Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Straight Line (Pty) Ltd has a current profit before tax of R250 000 for the year ended 31 December 2022. Included in this figure is

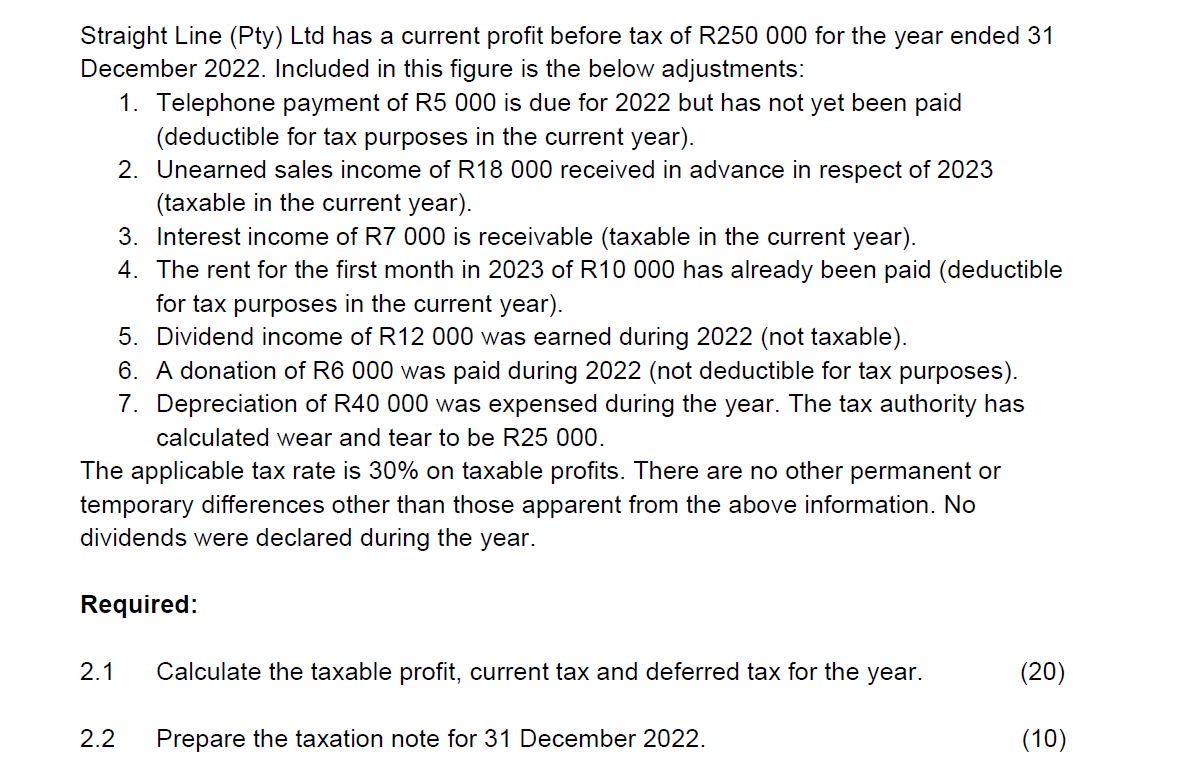

Straight Line (Pty) Ltd has a current profit before tax of R250 000 for the year ended 31 December 2022. Included in this figure is the below adjustments: 1. Telephone payment of R5 000 is due for 2022 but has not yet been paid (deductible for tax purposes in the current year). 2. Unearned sales income of R18 000 received in advance in respect of 2023 (taxable in the current year). 3. Interest income of R7 000 is receivable (taxable in the current year). 4. The rent for the first month in 2023 of R10 000 has already been paid (deductible for tax purposes in the current year). 5. Dividend income of R12 000 was earned during 2022 (not taxable). 6. A donation of R6 000 was paid during 2022 (not deductible for tax purposes). 7. Depreciation of R40 000 was expensed during the year. The tax authority has calculated wear and tear to be R25 000 . The applicable tax rate is 30% on taxable profits. There are no other permanent or temporary differences other than those apparent from the above information. No dividends were declared during the year. Required: 2.1 Calculate the taxable profit, current tax and deferred tax for the year. 2.2 Prepare the taxation note for 31 December 2022

Straight Line (Pty) Ltd has a current profit before tax of R250 000 for the year ended 31 December 2022. Included in this figure is the below adjustments: 1. Telephone payment of R5 000 is due for 2022 but has not yet been paid (deductible for tax purposes in the current year). 2. Unearned sales income of R18 000 received in advance in respect of 2023 (taxable in the current year). 3. Interest income of R7 000 is receivable (taxable in the current year). 4. The rent for the first month in 2023 of R10 000 has already been paid (deductible for tax purposes in the current year). 5. Dividend income of R12 000 was earned during 2022 (not taxable). 6. A donation of R6 000 was paid during 2022 (not deductible for tax purposes). 7. Depreciation of R40 000 was expensed during the year. The tax authority has calculated wear and tear to be R25 000 . The applicable tax rate is 30% on taxable profits. There are no other permanent or temporary differences other than those apparent from the above information. No dividends were declared during the year. Required: 2.1 Calculate the taxable profit, current tax and deferred tax for the year. 2.2 Prepare the taxation note for 31 December 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started