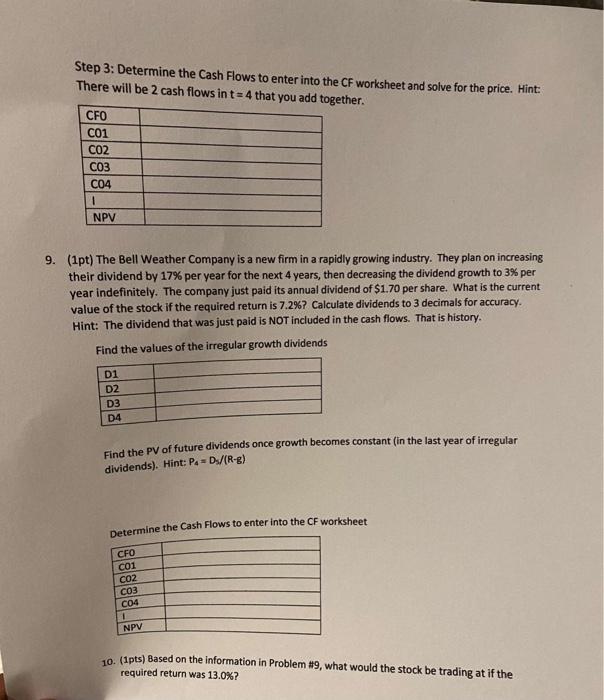

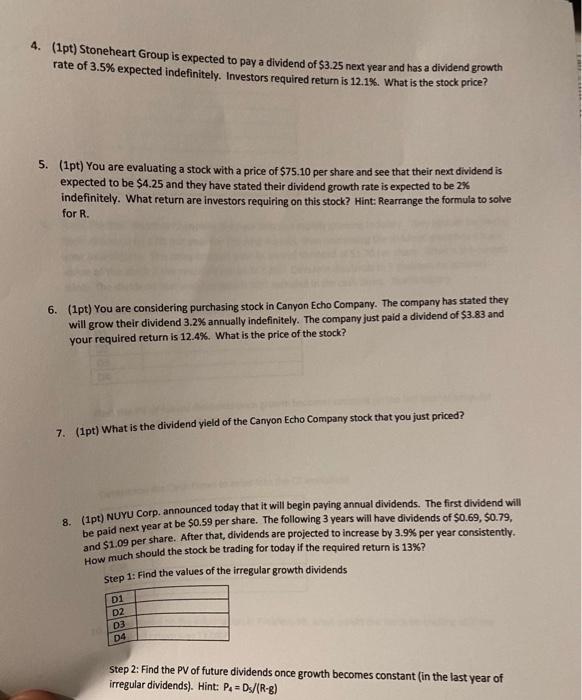

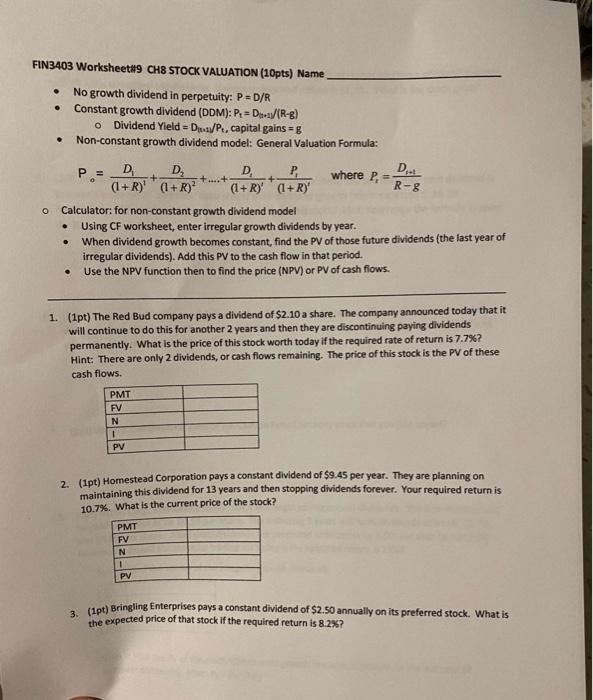

Step 3: Determine the Cash Flows to enter into the CF worksheet and solve for the price. Hint: There will be 2 cash flows in t=4 that unu add tazether. 9. (1pt) The Bell Weather Company is a new firm in a rapidly growing industry. They plan on increasing their dividend by 17% per year for the next 4 years, then decreasing the dividend growth to 3% per year indefinitely. The company just paid its annual dividend of $1.70 per share. What is the current value of the stock if the required return is 7.2% ? Calculate dividends to 3 decimals for accuracy. Hint: The dividend that was just paid is NOT included in the cash flows. That is history. Find the values of the irregular growth dividends Find the PV of future dividends once growth becomes constant (in the last year of irregular dividends). Hint: P4=D3/(Rg) netermine the Cash Flows to enter into the CF worksheet 10. (1pts) Based on the information in Problem \#9, what would the stock be trading at if the required return was 13.0% ? 4. (1pt) Stoneheart Group is expected to pay a dividend of $3.25 next year and has a dividend growth rate of 3.5% expected indefinitely. Investors required return is 12.1%. What is the stock price? 5. (1pt) You are evaluating a stock with a price of $75.10 per share and see that their next dividend is expected to be $4.25 and they have stated their dividend growth rate is expected to be 2% indefinitely. What return are investors requiring on this stock? Hint: Rearrange the formula to solve for R. 6. (1pt) You are considering purchasing stock in Canyon Echo Company. The company has stated they will grow their dividend 3.2% annually indefinitely. The company just paid a dividend of $3.83 and your required return is 12.4%. What is the price of the stock? 7. (1pt) What is the dividend yield of the Canyon Echo Company stock that you just priced? 8. (1pt) NUYU Corp. announced today that it will begin paying annual dividends. The first dividend will be paid next year at be $0.59 per share. The following 3 years will have dividends of $0.69,$0.79, and $1.09 per share. After that, dividends are projected to increase by 3.9% per year consistently. How much should the stock be trading for today if the required return is 13% ? Step 1: Find the values of the irregular growth dividends Step 2: Find the PV of future dividends once growth becomes constant (in the last year of irregular dividends). Hint: P4=Ds/(Rg) - No growth dividend in perpetuity: P=D/R - Constant growth dividend (DDM): Pt=D(t+1/(Rg) O Dividend Yield =D(r+1/Pt, capital gains =g - Non-constant growth dividend model: General Valuation Formula: Po=(1+R)2D1+(1+R)2D2++(1+R)tDt+(1+R)tP1wherePr=RgDt+1 Calculator: for non-constant growth dividend model - Using CF worksheet, enter irregular growth dividends by year. - When dividend growth becomes constant, find the PV of those future dividends (the last year of irregular dividends). Add this PV to the cash flow in that period. - Use the NPV function then to find the price (NPV) or PV of cash flows. 1. (1pt) The Red Bud company pays a dividend of $2.10 a share. The company announced today that it will continue to do this for another 2 years and then they are discontinuing paying dividends permanently. What is the price of this stock worth today if the required rate of return is 7.7% ? Hint: There are only 2 dividends, or cash flows remaining. The price of this stock is the PV of these cash flows. 2. (1pt) Homestead Corporation pays a constant dividend of $9.45 per year. They are planning on maintaining this dividend for 13 years and then stopping dividends forever. Your required return is 10.7%. What is the current price of the stock? 