Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Submit a detailed report to your potential investors and other stakeholders to explain and defend your costing strategies and to share your businesss performance to

Submit a detailed report to your potential investors and other stakeholders to explain and defend your costing strategies and to share your businesss performance to date. Be sure to effectively communicate with your stakeholders by breaking down concepts and using investor-friendly language to build their trust and confidence.

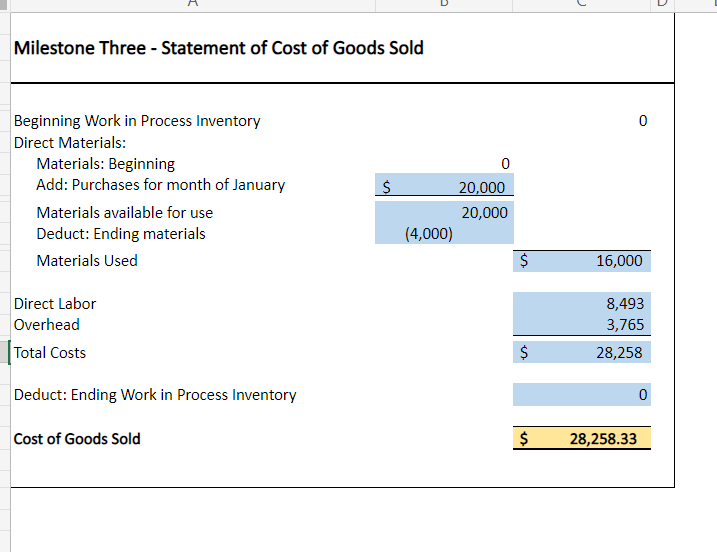

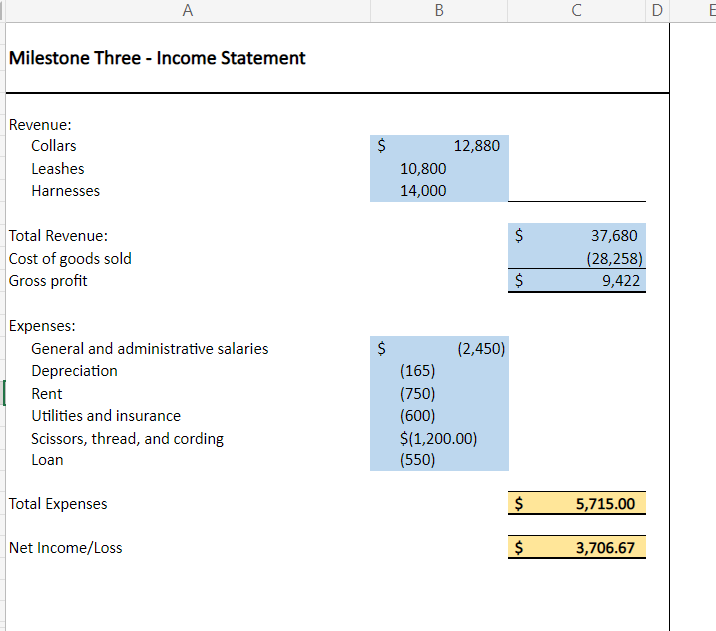

- Financial Statements: Using the information in the Milestone Two Market Research Data Appendix, assess your financial performance to date.

- Statement of Cost of Goods Sold: Share the statement of cost of goods sold and logically interpret the businesss performance against the provided benchmarks.

- Income Statement: Share the income statement and logically interpret the businesss performance against the provided benchmarks.

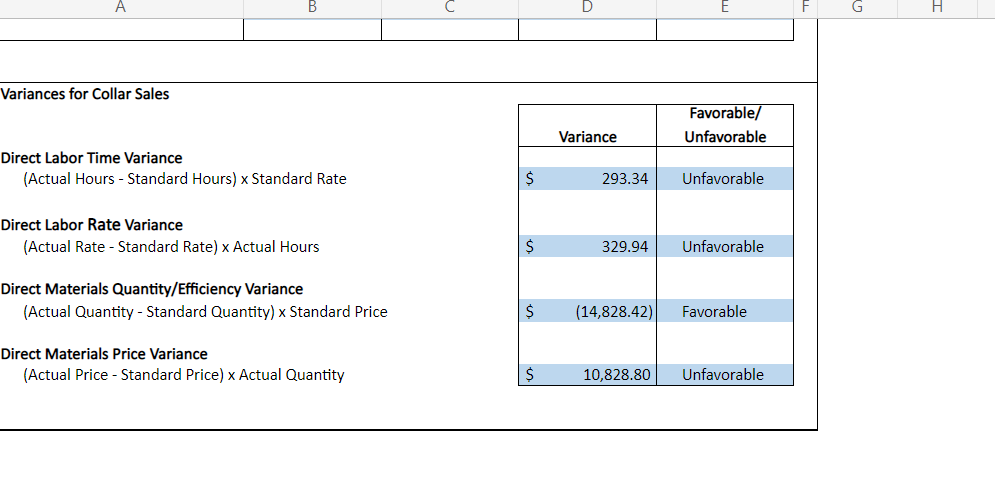

- Variances: Illustrate all variances for the direct labor time and the materials price.

- Significance of Variances: Evaluate the significance of the variances in terms of the potential to impact future budgeting decisions and planning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started