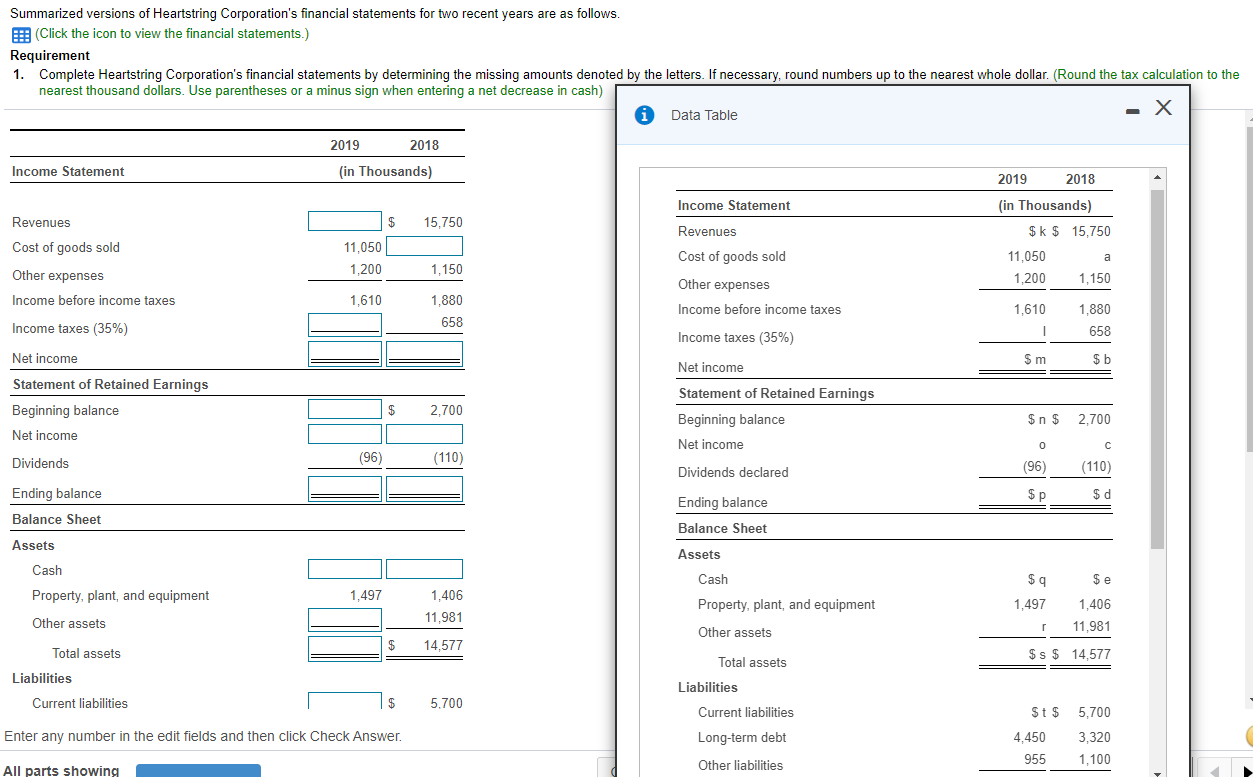

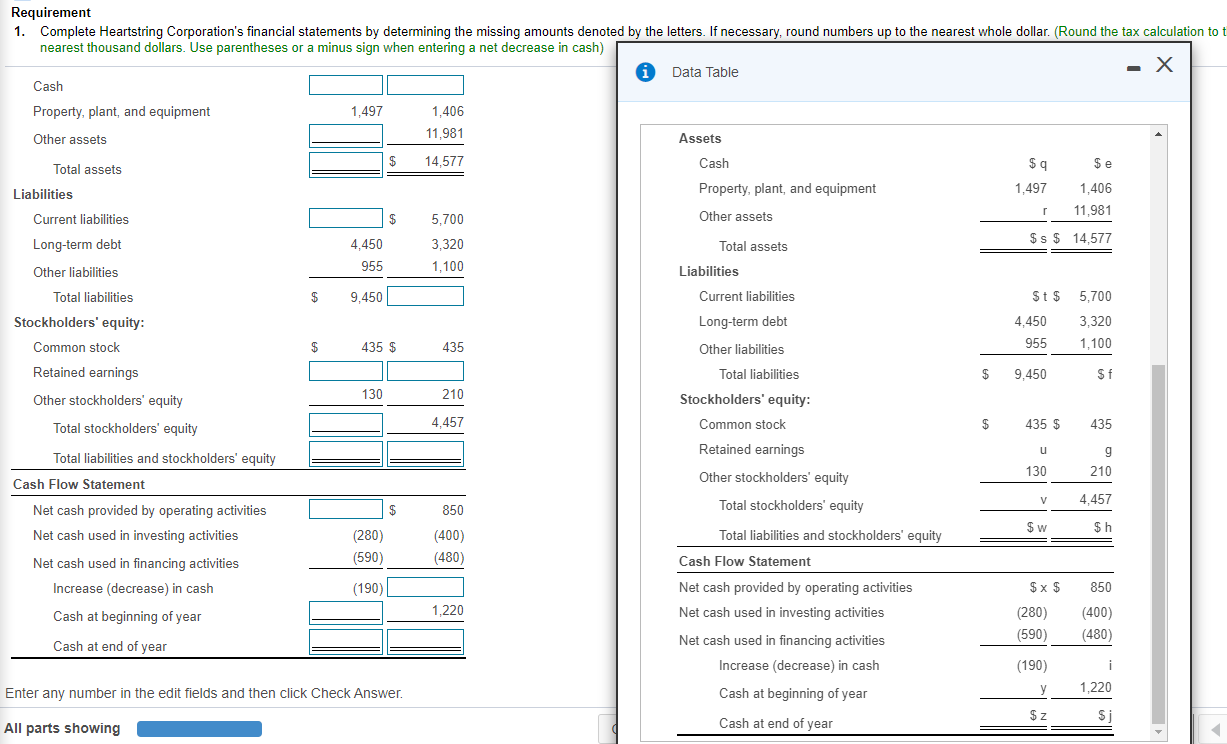

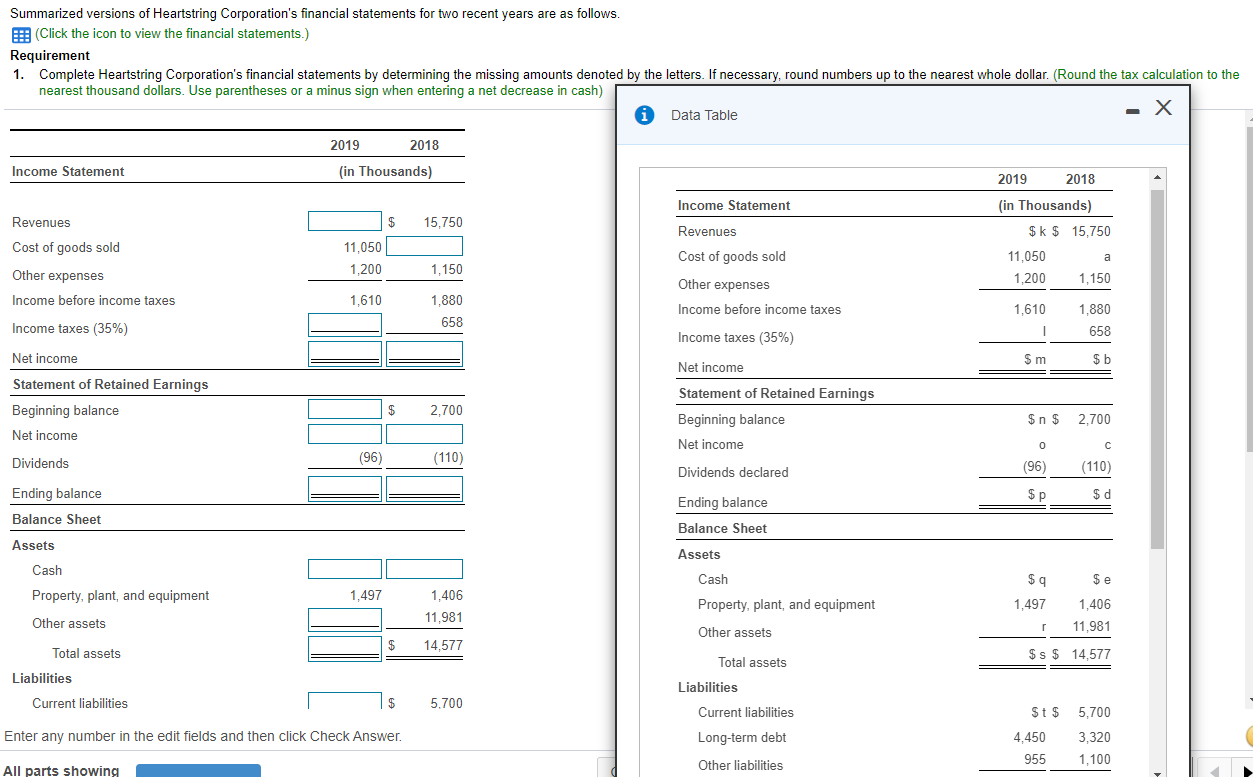

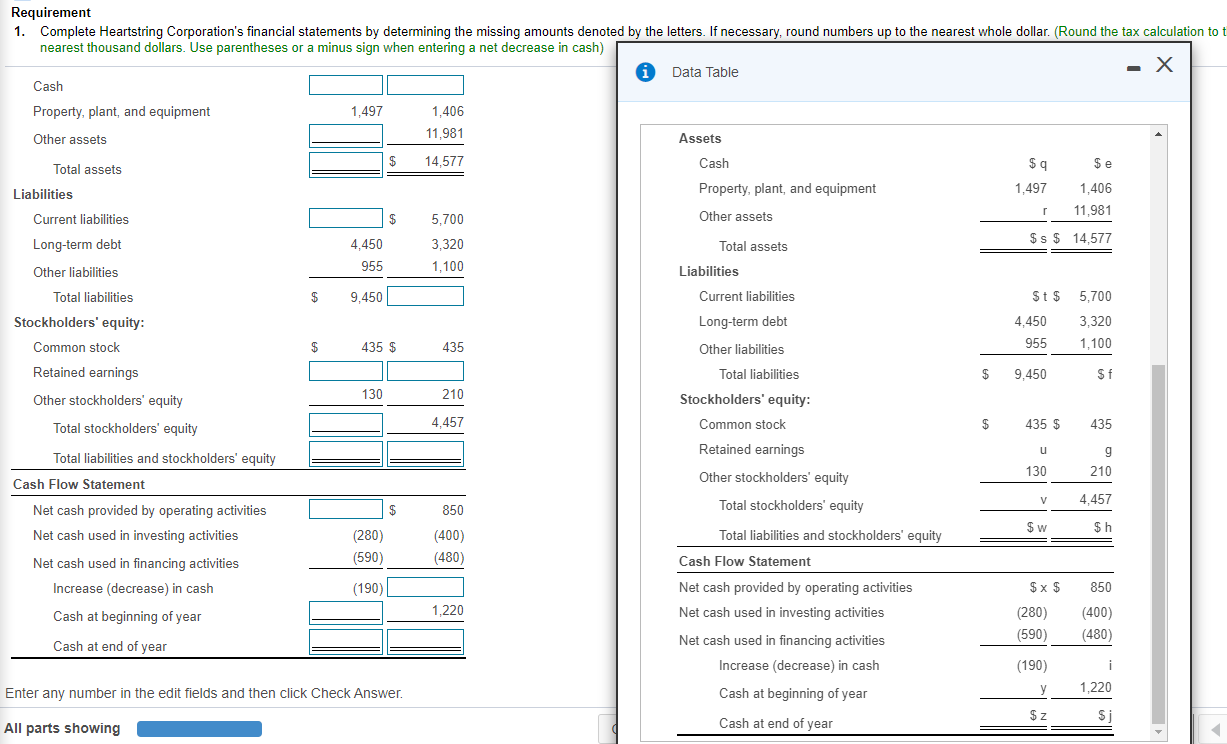

Summarized versions of Heartstring Corporation's financial statements for two recent years are as follows. (Click the icon to view the financial statements.) Requirement 1. Complete Heartstring Corporation's financial statements by determining the missing amounts denoted by the letters. If necessary, round numbers up to the nearest whole dollar. (Round the tax calculation to the nearest thousand dollars. Use parentheses or a minus sign when entering a net decrease in cash) Data Table 2019 2018 Income Statement (in Thousands) 2019 2018 Income Statement Revenues $ 15.750 (in Thousands) $k $ 15.750 Cost of goods sold 11,050 1.200 Revenues Cost of goods sold a 1.150 11,050 1,200 1,150 Other