3. (1pt) Bringling Enterprises pays a constant dividend of $2.50 annually on its preferred stock. What is the expected price of that stock if the required return is 8.28 ? Step 3: Determine the Cash Flows to enter into the CF worksheet and solve for the price. Hint: There will be 2 cash flows in t=4 that unu add tazether. 9. (1pt) The Bell Weather Company is a new firm in a rapidly growing industry. They plan on increasing their dividend by 17% per year for the next 4 years, then decreasing the dividend growth to 3% per year indefinitely. The company just paid its annual dividend of $1.70 per share. What is the current value of the stock if the required return is 7.2% ? Calculate dividends to 3 decimals for accuracy. Hint: The dividend that was just paid is NOT included in the cash flows. That is history. Find the values of the irregular growth dividends Find the PV of future dividends once growth becomes constant (in the last year of irregular dividends). Hint: P4=D3/(Rg) netermine the Cash Flows to enter into the CF worksheet 10. (1pts) Based on the information in Problem \#9, what would the stock be trading at if the required return was 13.0% ? 4. (1pt) Stoneheart Group is expected to pay a dividend of $3.25 next year and has a dividend growth rate of 3.5% expected indefinitely. Investors required return is 12.1%. What is the stock price? 5. (1pt) You are evaluating a stock with a price of $75.10 per share and see that their next dividend is expected to be $4.25 and they have stated their dividend growth rate is expected to be 2% indefinitely. What return are investors requiring on this stock? Hint: Rearrange the formula to solve for R. 6. (1pt) You are considering purchasing stock in Canyon Echo Company. The company has stated they will grow their dividend 3.2% annually indefinitely. The company just paid a dividend of $3.83 and your required return is 12.4%. What is the price of the stock? 7. (1pt) What is the dividend yield of the Canyon Echo Company stock that you just priced? 8. (1pt) NUYU Corp. announced today that it will begin paying annual dividends. The first dividend will be paid next year at be $0.59 per share. The following 3 years will have dividends of $0.69,$0.79, and $1.09 per share. After that, dividends are projected to increase by 3.9% per year consistently. How much should the stock be trading for today if the required return is 13% ? Step 1: Find the values of the irregular growth dividends Step 2: Find the PV of future dividends once growth becomes constant (in the last year of irregular dividends). Hint: P4=Ds/(Rg) - No growth dividend in perpetuity: P=D/R - Constant growth dividend (DDM): Pt=D(t+1/(Rg) O Dividend Yield =D(r+1/Pt, capital gains =g - Non-constant growth dividend model: General Valuation Formula: Po=(1+R)2D1+(1+R)2D2++(1+R)tDt+(1+R)tP1wherePr=RgDt+1 Calculator: for non-constant growth dividend model - Using CF worksheet, enter irregular growth dividends by year. - When dividend growth becomes constant, find the PV of those future dividends (the last year of irregular dividends). Add this PV to the cash flow in that period. - Use the NPV function then to find the price (NPV) or PV of cash flows. 1. (1pt) The Red Bud company pays a dividend of $2.10 a share. The company announced today that it will continue to do this for another 2 years and then they are discontinuing paying dividends permanently. What is the price of this stock worth today if the required rate of return is 7.7% ? Hint: There are only 2 dividends, or cash flows remaining. The price of this stock is the PV of these cash flows. 2. (1pt) Homestead Corporation pays a constant dividend of $9.45 per year. They are planning on maintaining this dividend for 13 years and then stopping dividends forever. Your required return is 10.7%. What is the current price of the stock? 3. (1pt) Bringling Enterprises pays a constant dividend of $2.50 annually on its preferred stock. What is the expected price of that stock if the required return is 8.28