Question

Sterling properties an German company whose shares are traded on the German Stock Exchange. The company was established in the late nineties when a major

Sterling properties an German company whose shares are traded on the German Stock Exchange. The company was established in the late nineties when a major German insurance company moved its portfolio of real estate assets to a new entity. The purpose of this transaction was to split real estate development from the insurance services and to engage in new development projects together with other investing parties. A few years after the company went public in 2007, the insurance company's ownership was diluted to less than 10 per cent and the company is now owned by several thousand German and foreign shareholders.

The last 15 years, Sterling Properties ASA has been one of a handful companies that attracts both large and smaller investors who want to put their money in the German real estate market. The accumulated financial value creation in this period has been high, not only because the market in general has developed favorably, but also because Sterling for a long period was successful with their new real estate projects.

At the end of 2021, the company owned 24 properties in Berlin and other German cities:

- Three mid-sized shopping malls

- Three hotels that are operated by a hotel chain

- Twelve office buildings with 3 000 to 9 000 m2 rentable space

- Six combined warehouse and light industry properties

2. Status in 2021

After an active period with a long and steady growth, the company had by 2021 reached a stall point in terms of rent revenues and bottom-line profit. In 2015, the company had decided to go into the hotel market. They made an agreement with the hotel chain Next Bestern and outsourced the operation of three new hotels in the Berlin region. These hotels opened shortly before the arrival of the COVID-19 pandemic, and in 2020 and 2021 the hotel chain was unable to pay the quarterly rents due to the low travel and conference activity caused by this unexpected situation. After lengthy negotiations in the fall of 2021/early winter 2022, the company decided to write off a major part of the unpaid rent and booked these losses in the financial reports for 2021. For the first time, Sterling reported a financial loss on the annual shareholders meeting in March 2022. The company's share price and corresponding market value has dropped significantly over the last 2-3 years.

In addition to the effect of the rent losses from the hotel properties, the company's profitability has also been challenged by an increase in vacant areas, both in the office and shopping markets. Up until 2018, the vacancy rate was less than 4 per cent of the total rentable space, but now more than twelve per cent of the total areas is vacant.

The costs for management, operations and maintenance of the real estate portfolio have also in recent years increased much more than the increase in rent revenue per square meter. The cash flow from the company's operational activities has been negative both in 2020 and 2021, but these liquidity losses have so far been compensated by new mortgage loans, which have contributed to sufficient cash reserves, despite its financial losses.

In December 2021, the Board of Directors approved a revised strategy plan for 2022-2026, where the overall long-term goals were summed up in three main areas:

1.High and steady financial return to our investors

2.Attractive tenants that create a high activity level in all our properties

3.High quality standards in all our properties, as perceived by our tenants. A summary of this strategy plan for 2022-2026 follows:

3. Summary of Sterling Properties' strategy plan for 2022-2026

After many years of steady rental revenue increase, a good profitability, and a high market value growth, we experienced some years ago that the positive development stopped. Even if we choose to disregard the effect of the pandemic, our total financial value creation the recent years have been challenged by an increasing level of vacant office and shop areas and increased costs for management, operations, and maintenance.

While many financial analysts for many years kept Sterling Properties ASA on their list of recommended investments, things changed around 2019. Several negative articles in business media also contributed to the impression that the company no longer was the investors' first choice for a diversified real estate placement.

Early 2021, The Board of Directors gave the new management team a clear mandate; it shall in addition to securing a good and stable return to our investors, also have a constant focus on finding new and attractive customers that demand high quality standards.

In the forthcoming strategy period, we must focus on consolidation rather than growth. To improve the company's solidity, we must sell approximately 15 per cent of our real estate portfolio. The cash that is left after the mortgage loans on these properties are paid will be used to reduce the borrowings on the remaining properties, particularly where the current loan to value ratio is uncomfortably high. The goal is that the mortgage loan balance of one of our properties should be between 40 and 60 per cent of the expected market value.

Real estate is a capital-intensive industry, and the total market value of our portfolio is more than 20 billion dollar. The focus we have had on following up our Return on Equity has not given us the right picture of the company's profitability. We cannot influence the Capital Turnover Rate much in the coming years, and we must therefore strive to influence The Rate of Return on Sales as much as possible in the strategy period that lies ahead of us. We know that this is influenced not only by the average rent level, but also by the vacancy rate, cost of management, operations, and management, as well as the interest level. Thus, we must ensure that the development of these factors is positive and sustained over time.

Although we have many experienced and highly competent people in our organization, we see a strong need to increase the company's human capital to be better prepared for the changes that are ahead of us. While we for many years had an entrepreneurial type of organizational culture, we see that the organization now suffers from lengthy decision processes and the lack of a commercial business spirit. This may have caused our gradual loss of market development skills and given rise to the loss of many customers when they have chosen not to renew their contracts after the first 5- or 10-year rent period has ended. This trend cannot continue! We must prioritize activities that increase the tenants' retention rate, because when we lose customers, it will take many years before we can try to win them back.

We need to make development and maintenance plans with corresponding budgets for each of our 24 properties, so we can plan for an increased attractivity for each object and secure a high rent level in the future. The increased focus on development and maintenance will not happen without an increased know-how and a good administrative capacity to develop well-functioning internal control systems for the property management.