expenses Income before income taxes 1,610 1,880 658 Other expenses Income before income taxes 1,610 1,880 Income taxes (35%) Income taxes (35%) 658 Net income $m $b Net income Statement of Retained Earnings Beginning balance Net income $ 2.700 Statement of Retained Earnings Beginning balance Net income $n$ 2,700 o (96 (110) Dividends Dividends declared (96) (110) Ending balance $p $d Balance Sheet Ending balance Balance Sheet Assets Assets Cash $ e Property, plant, and equipment 1,497 1,406 11.981 Cash Property, plant, and equipment Other assets $9 1,497 1,406 11,981 Other assets $ 14.577 Total assets $s $ 14,577 Liabilities Total assets Liabilities Current liabilities 5.700 Current liabilities $t$ 5,700 Enter any number in the edit fields and then click Check Answer. Long-term debt 4,450 955 3,320 1,100 All parts showing Other liabilities Requirement 1. Complete Heartstring Corporation's financial statements by determining the missing amounts denoted by the letters. If necessary, round numbers up to the nearest whole dollar. (Round the tax calculation to t nearest thousand dollars. Use parentheses or a minus sign when entering a net decrease in cash) Data Table Cash Property, plant, and equipment 1.497 1.406 Other assets 11,981 Assets $ Total assets 14,577 Cash $9 $ e Liabilities Property, plant, and equipment 1,497 1,406 r 11,981 Current liabilities $ 5,700 Other assets Long-term debt 4.450 3,320 Total assets $s $ 14,577 955 1,100 Other liabilities Liabilities Total liabilities $ 9,450 Current liabilities St $ 5,700 Stockholders' equity: Long-term debt 4,450 3.320 Common stock $ 435 $ 435 Other liabilities 955 1,100 Retained earnings Total liabilities $ 9,450 $f 130 Other stockholders' equity 210 Stockholders' equity: 4,457 Total stockholders' equity Common stock $ 435 $ 435 Total liabilities and stockholders' equity Retained earnings u 9 130 210 Cash Flow Statement Other stockholders' equity V 4.457 Net cash provided by operating activities $ 850 Total stockholders' equity $ w $h Net cash used in investing activities (280) (400) Total liabilities and stockholders' equity (590) (480) Net cash used in financing activities Cash Flow Statement Increase (decrease) in cash (190) Net cash provided by operating activities $x $ 850 1.220 Cash at beginning of year Net cash used in investing activities (280) (400) (590) Net cash used in financing activities (480) Cash at end of year Increase (decrease) in cash (190) i Enter any number in the edit fields and then click Check Answer. Cash at beginning of year 1,220 $ 2 All parts showing Cash at end of year