Question

In this section, you will select five stocks from the provided list and determine their values by applying an appropriate valuation model from the following

In this section, you will select five stocks from the provided list and determine their values by applying an appropriate valuation model from the following options: price to multiple model (earning or sales), dividend valuation model, or free cash flow to equity valuation model.

Five selected stocks are as follows:

IBM: Dividends: $6.21 (2018), Earnings: $3.42 per share, $14.77 billion EBITDA 2017, Sales: $79.14 billion (2017), $18.6 billion in Q3 2018

KO: Dividends: $1.56 (2018), Earnings: $0.58 per share, $8.84 billion EBITADA 2017, Sales: $35.02 billion (2017), $8.245 billion in Q3 2018

BAX: Dividends: $0.70 (2018), Earnings: $0.80 per share, $2.24 billion EBITADA 2017, Sales: $10.56 billion (2017), $2.76 billion in Q3 2018

NFLX: Dividends: N/A, Earnings: $0.89 per share, $7.16 billion EBITADA 2017, Sales: $11.69 billion (2017), $3.99 billion in Q3 2018

GE: Dividends: $0.48 (2018), Earnings: -$2.62 per share, $13.38 billion EDITADA 2017, Sales: $122.09 billion (2017), $29.57 in Q3 2018

The dividends shown are total calculated dividend payments for the calendar year. (EX: GE= $0.14 dividend payment in all four quarters of 2018 = $0.48 total for 2018)

A. Determine the value of each stock by using an appropriate model based on the characteristics provided for each stock; use each model at least once.

B. Provide a rationale for the stock valuation method you chose for each stock.

C. Using the calculated valuation, the current market price, and historical performance, determine the expected return for each stock.

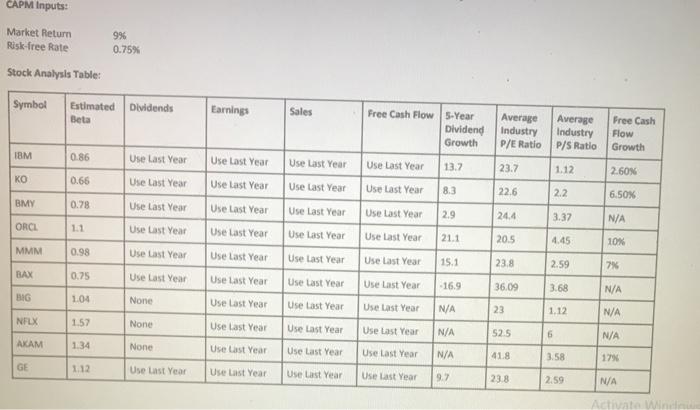

CAPM Inputs: Market Return Risk-free Rate 9% 0.75% Stock Analysis Table: Symbol Estimated Dividends Earnings Sales Free Cash Flow 5-Year Average Dividend Industry P/E Ratio Average Industry P/S Ratio Beta Free Cash Flow Growth Growth IBM 0.86 Use Last Year Use Last Year Use Last Year Use Last Year 13.7 23.7 1.12 2.60% 0.66 Use Last Year Use Last Year Use Last Year Use Last Year 8.3 22.6 2.2 6.50% BMY 0.78 Use Last Year Use Last Year Use Last Year Use Last Year 2.9 24.4 3.37 N/A ORCI 1.1 Use Last Year Use Last Year Use Last Year Use Last Year 21.1 20.5 4.45 10% MMM 0.98 Use Last Year Use Last Year Use Last Year Use Last Year 15.1 23.8 2.59 7% BAX 0.75 Use Last Year Use Last Year Use Last Year Use Last Year 16.9 36.09 3.68 N/A BIG 1.04 None Use Last Year Use Last Year Use Last Year N/A 23 1.12 N/A NFLX 1.57 None Use Last Year Use Last Year Use Last Year N/A 52.5 N/A AKAM 1.34 None Use Last Year Use Last Year Use Last Year N/A 41.8 3.58 17% GE 1.12 Use Last Year Use Last Year Use Last Year Use last Year 9.7 23.8 2.59 N/A Activate

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Stock Analysis A i IBM Using Dividend Growth Model PDrg From CAPM r RfBetaERMRf 0750869075 7845 Divi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started