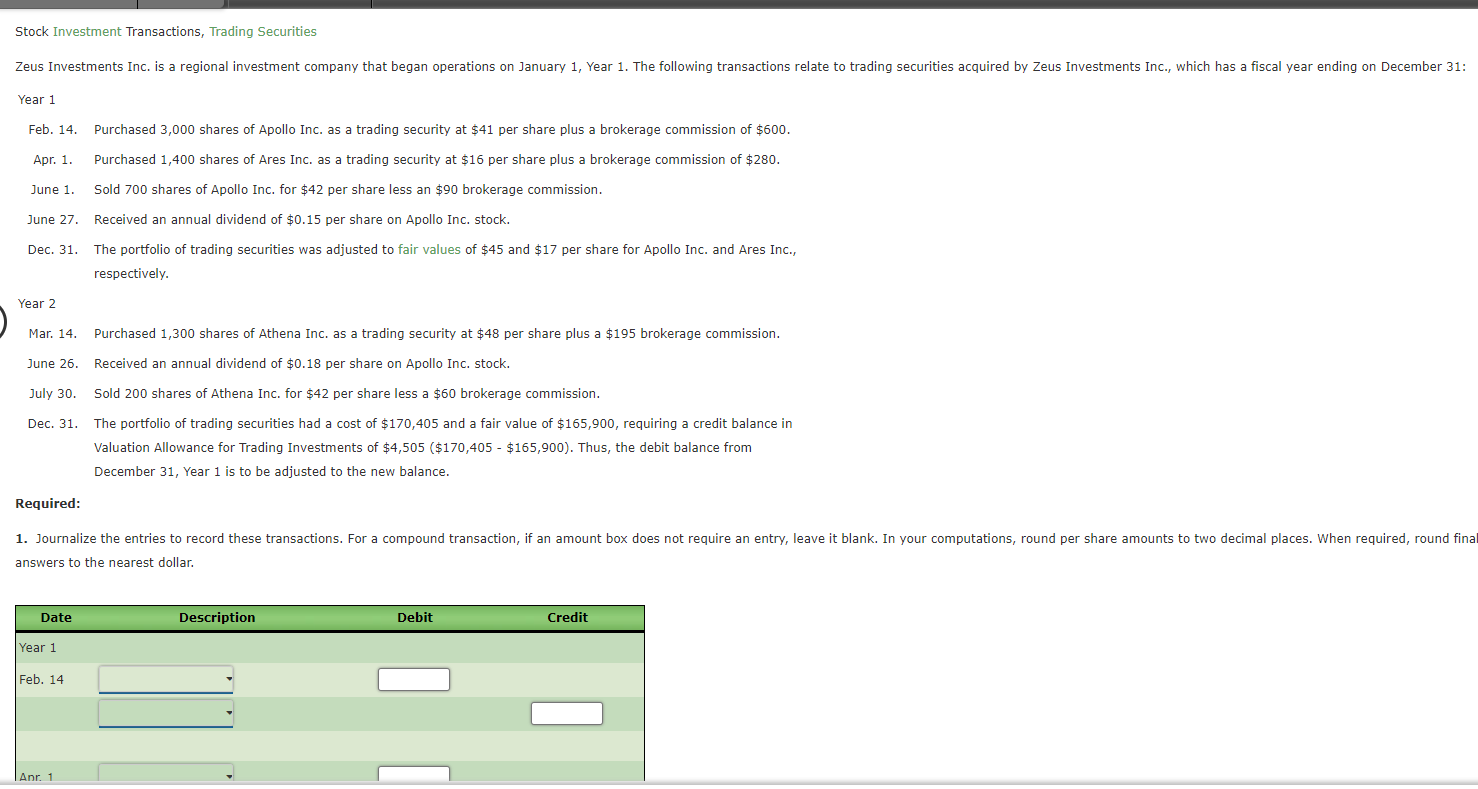

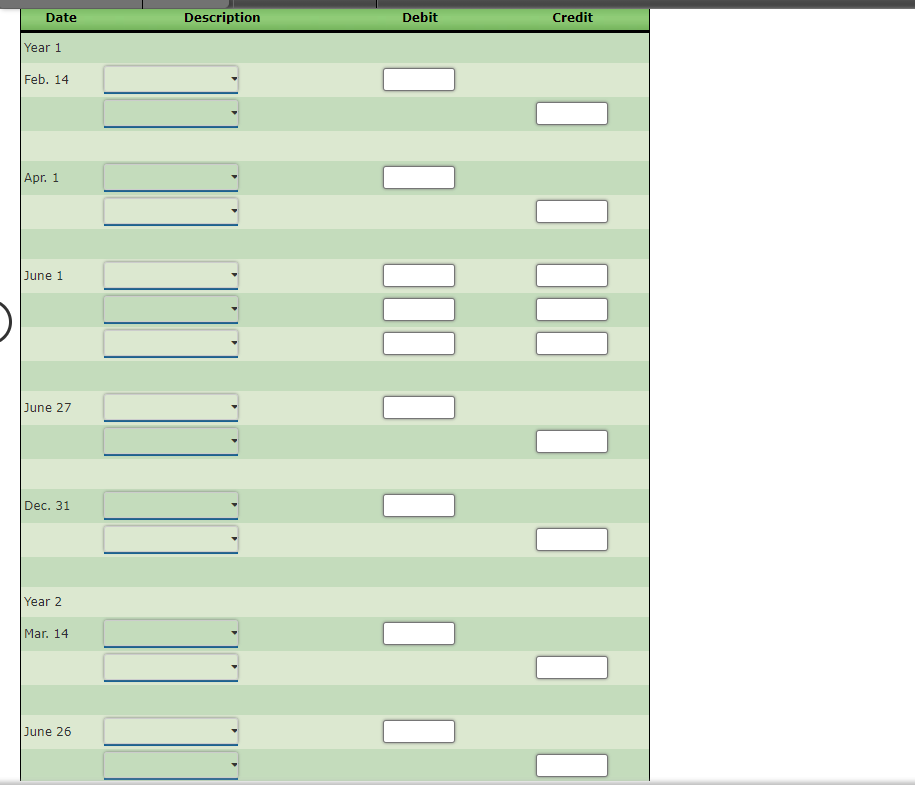

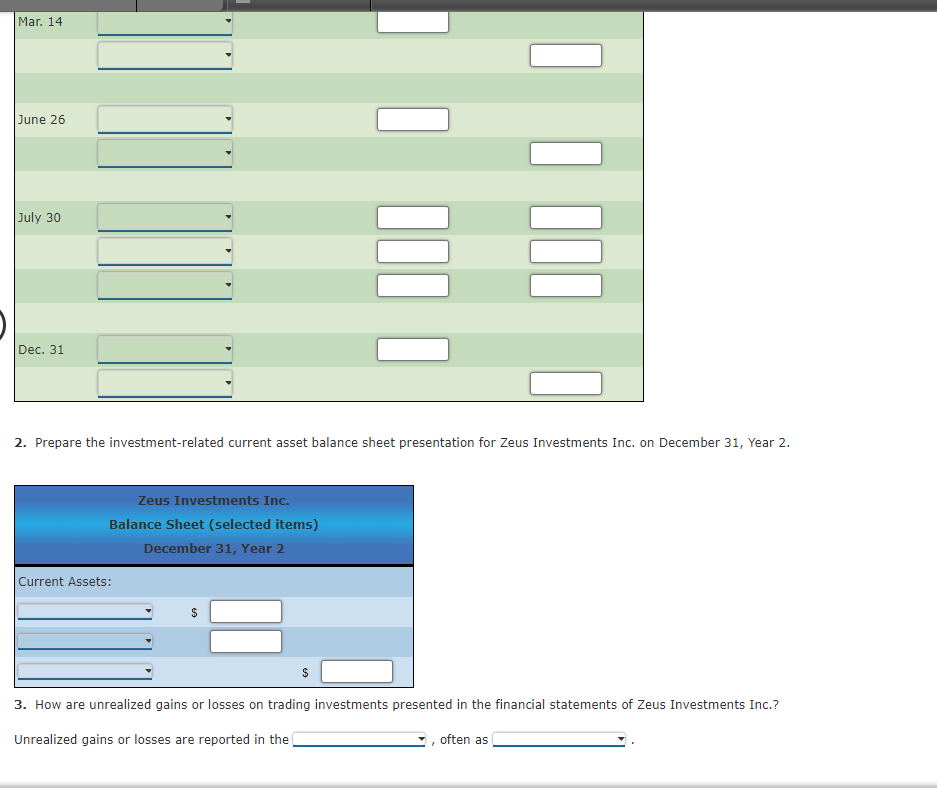

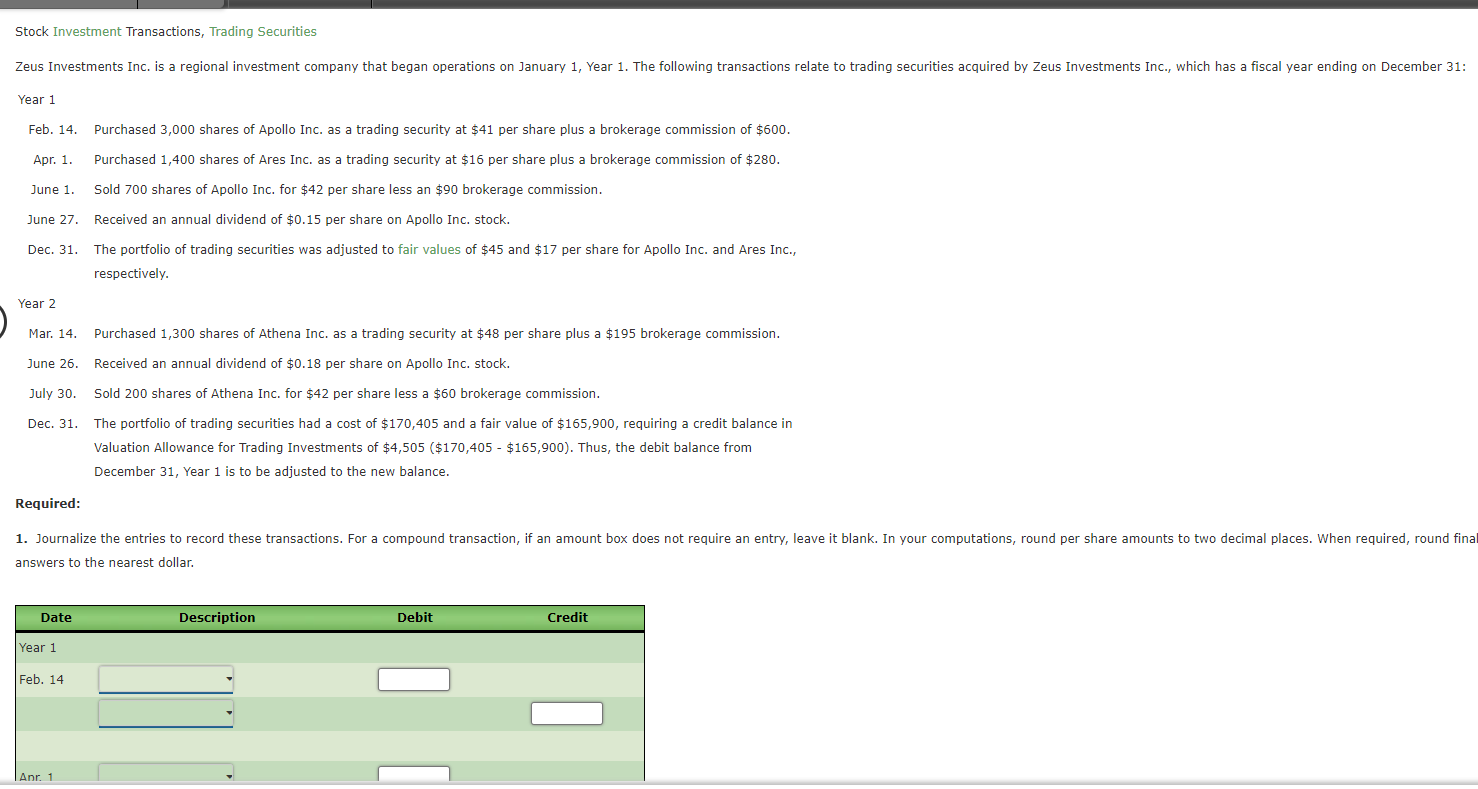

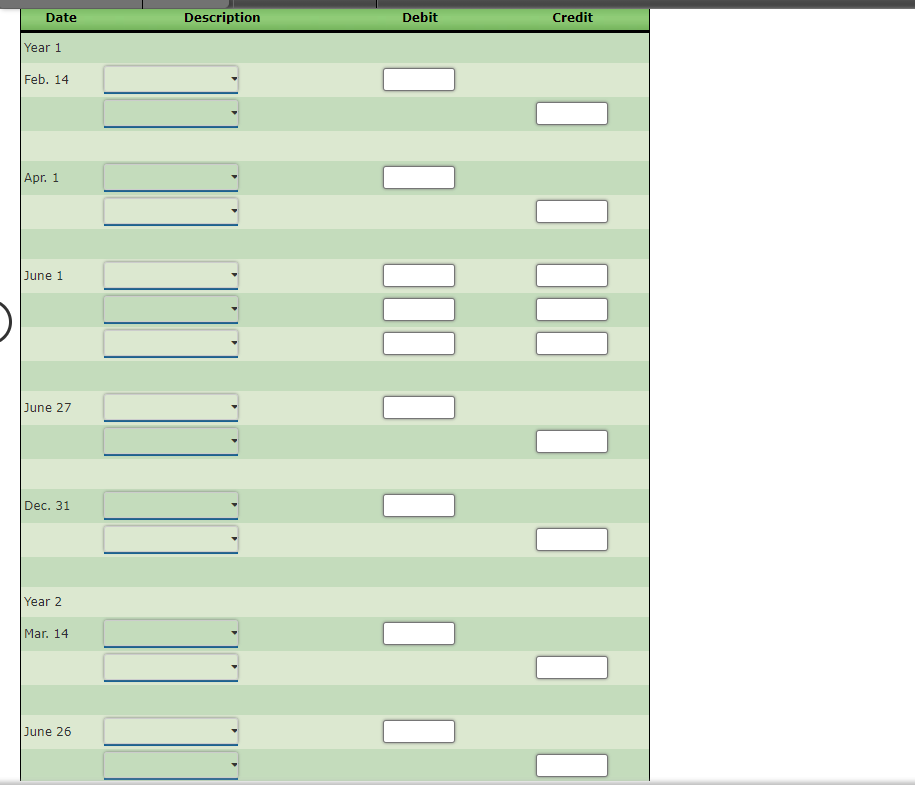

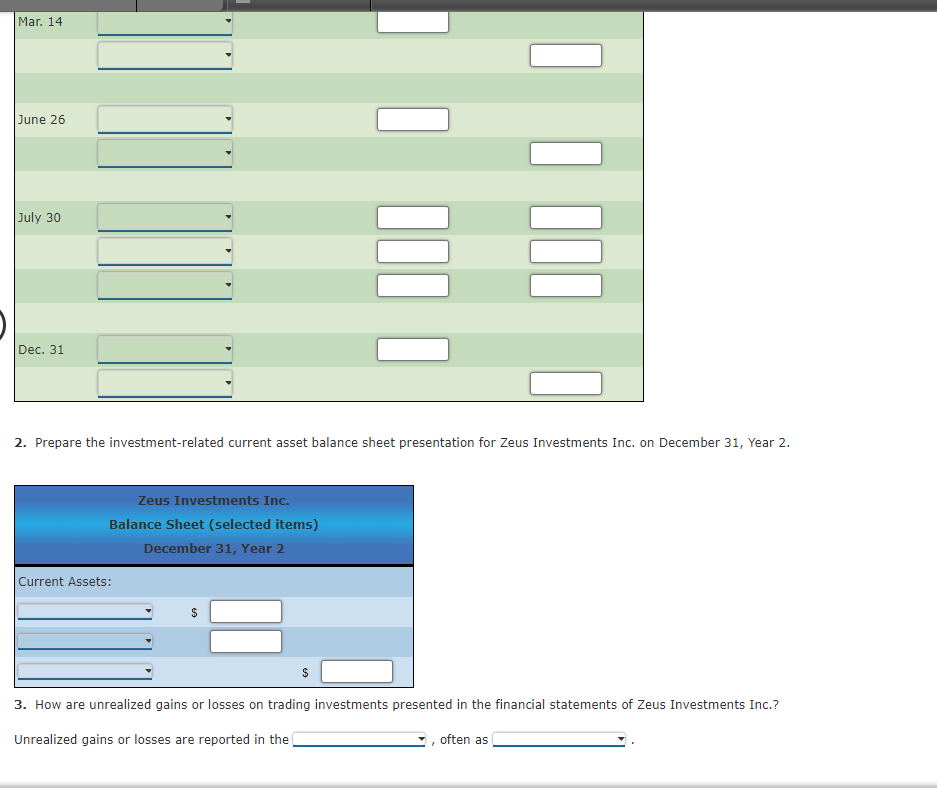

Stock Investment Transactions, Trading Securities Year 1 Feb. 14. Purchased 3,000 shares of Apollo Inc. as a trading security at $41 per share plus a brokerage commission of $600. Apr. 1. Purchased 1,400 shares of Ares Inc. as a trading security at $16 per share plus a brokerage commission of $280. June 1. Sold 700 shares of Apollo Inc. for $42 per share less an $90 brokerage commission. June 27. Received an annual dividend of $0.15 per share on Apollo Inc. stock. Dec. 31. The