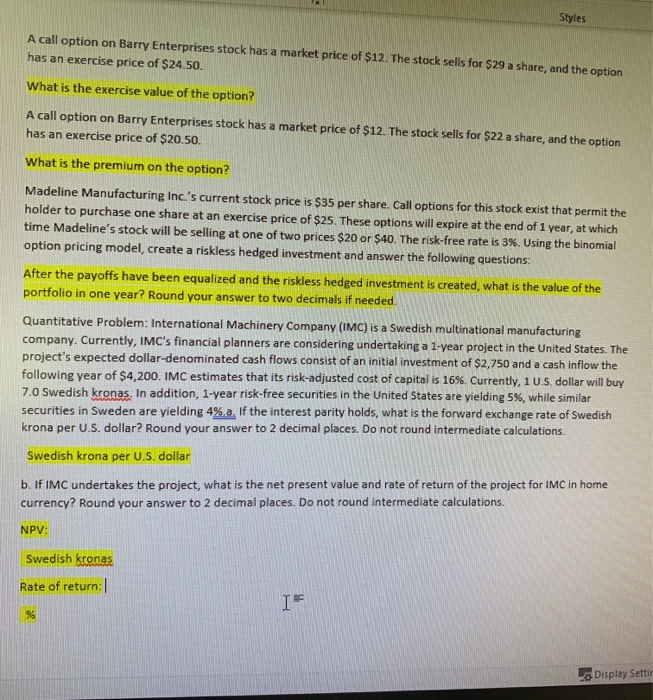

Styles A call option on Barry Enterprises stock has a market price of $12. The stock sells for $29 a share, and the option has an exercise price of $24.50. What is the exercise value of the option? A call option has an exercise price of $20.50. Barry Enterprises stock has a market price of $12. The stock sells for $22 a share, and the option on What is the premium on the option? Madeline Manufacturing Inc.'s current stock price is $35 per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of $25. These options will expire at the end of 1 year, at which time Madeline's stock will be selling at one of two prices $20 or $40. The risk-free rate is 3 %. Using the binomial option pricing model, create a riskless hedged investment and answer the following questions: After the payoffs have been equalized and the riskless hedged investment is created, what is the value of the portfolio in one year? Round your answer to two decimals if needed Quantitative Problem: International Machinery Company (IMC) is a Swedish multinational manufacturing company. Currently, IMC's financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar-denominated cash flows consist of an initial investment of $2,750 and a cash inflow the following year of $4,200. IMC estimates that its risk-adjusted cost of capital is 16 %. Currently, 1 U.S. dollar will buy 7.0 Swedish kronas. In addition, 1-year risk-free securities in the United States are securities in Sweden are yielding 4 %.a. If the interest parity holds, what is the forward exchange rate of Swedish krona per U.S. dollar? Round your answer to 2 decimal places. Do not round intermediate calculations. yielding 5 %, while similar Swedish krona per U.S. dollar b. If IMC undertakes the project, what is the net present value and rate of return of the project for IMC in home currency? Round your answer to 2 decimal places. Do not round intermediate calculations NPV: Swedish kronas Rate of return: I Display Settir