We also need to strengthen our competence within the finance and accounting areas and develop better routines and systems for the daily handling of accounting transactions. Each property will now be an individual profit center where one of the six members of Top Management will have the overall responsibility. Hence, each manager will have a portfolio of four properties to follow up. Empowered to make the necessary operational decisions daily, the manager is responsible for

reporting the status to the management team. We hope that this will reduce the number of decisions that the Top Management team will have to make, and that we now can speed up the decision processes significantly.

Sterling Properties ASA will also need to strengthen its professional network in the forthcoming years. We have lost many valuable contacts when former managers left the company, and we need to build up a good external network within banking and financing, law competence, and real estate engineering.

We need to convince the investors that we can give the best return in the real estate sector, and we think it is realistic to achieve a Return on Investments of around 10 per cent by the end of the strategy period. Together we shall make Sterling the most attractive company in the market, both for our investors and customers, and for us who work here!

4. The need for improvement of one of the company's internal processes

One of Sterling's three shopping centers is Myriaden in the mid-sized German city of Hamburg. Here, the rental contracts are here not time-limited to five or ten years as most office contracts are. Contrary, rent agreements are made with a 60-day cancellation period. A tenant that notifies the company for instance by the end of March, will be charged for rent in April and May and will then move out by the end of May.

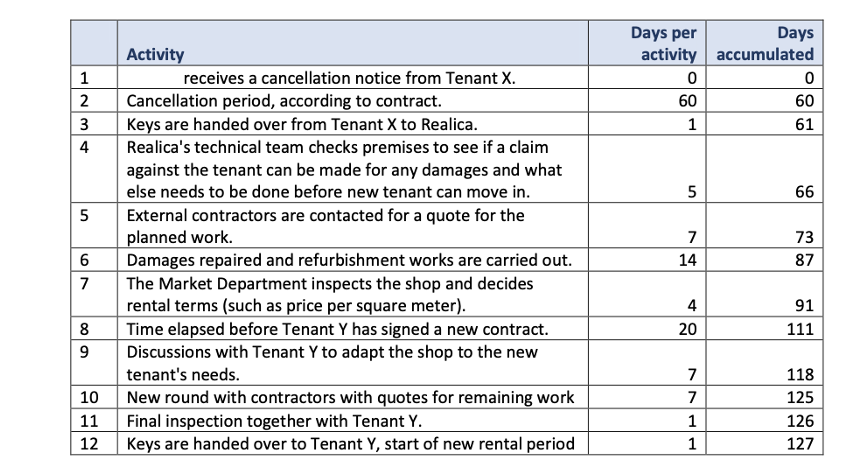

During the pandemic, 20 of the 50 shops in Myriaden closed, mainly due to insolvency and bankruptcy. Sterling is now in the process of finding new tenants for these vacant areas and wants to improve the effectiveness of the process where new tenants replace old ones. An important part of this process is to prepare the vacant area and make it look attractive for a new customer. In an ideal market situation, where Sterling has many potential clients interested in renting shop space, the company's profitability will be influenced by the number of days that the areas stay unused. It is therefore important to see what can be done to shorten the process starting with the existing tenant cancelling the contract ending with the new tenant moving in and paying rent. The process is highly standardized and based on routines that have been developed over many years. By observing the process, the company has been able to document the following 12 activities in the process cycle:

Question 1

Identify critical success factors in Sterling Properties ASA's strategy from 2022-2026 and place them in the correct strategic perspectives used in a Balanced Scorecard model.

Question 2

Design a strategy map based on your conclusions in question 1.

1 2 3 4 5 6 7 8 9 10 11 12 3 4 Activity receives a cancellation notice from Tenant X. Cancellation period, according to contract. Keys are handed over from Tenant X to Realica. Realica's technical team checks premises to see if a claim against the tenant can be made for any damages and what else needs to be done before new tenant can move in. External contractors are contacted for a quote for the planned work. Damages repaired and refurbishment works are carried out. The Market Department inspects the shop and decides rental terms (such as price per square meter). Time elapsed before Tenant Y has signed a new contract. Discussions with Tenant Y to adapt the shop to the new tenant's needs. New round with contractors with quotes for remaining work Final inspection together with Tenant Y. Keys are handed over to Tenant Y, start of new rental period Days per Days activity accumulated 0 0 60 60 61 66 73 87 91 111 118 125 126 127 1 5 7 14 4 20 7 7 1 1 1 2 3 4 5 6 7 8 9 10 11 12 3 4 Activity receives a cancellation notice from Tenant X. Cancellation period, according to contract. Keys are handed over from Tenant X to Realica. Realica's technical team checks premises to see if a claim against the tenant can be made for any damages and what else needs to be done before new tenant can move in. External contractors are contacted for a quote for the planned work. Damages repaired and refurbishment works are carried out. The Market Department inspects the shop and decides rental terms (such as price per square meter). Time elapsed before Tenant Y has signed a new contract. Discussions with Tenant Y to adapt the shop to the new tenant's needs. New round with contractors with quotes for remaining work Final inspection together with Tenant Y. Keys are handed over to Tenant Y, start of new rental period Days per Days activity accumulated 0 0 60 60 61 66 73 87 91 111 118 125 126 127 1 5 7 14 4 20 7 7 1 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started