portfolio of trading securities was adjusted to fair values of $45 and $17 per share for Apollo Inc. and Ares Inc., respectively. Year 2 Mar. 14. Purchased 1,300 shares of Athena Inc. as a trading security at $48 per share plus a $195 brokerage commission. June 26. Received an annual dividend of $0.18 per share on Apollo Inc. stock. July 30. Sold 200 shares of Athena Inc. for $42 per share less a $60 brokerage commission. Dec. 31. The portfolio of trading securities had a cost of $170,405 and a fair value of $165,900, requiring a credit balance in Valuation Allowance for Trading Investments of $4,505 ( $170,405 - $165,900 ). Thus, the debit balance from December 31 , Year 1 is to be adjusted to the new balance. Required: answers to the nearest dollar. \begin{tabular}{|lr|} \multicolumn{1}{|c|}{ Date } & Description \\ \hline Year 1 & \\ Feb. 14 & \\ & \\ \hline \end{tabular} Apr. 1 June 1 June 27 Dec. 31 Year 2 Mar. 14 June 26 2. Prepare the investment-related current asset balance sheet presentation for Zeus Investments Inc. on December 31 , Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Zeus Investments Inc.? Unrealized gains or losses are reported in the , often as Stock Investment Transactions, Trading Securities Year 1 Feb. 14. Purchased 3,000 shares of Apollo Inc. as a trading security at $41 per share plus a brokerage commission of $600. Apr. 1. Purchased 1,400 shares of Ares Inc. as a trading security at $16 per share plus