Answered step by step

Verified Expert Solution

Question

1 Approved Answer

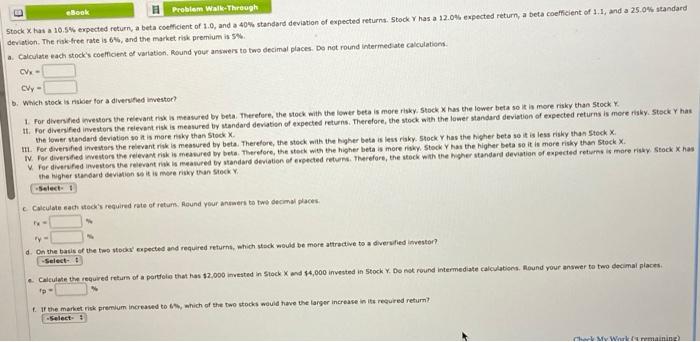

. Stock x has a 10.5% expected return, a beta coefficient of 1.0, and a 40% standard deviation of expected returns. Stock Y has a

.

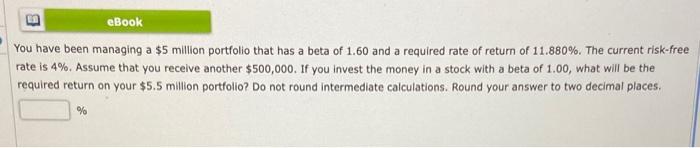

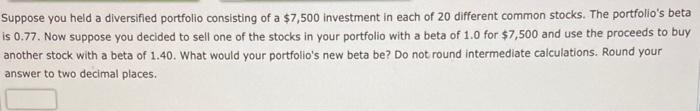

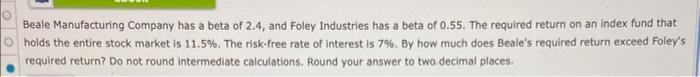

Stock x has a 10.5% expected return, a beta coefficient of 1.0, and a 40% standard deviation of expected returns. Stock Y has a 22.0% expected return, a beta coefficient of 1.1, and a 25.0% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. a. Calaiate each stock's coefficint of variation, Round your answers to two decimal places. Do not round intermedate calculatiens. CVx= CVy= b. Which stock is nukee for a diversited urestoc? 1. For diversfed ivevers the relevant risk is meawred by beta. Therefore, the stock with the fower beta is more risky, stock X has the lower beta so is is more risky than 5 tock Y. It. For divenfed iwestors the reievant risk is measured by mandard devitish of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more risky. Stsck y has the loner standerd deviation v0 a is mare niky than Stock x. Ith. For diversfied imestars the relevant rik is meawred by beta. Therefore, the stock with the bigher beta is less riaky. 5 tock y has the higher beto so is is less rishy than 5 tork x. the Higher standad deviation so it is mere risky than stock. . c. Coiculate each stod's required rate of return. Aound your answers to twe cecomal places: d. On the basis of the two stoax 6 pected and required returns, which stock would be more attrective to a diversfied iovestor? 2. Calcuate the requred returs of a partola that has 12,000 imvested in 5100XX and 14,000 inverted in 5 tock Y, Do not round imtermediate calculations. Round your answer to two decimal places. 1. If the market rick premium increased to bh, which of the two stocks woula hwo the largor increase in its requred return? You have been managing a $5 million portfolio that has a beta of 1.60 and a required rate of return of 11.880%. The current risk-free rate is 4%. Assume that you receive another $500,000. If you invest the money in a stock with a beta of 1.00, what will be the required return on your $5.5 million portfolio? Do not round intermediate calculations. Round your answer to two decimal places. Suppose you held a diversified portfolio consisting of a $7,500 investment in each of 20 different common stocks. The portfolio's beta is 0.77. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 1.0 for $7,500 and use the proceeds to buy another stock with a beta of 1.40. What would your portfolio's new beta be? Do not round intermediate calculations. Round your answer to two decimal places. Beale Manufacturing Company has a beta of 2.4, and Foley Industries has a beta of 0.55. The required return on an index fund that holds the entire stock market is 11.5%. The risk-free rate of interest is 7%. By how much does Beale's required return exceed Foley's required return? Do not round intermediate calculations. Round your answer to two decimal places Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started