Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Step by step solution would be grateful for each part thanks [Total 10 marks] Question 1 Middle Ltd purchased 70% of Down Ltd for 65p

Step by step solution would be grateful for each part thanks

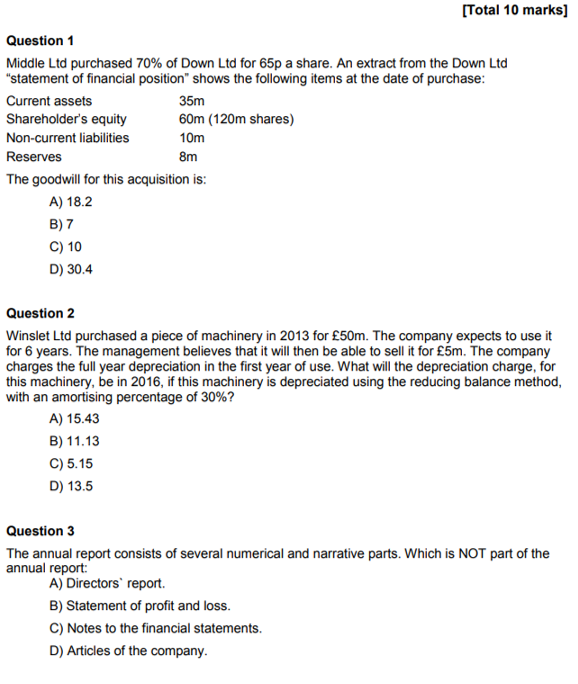

[Total 10 marks] Question 1 Middle Ltd purchased 70% of Down Ltd for 65p a share. An extract from the Down Ltd statement of financial position shows the following items at the date of purchase Current assets Shareholders equity Non-current liabilities 35m 60m (120m shares) 10m 8m The goodwill for this acquisition is A) 18.2 C) 10 D) 30.4 Question 2 Winslet Ltd purchased a piece of machinery in 2013 for 50m. The company expects to use it for 6 years. The management believes that it will then be able to sell it for 5m. The company charges the full year depreciation in the first year of use. What will the depreciation charge, for this machinery, be in 2016, if this machinery is depreciated using the reducing balance method with an amortising percentage of 30%? A) 15.43 B) 11.13 C) 5.15 D) 13.5 Question 3 The annual report consists of several numerical and narrative parts. Which is NOT part of the annual report: A) Directors report. B) Statement of profit and loss C) Notes to the financial statements. D) Articles of the companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started