a brokerage commission of $280. June 1. Sold 700 shares of Apollo Inc. for $42 per share less an $90 brokerage commission. June 27. Received an annual dividend of $0.15 per share on Apollo Inc. stock. Dec. 31. The portfolio of trading securities was adjusted to fair values of $45 and $17 per share for Apollo Inc. and Ares Inc., respectively. Year 2 Mar. 14. Purchased 1,300 shares of Athena Inc. as a trading security at $48 per share plus a $195 brokerage commission. June 26. Received an annual dividend of $0.18 per share on Apollo Inc. stock. July 30. Sold 200 shares of Athena Inc. for $42 per share less a $60 brokerage commission. Dec. 31. The portfolio of trading securities had a cost of $170,405 and a fair value of $165,900, requiring a credit balance in Valuation Allowance for Trading Investments of $4,505 ( $170,405 - $165,900 ). Thus, the debit balance from December 31 , Year 1 is to be adjusted to the new balance. Required: answers to the nearest dollar. \begin{tabular}{|lr|} \multicolumn{1}{|c|}{ Date } & Description \\ \hline Year 1 & \\ Feb. 14 & \\ & \\ \hline \end{tabular} Apr. 1 June 1 June 27 Dec. 31 Year 2 Mar. 14 June 26 2. Prepare the investment-related current asset balance sheet presentation for Zeus Investments Inc. on December 31 , Year 2. 3. How are unrealized gains or losses on trading investments presented in the financial statements of Zeus Investments Inc.? Unrealized gains or losses are reported in the , often as