Answered step by step

Verified Expert Solution

Question

1 Approved Answer

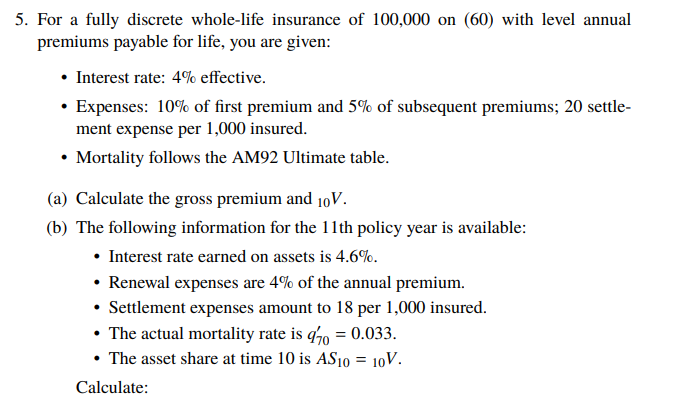

Step by Step with actuarial symbols pls 5. For a fully discrete whole-life insurance of 100,000 on (60) with level annual premiums payable for life,

Step by Step with actuarial symbols pls

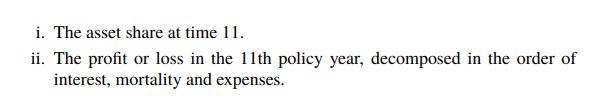

5. For a fully discrete whole-life insurance of 100,000 on (60) with level annual premiums payable for life, you are given: - Interest rate: 4% effective. - Expenses: 10% of first premium and 5% of subsequent premiums; 20 settlement expense per 1,000 insured. - Mortality follows the AM92 Ultimate table. (a) Calculate the gross premium and 10V. (b) The following information for the 11th policy year is available: - Interest rate earned on assets is 4.6%. - Renewal expenses are 4% of the annual premium. - Settlement expenses amount to 18 per 1,000 insured. - The actual mortality rate is q70=0.033. - The asset share at time 10 is AS10=10V. Calculate: i. The asset share at time 11 . ii. The profit or loss in the 11th policy year, decomposed in the order of interest, mortality and expensesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started